Advanced transportation experts from Impax Asset Management, Stanford University and eMotorwerks highlight key risks and opportunities in the electrification of transportation and a shifting mobility landscape:

– While bullish predictions abound regarding the uptick of electric vehicles, major headwinds to growth remain, including the residual value of EVs and the lack of proven charging infrastructure models.

– Unlimited autonomous driving is expected by 2035, but not without major advances in data compression and edge computing technologies.

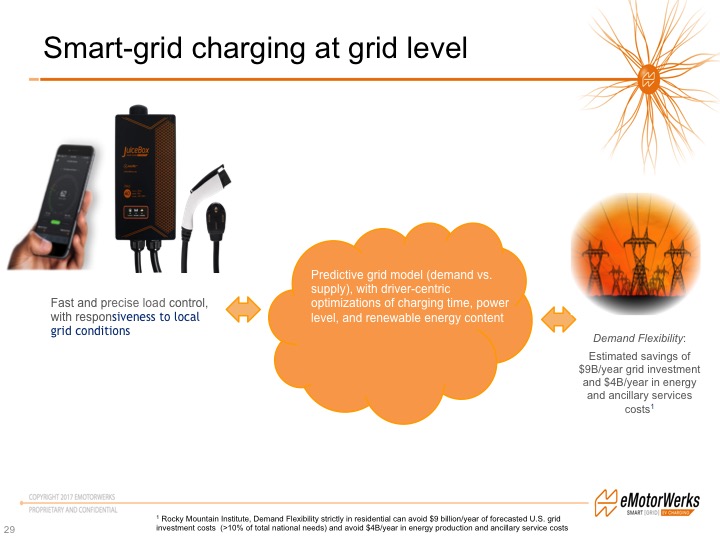

– Without the deployment of a “smart” charging infrastructure, EVs will increase the use of fossil fuels, utilities will experience more power outages, and the grid will require expensive upgrades.

Despite these challenges, experts agree that the future of mobility is creating opportunities for faster, cleaner, cheaper, and safer transportation.

These are some of the takeaways from CleanTechIQ’s webinar, The Future of Transportation, held on April 17.

Impax Asset Management, a $16 billion AUM UK-based money manager, looks to invest in public companies that provide solutions to environmental problems, says Justin Winter, a portfolio manager at the firm. Among the firm’s investments have been investments in companies benefiting from the electrification of transportation. This can help fight pollution, since the transportation sector accounts for 22% of greenhouse gas emissions worldwide

The electric vehicle (EV) market is expected to grow rapidly and will account for 30% to 40% of passenger vehicle sales by 2030, according to data he cited from research firm Ricardo. Winter outlined several reasons for this expected growth:

– Volkswagen’s emissions scandal in 2015, dubbed “Dieselgate,” resulted in massive fines and changed the mindset of regulators and consumers, he says, and has driven more governments to enact policies that promote the adoption of EVs.

– The economics are improving for EVs as more investment and manufacturing is driving down the cost of batteries – which can comprise 50% of an EV’s cost –making EVs more affordable. In fact, the total cost of ownership (TCO) of EVs will be equal to the TCO of traditional vehicles within five years, he says.

– China, the world’s largest car market, is playing a critical role by promoting EV adoption. China sees EVs as an opportunity to manage its air pollution issues, and is supporting the creation of an EV industry.

However, Winter also pointed out uncertainties that could limit the market’s growth:

– EVs will put more pressure on the elecrtric grid, requiring upgrades to grid infrastructure.

– EV charging models are still evolving, and there’s a major lack of existing EV charging infrastructure.

– The relatively low market value of used EVs presents a major headwind to growth. Fleet buyers focus on TCO when deciding on vehicle purchases, he says, with EV’s residual value being a key consideration. The market won’t really accelerate until the TCO of EVs hits parity with conventional vehicles, he says.

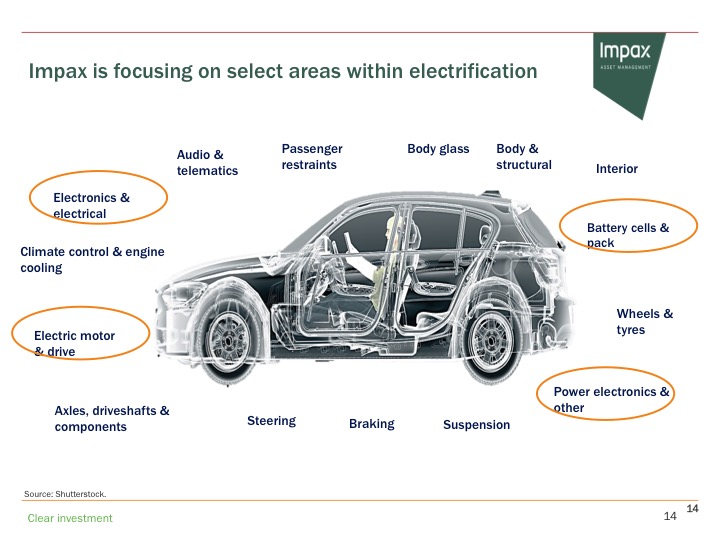

Where is Impax finding investment opportunities?

Impax is cautious on the large auto original equipment manufacturer brands, Winter says. He is seeing more opportunities to invest in the critical component that go into EVs with strong market positions and business models that create barriers to entry, enabling Impax to fully benefit from the market’s growth.

For example, Impax invested in a UK-based company that manufactures cathodes, which are a vital part of batteries. The company invested in its manufacturing capabilities that created economies of scale to more efficiently meet the growing demand from battery manufacturers.

Another example is Impax’s investment in a Swiss industrial company that makes transducers that measure the electrical voltage in cars, improving their energy efficiency.

As an investor that integrates environmental, social and governance (ESG) criteria in its investment process, Impax seeks companies that have high standards for corporate governance and strong supply chain management practices, Winter says.

When investing in the EV industry, this ESG tilt leads Impax to analyze issues such as child labor practices in the mining of elements for battery components, such as cobalt and lithium, and the security of supply chains in fragile governments like the Democratic of Congo, where these metals are mined, says Winter. These types of issues can lead to both ethical considerations and business risks that investors need to consider in this industry, he points out.

Early Stage Trends: the View from Silicon Valley

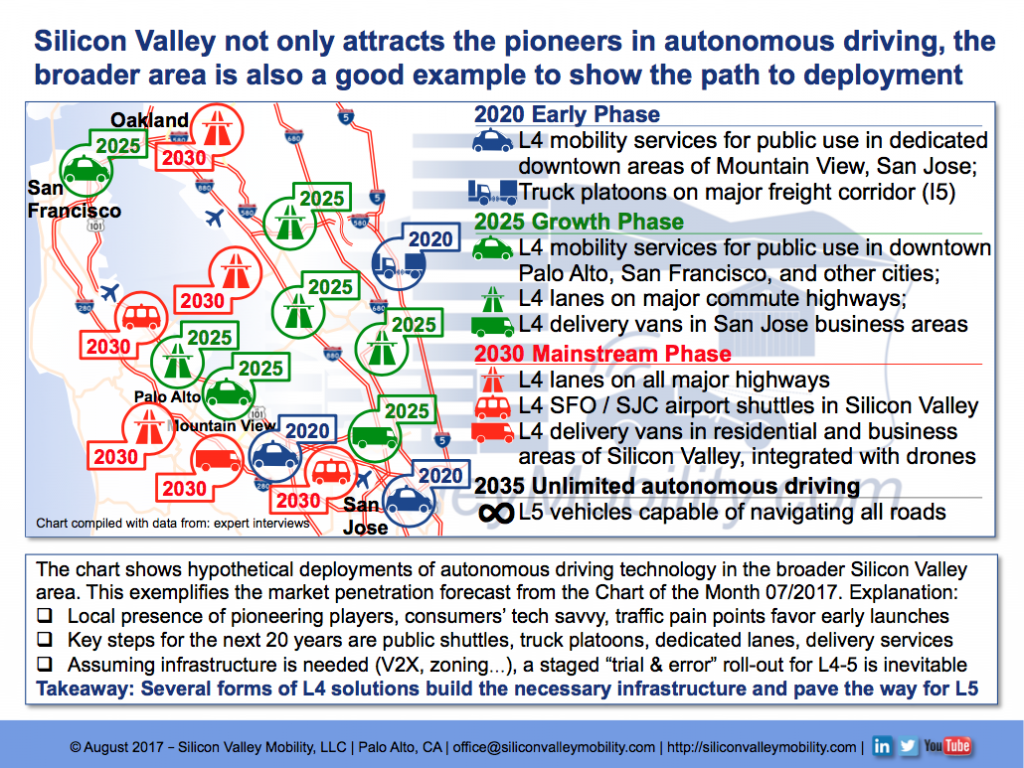

In upcoming years, environmental challenges, population growth and urbanization will lead to mobility challenges that include more accidents, congestion, pollution, greater energy consumption and inequality. Silicon Valley will play a key role in addressing these challenges and transforming the transportation industry, says Sven Beiker, founder of research firm Silicon Valley Mobility, a lecturer at the Stanford Business School and former McKinsey & Co. consultant.

Some of the solutions the tech industry is developing include greater automation, vehicle-to-grid and vehicle-to-vehicle communications, electrification and car- and ride-sharing, he says.

Beiker says the most common question he fields is, When will we have fully autonomous cars?

The evolution of autonomous vehicles includes shuttle services guided by GPS in select cities by 2020; autonomous vehicle lanes on major highways by 2025; and unlimited autonomous driving, capable of navigating all roads, in 2035, he says.

Autonomous vehicles will generate an unprecedented amount of data coming from cameras and sensors on vehicles. A major challenge will be utilizing all of this data; it will require 5G Wi-Fi connectivity to upload this information to servers, Beiker says. He points to advances in data compression and “edge computing” technologies as being critical to being able to use the data for necessary development – such as the development of new maps that show where congestion is – to enable autonomous vehicles to operate.

Consumers are also changing how they move around, since mobility is no longer tied to economic growth and the rate of young licensed drivers is dropping, Beiker says. He points to the widening gap between passenger miles traveled and GDP growth to illustrate this point.

Since Uber and Lyft dominate consumer ride sharing, the most compelling new mobility models Beiker is seeing are on the commercial side, including “freight as a service,” or ride sharing for freight. This can allow trucking companies to better utilize their fleets and offset the seasonality of their business, since 50% of their capacity is currently going unused.

EV Charging: New “smart” models opening up the market for EVs

The projections for EV charging growth is strong, with 60 million charging ports expected to be installed across the U.S. by 2025, driving $80 billion of investment in charging infrastructure, says Preston Roper, Chief Marketing and Operating Officer of Silicon Valley-based eMotorWerks, which develops intelligent EV charging stations. The company was acquired by Italian utility Enel, through its subsidiary Enernoc, last October.

Roper sees growing interest by utilities, energy companies and auto manufacturers to incorporate new EV charging technologies. Many of these companies are experimenting with new business models.

With growing demand for EVs, a new “fueling network infrastructure” is needed worldwide, he says. EVs are expected to exceed 1GW of peak demand and add 1600 GWh of energy demand each year. This new load being added to the grid will cause problems for utilities.

Utilities and grid operators need to avoid these peak procurement costs, defer the need for expensive grid upgrades and bypass potential grid outages caused by this new load. They also need to increase their usage of renewables for EV charging, he says.

In order to achieve these things, Roper says, utilities need to implement “smart charging” technologies that can aggregate and control this new EV load, as well as be responsive to local grid conditions and enable consumers to participate in incentive programs that shift their EV charging to off-peak hours.

For its part, eMotorwerks develops EV charging systems that gives utilities and grid operators data to help them identify when different grid resources are available, and to optimize their use of renewables. Roper’s company is implementing its smart charging systems with utilities on the West Coast that want to understand the grid impact of a growing number of EVs so they can be prepared for the even wider adoption of EVs in the future.

The company mainly focuses on selling smart charging stations to home owners, which is where 80% of EV charging currently occurs. It has 30,000 systems deployed in that market, he says.

He adds that eMotorwerks is also seeing an uptick in demand for EV charging in the workplace as employers want to provide it as a benefit to employees.

However, in order to drive further adoption of EVs, the major focus needs to be on the rollout of DC fast-charging networks in major transport corridors across the U.S., he says. The company is now working with several large auto OEMs to add smart grid capabilities to their DC fast-charging stations. These companies are also rolling out new subscription charging models, he says.

Although Roper expects that EV charging infrastructure will be commoditized over time, the industry’s focus will be on differentiation by adding intelligence that enables these systems to predictably manage grid resources in order to match clean energy sources to an aggregated load consisting of “tens of thousands of EVs.”

And third-party financing opportunities will be available through the development of “charging as a service” models, such as eMoterwerks’ program Juicenet, which involves a small upfront payment for its hardware, with charging payments then spread out over time. This, Roper says, lowers the cost of ownership through participation in demand-response and other utility incentive programs.

The financing market will further open up as batteries develop and more intelligence is added to these systems, Roper believes. That will enable more opportunities for vehicle-to-grid services, including demand response, peak shaving, load shifting, and capacity services.

To see a replay of the webinar, click here.