The quarterly numbers are in and it looks like investors are moving from the coast to the heartland. With almost $225 million across 37 deals, agriculture and food venture capital investment is up 153 percent from Q4 last year and more than double what it was in the first quarter of last year. Q4 2013 saw 16 deals totaling nearly $89 million and 25 deals totaling $108 million were closed in Q1 2013, according to data from The Cleantech Group.

While the numbers paint a clear picture, investor’s appetite for AgTech startups also shone through when a panel of judges that included Khosla Ventures investor Benny Buller, Chrysalix President and CEO Wal van Lierop, Bright Capital Partner Nety Krishna and Paul Straub, director at Claremont Creek Ventures, chose HoneyComb as their top choice among 15 diverse clean tech startups.

The early-stage Portland Oregon-based startup proved to investors at the recent pitch contest in San Francisco that its drone-powered agricultural surveying solutions that enable the agricultural industry to lower resource usage, increase yield and better manage their crops was worth their vote.

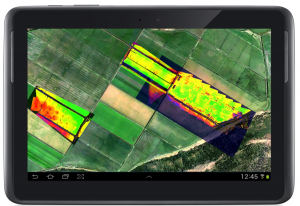

HoneyComb mapping and data processing

To no surprise, the core of the company’s value proposition is in its data. The unmanned drones, called AgDrones, gather images that are then processed by Honeycomb’s algorithms to generate maps for use desk side or in the field. Furthermore, the data is georeferenced so that variable rate maps can be uploaded directly to tractor navigation systems or used as handheld maps for delicate crops.

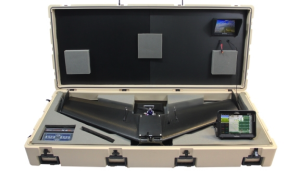

Founded by Ryan Jenson, Ben Howard and John Faus, Honeycomb launched in January 2014 with its out-of-the-box fixed wing ag drone that will cost about $15,000. The company fits neatly within the broadening precision farming market that is quickly being redefined by the use of robotic devices for data aggregation. The information captured by the drones camera and sensors can be used by farmers to spot the spread of diseases or pets, irrigation issues or irregularities in plant growth.

Apart from a $150,000 grant in March from Oregon BEST Center (Built Environment and Sustainable Technology), and $125,000 in venture debt, the company is self-funded. The company has confirmed that it is currently seeking additional funding, and, according its SEC Filing, its seeking to raise $500,000 total.

HoneyComb drone

Honeycomb isn’t the only ag drone startup standing. There have been other fledgling entrants already this year, including Aerial PrecisionAg (acquired by RoboFlight Systems on April 8) and Precision Drone. And then there’s Bosh Precision Agriculture, which started repurposing military drones for use by farmers last year, the PrecisionHawk, which launched in 2010 and raised $1 million in angel funding from Indiana University last August. And New Zealand’s Hawkeye UAV that has been offering unmanned aircraft observation since 2009.

The Association for Unmanned Vehicle Systems International estimates drone technology will produce an $82 billion economic impact and create more than 100,000 jobs by 2025. The Federal Aviation Administration estimates that 10,000 drones could be airborne in the United States by 2018. According to many though, that number is on the low side.

Despite the momentum behind the potential of drones in the ag industry, their use is still at a crossroads as the Federal Aviation Administration hasn’t approved them for commercial use just yet. The agency plans to draft airspace use rules by September 2015 and the meantime has allowed for commercial use in six test areas throughout the country.

Clean Tech Startups Seeking Venture Capital Funding

The judges singled out Honeycomb from the 15 other start-ups from around the globe pitching for venture capital funds during the Cleantech Forum, including:

Algenetix (raised $2 million in Series A funding in April 2013 from Two Oceans)

An industrial biotech company incubated from the Kapyon Ventures pipeline. The company develops single cell petrochemical alternatives using its proprietary PhotoSeed technology, which improves lipid productivity in industrial microbes.

A consumer mobile and web application company delivering a unique solution to water utilities and their customers, connecting utilities to their customers on the devices they use and prefer.

Based in Italy, a market leader for fully integrated hydrogen-based fuel cell back-up and energy storage solutions. EPS has produced and installed more than 500 fuel cell power systems within Europe, Asia Pacific, Africa and Middle East and NAFTA.

Based in Sweden, Ferroamp’s EnergyHub allows solar cells and local energy storage to be combined in a single home unit. The EnergyHub automatically controls the energy flows between solar cells, energy storage, local loads and the grid.

Based in New Zealand, GVT is a new type of continuously variable transmission (CTV) based on gyroscopic reaction. GVT is capable of large speed ratios, without the need to utilize gears for generating electricity from wind and wave power resources.

Based in Singapore, Latenrgy is an early-stage startup developing grid-level thermal energy storage solutions specifically for solar thermal and nuclear power sector.

OndaVia (raised $1M in March 2013 from Band of Angels)

Based in California, OndaVia develops microfluidics- and nanotechnology-based solutions that are capable of detecting contaminants.

A technology company in southern Sweden, having developed a water recycling technology to be used in domestic appliances as well as space.

PowWow Energy (The first-place winner of the Cleantech Open in 2013, where it won $200,000.)

It created a smart leak detector for farmers and ranchers. According to the company’s data, leaks can cost farms thousands of dollars and wipe out crops entirely. The company installs smart meters and collects data from utility companies to identify leaks, then text messages results.

Solar Site Design (raised $50K from Village Capital in Oct 2013)

Solar Site Design is a collaborative, cloud-based content management platform that offers a complete project development solution for solar professionals.

Sunfire (raised a Series B round in Feb 2014 from Bifflinger Venture Capital, Total Energy Ventures, and Electranova Capital)

Germany-based SunFire provides third-generation liquid fuels and combustibles. It offers petrol and diesel from carbon dioxide and water by coupling renewable energy, as well as kerosene, waxes, methanol, and methane/synthetic natural gas. The company also allows storage of renewable electrical power in liquid fuels with storage, loading, and transport capabilities.

Advanced power management solutions which help everyday people reduce energy consumption in their homes and workplaces.

Based in California, Converts low grade waste plastics to petroleum fuels similar to diesel and gasoline blendstocks.