When asked to name his favorite new technology that could revolutionize the geothermal industry, Karl Gawell says he can’t. What’s most exciting isn’t new mapping technology to reduce the famously high risk of drilling new geothermal wells, nor the cost savings of collocating with natural gas sites, or efficient new drilling technologies like fracking and horizontal drilling.

For Gawell, president of the Geothermal Energy Association, the best part of these advancements is that they’re all maturing at the same time, thanks largely to leadership by the U.S. Department of Energy.

“What I think is exciting is that they’re doing so much because for so many years they were doing virtually nothing,” Gawell said of DOE in a recent phone interview. “These technologies don’t all have to pay off. But if even some of them pay off, they could reduce the risk and increase the returns from geothermal pretty dramatically.”

American innovations come at a crucial time. Globally the geothermal industry generated 11.4 gigawatts in 25 markets last year, 27 percent of which was based in the U.S., according to an estimate by Bloomberg New Energy Finance analyst Mark Taylor. The worldwide total is projected to grow to 28.3 gigawatts across 62 markets by 2030 as the focus moves away from America to countries like Indonesia, which could triple its geothermal output in that time, Taylor found.

“You really want to be building the industry and pushing the technology forward because if we don’t do it, somebody else will,” Gawell said.

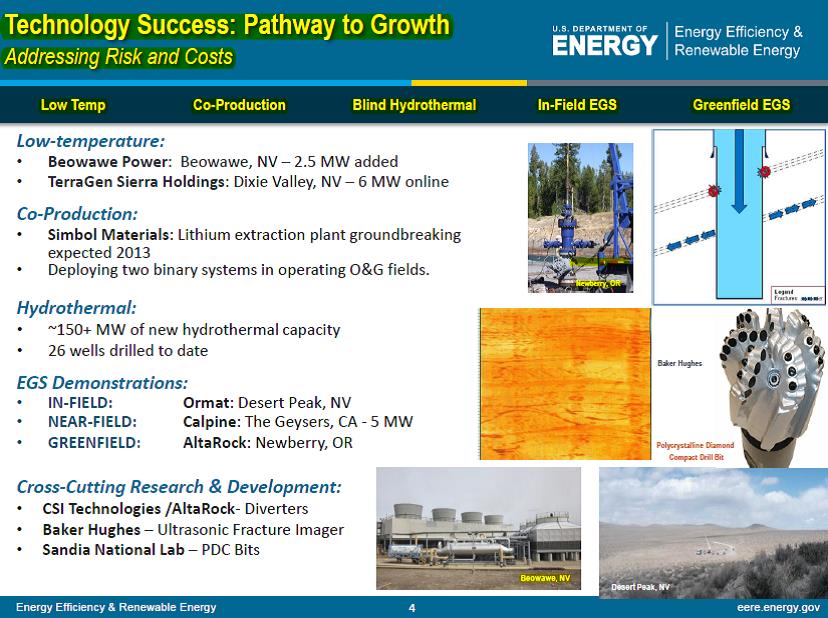

For now, though, the DOE’s Geothermal Technologies Office has a strong lead in developing new practices. The office had an annual budget of $470 million in funding and 170 research projects last year, according to its latest report.

During his speech at the recent U.S. and International Geothermal Energy Finance Forum, Doug Hollett, director of the office, laid out what he sees as potential geothermal game changers, including:

– Maps. The biggest bottleneck for funding geothermal projects is the risk of spending $5 million to dig a dry well. New imaging technology developed by the oilfield company Baker Hughes to detect fractures in deep, hot rock could change that equation, Hollet believes.

“You’ve got to find other techniques to lower the risk and the cost of drilling,” Hollett said.

Halley Dickey, director of Geothermal Business Development for TAS Energy, said he knows of a company whose new software has a 100 percent success rate of drilling wells “that are coming in north of 10 megawatts” each.

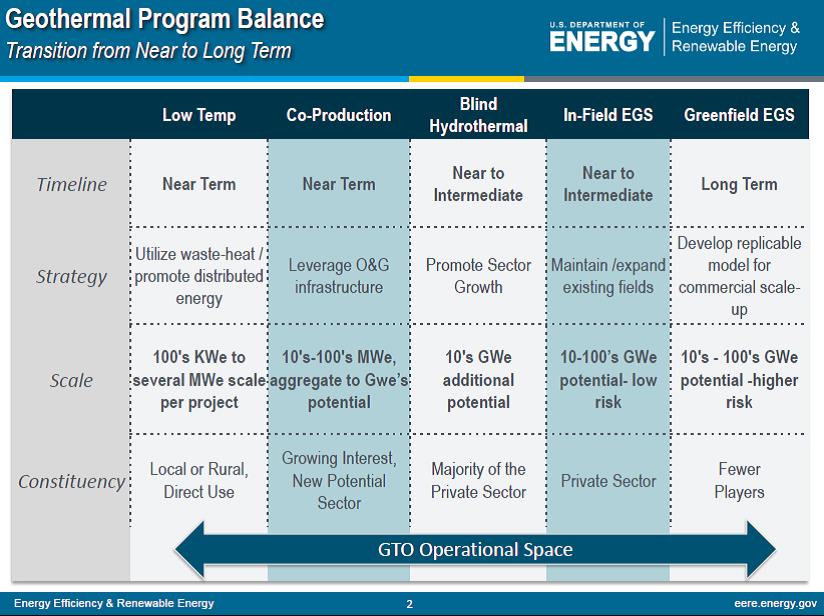

– Co-produced hydrothermal. Even without surface manifestations like hot springs, many rock formations across the U.S. have sufficient heat to power the next generation of geothermal power. Many such sites also have opportunities for natural gas production, creating a mutually beneficial cycle: Reuse of hot fracking waste to generate steam more efficiently and low-cost, on-site power production without connection to the grid.

“Importantly, we see it as a near-term opportunity,” said Hollett, “getting more deployed low-temperature resource connected up and on-grid.”

In its report, DOE singled out the Dixie Valley Bottoming Binary Project as its best low-temperature, co-production site for scientific research and overall progress.

“Colocation? It’s beginning to happen,” Gawell says.

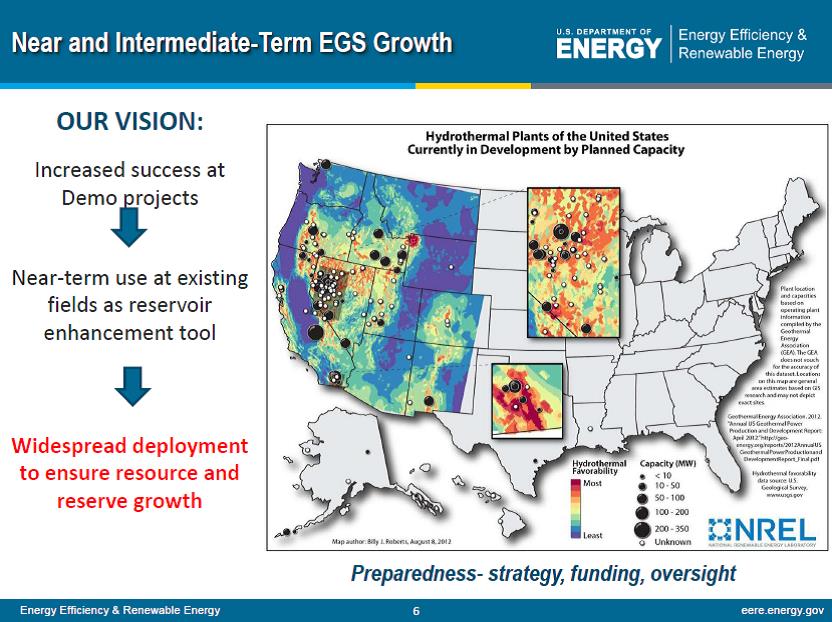

– Infield and greenfield enhanced geothermal systems (EGS). By creating artificial reservoirs that feed liquid through fissures of hot rock, geothermal can move away from traditional resources like California’s Geysers, where water and heat are visible on the surface, and expand into hitherto untapped markets.

“The vast majority of the best geothermal resources lie untapped,” Trent Phillip, Managing Partner, Ambata Capital Partners, said at the forum.

Hollett pointed to Ormat Technologies, which on April 10 became the first company to connect an EGS plant to the grid. “Importantly, we see it as a near-term opportunity,” he said.

EGS can be added onto existing, infield natural gas wells. It also must succeed in greenfield sites, which DOE sees as “highly important to the long-term future” of EGS. This emphasis is best seen at AltaRock Energy’s geothermal plant near Bend, Oregon.

“Since the project has high visibility and is in a greenfield, failure to reach its goals would be taken among some as a black mark against EGS anywhere,” according to the department’s report.

“The most promising new technology is EGS,” says Jon Weisgall, lobbyist for MidAmerican Energy, which owns CalEnergy Generation, operator of 10 geothermal plants in California.

– Better drilling. Techniques developed by the oil and gas industries could drive down risk and cost and boost production of geothermal resources, Hollett said. Horizontal drilling minimizes risk and cost by opening up more subterranean rock to development from a single well. ARPA-E is researching laser-assisted drilling project “that has great results,” said Hollett.

“Trying to hit those fractures with horizontal wells versus trying to hit them with vertical wells, you can see the math and you can see why we’re so excited about it,” he said.

– Materials. Improved membranes can extract more valuable commodities from geothermal brine. Hollett pointed out work at the Hudson Ranch plant in California, which is capturing lithium for use in batteries.

“What other fun things do we have dissolved in geothermal fluids besides lithium and manganese?” Hollett wondered.