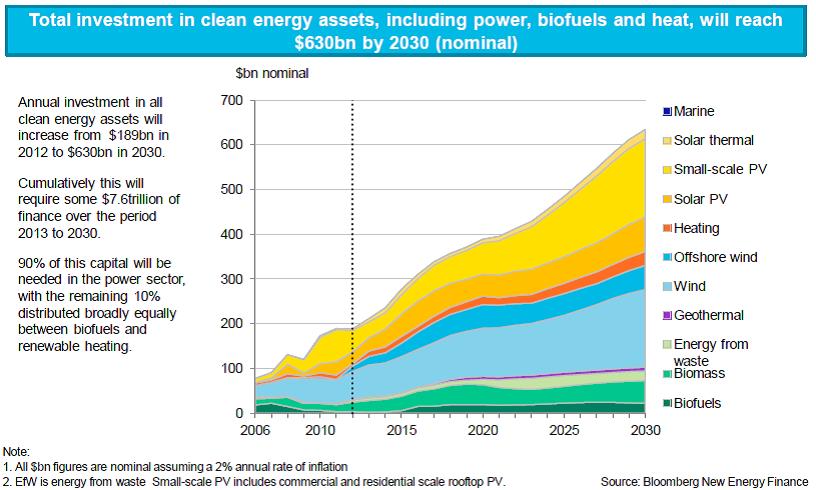

Sure, worldwide investment in clean energy dropped 22 percent to $40.6 billion during the first quarter of 2013, according to Bloomberg New Energy Finance. But don’t pay too much attention to those dismal numbers. Annual investment in the sector will more than double over the next 17 years, reaching $630 billion by 2030, according to the company’s latest estimate.

“This looks very bullish,” compared to other recent estimates, said Michael Liebreich, chief executive of New Energy Finance, during a presentation this week. “It’s not fanciful.”

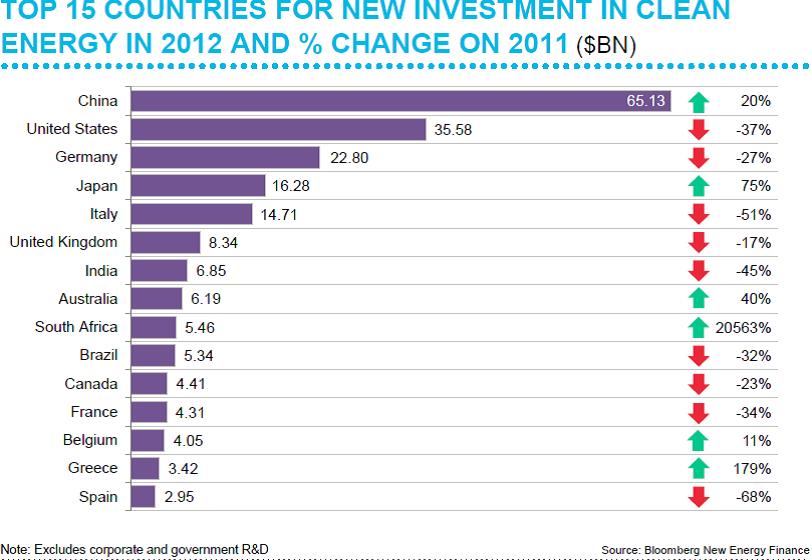

The biggest reasons for Liebreich’s optimism? Continued, dramatic drops in the price of clean energy, combined with strategic decisions to invest in renewable technology by countries including Japan, South Africa and Saudi Arabia. There’s also China, which increased investment in renewable energy by 20 percent in 2012, quickly outpacing the United States to become “the epicenter of investment this sector,” said Liebreich.

Another success that points to the future, he said, is happening in Australia, where clean energy investment rose 40 percent last year, driven partly by the fact that wind power is now cost-competitive with coal there, without subsidies. The prediction includes renewable energy, carbon capture and storage, energy efficiency, smart grid and power storage, but does not include large-scale hydro, nuclear or gas.

With the cost of solar panels dropping 80 percent and wind electricity costs declining since 2008, plus electric vehicles projected to become cost-competitive with traditional vehicles by 2020 at the latest, the future of renewable energy looks “very impressive,” Liebreich said.

This is why analysts who focus on infamous renewable failures may be missing the true story, he said. Yes, we have witnessed Solyndra’s collapse, continued policy disruptions caused by the yo-yo effect of U.S. tax credits, and the retroactive rollback of feed-in solar energy tariffs in Spain. And yes, the demand side of renewable energy manufacturing is hurting, said Liebreich.

But what about all those companies earning a profit by placing those newly cheap solar panels and wind turbines to use? Year-to-year U.S. clean energy investment may have dropped 32 percent in 2012, but installations grew by 100 percent, indicating that renewable energy is “an industry going two different ways at the same time,” he said.

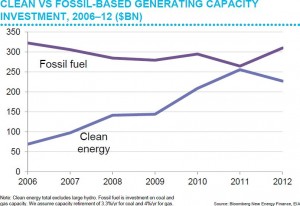

Meanwhile, clean energy projects now account for 40 percent of all investment in new generation on the electrical grid, said Liebreich.

“If you think about the decisions that your average utility and your average [independent power producer] make,40 percent of the time they’re thinking about renewable energy, he said: “That’s what they’re investing in.”

At the moment, investors seem overly concerned with the declines, and insufficiently interested in the growth.

“There hasn’t been very much differentiation amongst public market investors between the suppliers who are suffering pain and the demand side which is actually performing well,” he said. “That’s why we see Warren Buffet investing in green and solar, and he’s certainly not the only smart investor.”

Another entity making major investments in green energy is the U.S. military. Liebreich met recently with some of the military’s top planners on sustainability, and was impressed by their sophistication on the topic.

“The military understands this stuff very, very well,” he said—especially “the role of clean energy and insulating themselves” from unexpected shocks, he added.

Liebreich’s predictions of a rosy future come with some major caveats, however, focusing on all the unpredictable volatility facing energy markets.

“Forecasting this stuff is actually hard. We don’t know how much it will cost to extract shale gas in China,” he said. “There probably couldn’t be a more important question in the world today, and we don’t know the answer to it.”

All of which leads to Liebreich’s advice for what it will take for companies to succeed in the emerging energy market, which will be defined by potentially big plays in unconventional oil and gas, and big gains in efficiency that are starting to make renewable energy and transportation alternatives cost-competitive with fossil fuels.

Those qualities of success boil down to what Liebreich calls the “New Energy ROI”:

Resilience.This involves the ability to envision and plan for future shocks, including cyberwarfare, natural disasters and geopolitical strife. One of the biggest tests of resilience will focus on water, Liebreich believes. For example, five of China’s largest drinking water facilities are located in areas already wracked by water scarcity, and conditions are only expected to intensify by 2030.

“Water is rising on our screens in a big way, starting with the nexus between industry,” Liebreich said. “You have to take this into account when making investments.”

Optionality.What’s your investment Plan B? Technologies including energy efficiency, power storage, demand management and mini-grids give companies of all kinds options during times of crisis.

“Are equity analysts putting appropriate value on utilities that have got diversified generation portfolios?” Liebreich asked. “Are the analysts and investors valuing that correctly?”

Intelligence.We are experiencing an overwhelming tsunami of data right now, and investors are either surfing it or drowning, Liebreich said. Harnessing Big Data, smart grid and other data-driven solutions—without getting drowned in numbers—will be key for success. “In a volatile world, information is essentially the only way that you can protect your asset value.”

Understanding that renewable energy markets differ significantly from conventional wisdom about them, and using these guidelines for success, amount to “a checklist to see if your strategy is robust to the realities of the world,” Liebreich said. “If you’re not strategically integrating those trends, you can be pretty sure that your competitors are.”

When considering all the elements of this checklist, one arrives at a new way of thinking about success and growth. Under the old model, which Liebreich labeled “dinosaur heuristics,” successful companies focused on building massive scale, centralization and vertical integration to create enough capacity to deliver baseload supply plus occasional peaks, protected by a military mindset of confidentiality and institutional defense.

That old way is about to go extinct, Liebreigh predicts, replaced by “mammal heuristics” that value coalitions and networks, data sharing, efficiency, demand management and a strong R&D budget.

Liebreich mentioned several people he sees as mammals well adapted to the coming age, including Elon Musk and NRG Energy CEO David Crane. Then Liebreich posed the kicker: “The question I leave you with is: Are you mammals?”