AeroFarms Corporate Farm Main Entry

It’s been a busy end to the year for vertical farming company AeroFarms. The privately held company is set to open a $40 million, 69,000 square foot indoor farm in Newark, New Jersey, and also closed in December on a $20 million venture funding round. AeroFarms will raise new project finance capital and venture capital funding this year and beyond, and will be hiring aggressively as it opens additional facilities in the US and possibly in China as well.

Financiers, meanwhile, say they’re willing to consider backing additional vertical farms, which can bring pesticide-free greens to local consumers while also reutilizing urban buildings.

AeroFarms says its new facility will be the world’s largest vertical farm when it opens in a converted steel factory in a run-down section of Newark called Ironbound. It will also house the company’s headquarters. The project overall will create about 80 permanent jobs, and AeroFarms is partnering with local community organizations to help hire local residents for some of those positions.

The farm will produce up to two million pounds of herbs and leafy greens each year. It will be 75 times more productive per square foot than a traditional field farm, according to the company, while using 95% less water and no pesticides.

Financing the New Facility

Those are attractive numbers, and they helped AeroFarms pull together some $40 million in financing to build out the new farm and headquarters. That includes $30 million in project financing from Goldman Sachs, Newark-based Prudential Financial, and building owner RBH Group. Goldman is handling the bulk of that $30 million through its Urban Investment Group, part of its impact investing unit, using equity, debt and bridge financing.

Goldman liked the project in part because “it repositioned underutilized infrastructure to promote local employment and stimulated urban agriculture to engage youth in food education,” the company tells CleanTechIQ. “Importantly, the project also allowed UIG to support the growth of a company that we believe can have a disruptive impact on food production in urban areas.”

Goldman’s UIG has committed $4.3 billion of capital to projects since its founding in 2001. The group “seeks double-bottom-line returns by providing flexible financing for community projects that respond to the needs of low- and moderate-income communities and support public sector priorities,” the unit says.

The AeroFarms project has also received about $9 million in public funding in tax credits and grants. Those include up to $2.2 million from the New Jersey Economic Development Authority and $6.5 million in tax credits through the agency’s Grow NJ program, aimed at encouraging AeroFarms to choose Newark over an alternate location it was considering in Philadelphia. The project also received federal New Market Tax Credit allocations from United Fund Advisors and Dudley Ventures, an investment and advisory firm that specializes in tax credit and related investments.

The New Markets Tax Credit program was launched by the Clinton administration in 2000, intended to spark revitalization projects in low-income areas. It essentially gives tax credits to entities that invest in such areas.

Joel Superfon, director of investment management and advisory services at Dudley Ventures, says the firm sees AeroFarms as a “job creation” project for Newark’s Ironbound neighborhood. AeroFarms “were taking an innovative product that had not been done commercially yet, in an area that had been completely divested of any capital,” Superfon says. He says it’s an “incredibly sustainable, low water usage and innovative” project that will both create jobs and provide a valuable product — leafy greens — to Newark and the surrounding region.

The project’s overall funding was a combination of debt, tax credits, and government funding, “which you often see in New Markets transactions,” Superfon says, while AeroFarms put in capital as sponsor equity as well. “We rarely see one source of financing,” he says of projects like this. “It takes some leverage, it takes the community, it takes the New Markets tax credits… It was really a broad combination of those capital sources.”

The Newark project qualified for New Markets credits because of its “focus on putting capital to use in low income areas that create jobs, create services for low-income individuals, and have sustainable economic and environmental attributes,” Superfon says.

New Markets tax credits can also be applied to biogas projects, facilities that reuse dairy waste, biosolids, and agricultural byproducts to create green gas for transportation off-take, says Dudley Ventures CEO James Howard Jr. “It’s just a totally interesting play at the moment, and one we’ve been really focused on. “

History, Funding of AeroFarms

AeroFarms was founded in 2004 by Ed Harwood, a former associate professor at Cornell University’s Cooperative Extension, and engineer Travis Martin. Its first commercial aeroponic farm opened that year near Ithaca, New York, and sold greens to area restaurants and supermarkets for the next four years.

AeroFarms raised $1.7 million in Series A financing in 2009 with the The Quercus Trust and 21 Ventures. Two years later the company merged with Just Greens, a startup focused on vertical farming, and Just Greens’ founders David Rosenberg and Marc Oshima became AeroFarm’s CEO and chief marketing officer, respectively, positions they still hold.

In December, the company closed on a Series B venture financing round for $20 million, with Wheatsheaf Group leading the investment, according to the Wall Street Journal; Wheatsheaf joins previous investors including GSR Ventures, MissionPoint Capital and Middleland Capital. AeroFarms has now raised a total of $70 million in funding, according to CEO Rosenberg. The company will use the new funding to help build additional facilities, and to launch its own brand for consumers; until now, AeroFarms has sold its produce on a white-label basis, the Journal reports.

AeroFarms has been receiving positive press as it’s been constructing its new Newark facility, in publications ranging from the New York Times to Bloomberg to CNBC. That has helped the firm raise its profile, and raise capital. “Because we have been getting press, we’ve been getting demand [from investors] from all over,” Rosenberg says.

One key to securing the project financing, Oshima says, has been demonstrating the firm’s expertise in areas like engineering, horticulture and food safety. Indeed, AeroFarms’ headcount, about 40 now, includes many people with secondary degrees in fields like engineering, crop biology and horticulture.

The company also expects the new facility to be cash flow positive by the end of 2016.

Driving the expectation of robust sales for their leafy greens, Rosenberg explains, “There’s a strong demand for local food production. And there’s a lack of supply of quality local food production.”

Automation helps drive down AeroFarms’ cost structure, and it uses automated processes for feeding, harvesting, and cleaning the reusable “growth media,” Rosenberg says as well as for packaging. All that automation doesn’t come cheap, which means the company has to get big if it’s going to be profitable. “You need the economies of scale to pull in all that automation,” he says.

The Pros and Cons of Urban Farming

AeroFarms operates differently from other urban farmers, particularly traditional greenhouse hydroponic operations, which are often found on rooftops and grow produce in nutrient-rich liquid solutions. AeroFarms grows up, not out, which can allow for considerably more production per square foot. The firm also grows its product aeroponically in an enclosed environment, with the plants anchored in a patented reusable cloth medium that is soaked with nutrient-rich mist at precise intervals.

Some vertical greenhouse farms rotate trays of plants to ensure every plant gets enough sunlight; many others, like AeroFarms, use artificial lighting, typically specialized LEDs, to replace natural sunlight.

AeroFarms Technical Diagram

Vertical Farming Methods

AeroFarms says using an aeroponic mist leads to faster growing cycles — about two weeks, versus four weeks for traditional farming — and greater production. The company’s process uses 95% less water, and about half the normal fertilizer, than traditional field farming does. It’s also a cleaner and safer process, the company says: the growing medium is sanitized between every growing cycle, and the indoor locations means it’s sanitary, with insects and weeds kept away. That lets them use no pesticides, herbicides or fungicides.

On the other hand, vertical farms whether aeroponic or hydroponic, have only a limited menu in terms of what they can grow. It’s a capital-intensive process with high start-up costs, and it uses a lot of energy. The economics of vertical farming have only recently become viable, thanks to improved technology and a growing consumer preference for locally sourced foods.

Despite improvements in LED technology and drops in prices, lighting is still expensive: the lights make up about 50 percent of the company’s capital expenditure, Rosenberg has said.

Skeptics note that such heavy reliance on electricity may undercut one of the benefits of vertical farming. “If you wind up using more energy to light the plant than it would have cost to truck them across the country, then at least from an energy standpoint, you’re not coming out ahead,” BrightFarms founder — and AeroFarms competitor — Ted Caplow recently told NPR. BrightFarms develops hydroponic rooftop greenhouses that use natural sunlight.

LED Prices Fall, Boosts Vertical Farming

Proponents fire back by noting that LED lights are becoming more and more efficient — prices have fallen 85 percent in the last six years, while their output per watt has doubled, according to Bloomberg — which lets vertical farms be much more productive. Indeed, AeroFarms claims it produces about 40 pounds of produce per square foot annually, versus six or seven pounds for the typical hydroponic greenhouse.

The company uses a custom-built control panel that, along with computers and big data collected from its operations, lets the company fine-tune the lighting intensity and color wavelength.

Harwood worked with Neil Mattson, a professor at Cornell’s School of Integrative Plant Science, to figure out the best mixture of light for the plants. Harwood tells Bloomberg that using only red and blue LEDs have cut energy costs by 15 percent. Tweaking the lights has other impacts as well, such as making arugula taste more peppery, or kale taste sweeter, Bloomberg reports.

Vertical Farming Crops in Demand

Indoor farms in general have limited product ranges. Vertical farms that use artificial lighting, hydroponic and aeroponic alike, typically grow only herbs and leafy greens; trying to grow grains or fruits or vegetables indoors, with artificial lighting, would require huge amounts of energy, experts say. Hydroponic greenhouse farmers like BrightFarms and Gotham Greens grow tomatoes as well as greens.

Some consumers think hydro- or aeroponically grown plants don’t taste as good. Farmers, though, say they have tweaked the formula of the nutrients they feed their crops — or, as AeroFarms has done, perfected the lighting mix — to make the plants taste as good as, or just about as good as, those grown in soil.

Aerofarms can grow up to 250 different types of leafy greens, Rosenberg says, but the company is still figuring out what specific greens it will grow in Newark, and how much of each. “We’re determining the product mix based on feedback from partners on the selling side, such as retailers and food service operators,” Oshima says. “We have more demand than capacity. We need to make sure we prioritize our strategic partners in the right way.

The crop mix will be chosen in part to maximize productivity. “We are focusing specifically on short stem leafy green crops, micro greens, first,” Oshima says. “The reason is that you can get as many vertical rows as you can to get the highest farm productivity you can. The smaller the plant, the smaller space you need, and the more rows you can get in there.”

AeroFarms Growing Room

Investor Interest, and Caution

Oshima says he’s seeing increased investor interest in the vertical farming space. Other vertical farming companies include FarmedHere and Green Sense Farms in the Chicago area; Alegria Fresh in Irvine, California; Green Spirit Farms in New Buffalo, Michigan; and Vertical Harvest in Jackson Hole, Wyoming. Vertical farms are also sprouting up in Europe and Asia, including in Singapore and Japan, where Toshiba and Panasonic are both producing commercial-grade vertical farms. Meanwhile, what is said to be the world’s first underground urban farm, Growing Underground, opened in London in a former World War II air raid shelter in June.

When it comes to funding urban farms, investors are drawn to the fact that the produce can be farmed at or near the retail outlets to minimize shipping costs and time, thereby reducing food waste, limiting the need for refrigeration and cutting vehicle emissions. Vertical farming also generates greater yield and productivity per square foot versus traditional farming and uses about one-tenth the water per pound of produce. VCs, so far, have tended to prefer investing in hydroponic greenhouses that use natural sunlight, rather than indoor vertical farms. With hydroponic greenhouses, “the energy quotient is lower than [indoor] vertical farming methods,” says Peter Grubstein, founder of NGEN Partners. NGEN was the lead investor in BrightFarms’ Series A funding round in 2011.

BrightFarms, a leading commercial rooftop hydroponic greenhouse developer, has raised over $25 million in financing, including a $13.6 million Series B venture investment in November from WP Global Partners, NGEN Partners, and Emil Capital Partners. It also raised project finance capital from Clean Feet Investors and Prudential to build a greenhouse farm in Culpeper County, Virginia, which began operation in October to supply produce for Ahold supermarkets in the Virginia, Maryland, DC and Delaware areas.

BrightFarms now has three operational farms and one in construction. It developed an innovative financing technique called produce purchase agreement (PPA) financing that securitizes the company’s long-term fixed price food supply contracts with supermarkets.

Lufa Farms is another key player in rooftop hydroponic greenhouses, and has raised over $4.5 million in financing to date. It claims to have built the world’s first urban rooftop greenhouse farm in Montreal atop an existing industrial building in early 2011 and now has two operational rooftop farms in the Montreal area. Lufa sells its produce directly to consumers through an online marketplace.

Andrée-Lise Méthot, founder and managing partner of Canadian VC firm Cycle Capital Management, Lufa Farm’s lead investor, particularly likes Lufa Farm’s gains in energy efficiency, which is 50 percent greater than conventional greenhouses, she tells CleanTechIQ. And, she says “rooftops are now considered as the new fields or new lands and can be attractive to solar, wind, and farming.”

And Gotham Greens, with two working hydroponic greenhouses in Brooklyn, including one on top of a Whole Foods Market, is set to expand in Chicago with what it’s calling the world’s largest rooftop farm perched on top of Method Products’ new nontoxic biodegradable soap factory. The 75,000 square foot hydroponic greenhouse will grow a million pounds of pesticide-free tomatoes, herbs and leafy greens each year. (See our in-depth profile of Gotham Greens.)

Rendering of Method’s Soap Factory in Chicago with Gotham Greens Rooftop Farm

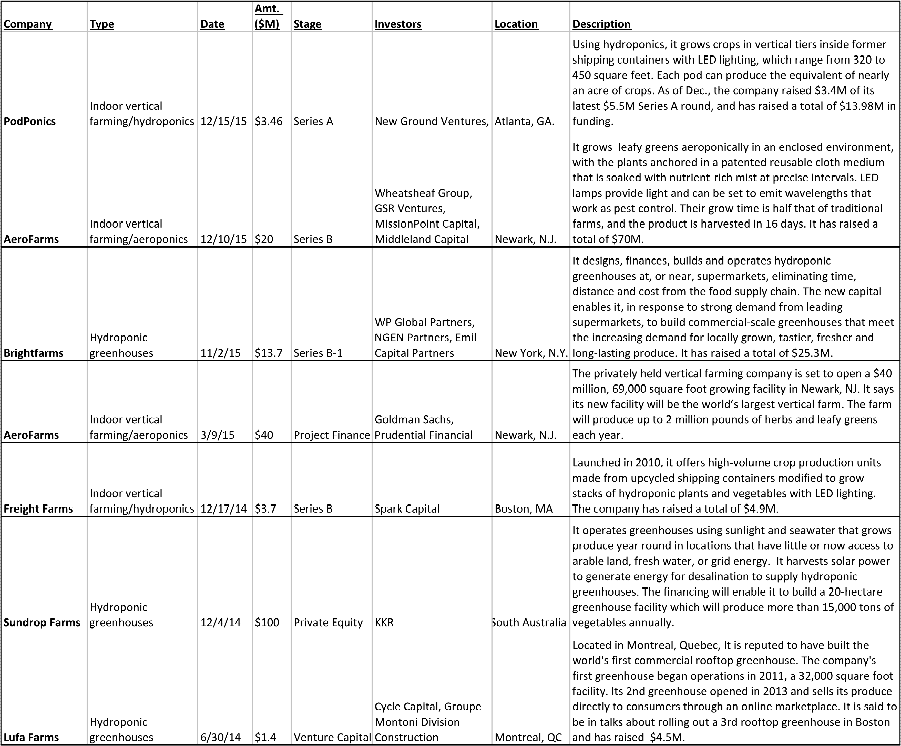

Although rooftop hydroponic greenhouses have gained the majority of investor interest in urban farming over the past several years, interest in indoor vertical farming using artificial lighting is on the rise due to recent technological advancements and the nearly 90 percent drop in the prices of LED lighting over the past two years. This emerging investor interest is reflected in our urban farming funding data in Table 1 (see bottom of this article), which notes four financings of indoor vertical farm companies over the past year and seven total financings of urban farms.

Urban farming is drawing interest from VCs focused on clean technology as well as VCs with a broad technology focus. CleanTechIQ has spoken with investors at leading venture capital firms that are exploring potential investments in the urban farming space, such as Black Coral Capital, SJF Ventures, and Google chairman Eric Schmidt’s Innovation Endeavors, which recently launched Farm2050, an agriculture technology startup accelerator that includes corporate partners Google, DuPont, Agco, United Technologies’ Sensitech, Wilbur-Ellis, and 3D Robotics.

However, amid this emerging investor interest and the proliferation of new companies entering the urban farming market, investors need to be cautious and conduct serious due diligence in order to avoid the potential pitfalls of this emerging sector. To mitigate risk, investors should identify companies that have in-house expertise in mechanical engineering, crop biology and horticulture, and that also have the operating processes in place to efficiently produce safe and nutritious foods, experts say.

Even AeroFarms’ CEO urges caution and faults some vertical farming companies. “There’s been a lot of companies in this space, and I think over 75% percent are going to go out of business in the next three years,” Rosenberg says bluntly, questioning how some of them approach pricing and costs, as well as food safety. “I think there’s going to be a lot of financial pain in this space in the coming years,” he says.

The Outlook for Urban Farming, Investment Opportunities

AeroFarms has aggressive plans for growth in the next year too. The company is planning to build two more facilities in the Northeast U.S., at about $30 million each, and is raising new project finance capital for both; Goldman and Prudential are likely to be the financiers for both, according to Rosenberg. Two more projects are planned for 2017, he adds.

The company is looking at another round of venture capital funding in the second half of 2016, and will be “hiring like crazy,” Rosenberg says.

AeroFarms is also considering a big urban farm in China. “We’re exploring building an $84 million project in China,” according to Rosenberg. He declines to go into specifics but says AeroFarms executives have been to China a few times and have identified a location, and says an announcement is likely to come in the first quarter. “The demand in China for safe food is big,” Rosenberg says

In terms of financing for urban or vertical farming, the industry remains immature, Dudley Venture’s Howard says. “I still think there’s a ways to go,” he says. “Particularly in agriculture, lenders want a bigger, well-capitalized entity behind it.” Things are changing, he adds. “l do see that there’s progress being made. Slow, though. We’ve been a part of that process of bringing people into the space.”

The ongoing presence in the space of firms like Goldman Sachs would help a lot, and Goldman is signaling that AeroFarms may not be the last investment in urban agriculture that its Urban Investment Group makes. “While this is Goldman Sachs UIG’s first real estate investment involving an urban agriculture company, we are very intrigued by the industry’s potential to transform underutilized industrial buildings in urban markets and to provide urban populations with access to fresh, healthy and sustainable food options,” the company tells CleanTechIQ.

Rosenberg cautions that it’s not an easy field. “There’s this romanticized notion of local food production,” he says. “And it’s cool, but you’ve got to do it right, it’s a really hard industry. I’m reminded of that every day. But people are underappreciating the complexity in this space… The investors aren’t asking the right questions and the people in the space aren’t taking the right steps.”

Yet Rosenberg remains optimistic overall. “Ultimately the industry is going to survive and be successful and have a meaningful spot within the agricultural community.”

New Sources of Funding for Sustainable Infrastructure

Some investors complain that urban farming and the clean tech sector overall is too capital intensive, which is keeping away early stage investment. However, Cycle Capital’s Méthot believes that a greater variety of capital will enter the market to finance clean tech infrastructure, including urban farms.

“We need to redefine a way to finance more infrastructure play in clean tech and I believe many scenarios can be explored: VC, venture debt, etc.,” she says. “There’s a real challenge related to infrastructure deals and we need to find a way to invest in these kind of innovations because they can change the world.”

Climate change and food security issues are central to Cycle Capital’s urban farming investment thesis. “With growing population, urbanization, climate changing and drought like the one actually occurring in California, there is no doubt there are great needs for innovative technology to fulfill needs for food in urban areas,” Méthot says. “We have no doubt this sector will necessitate investments and generate great returns to investors”.

Regarding the quality of today’s urban farming deals, Méthot tells CleanTechIQ that Cycle Capital is “seeing great deals and investing in growing companies in the space.”

Table 1 – Notable Urban/Vertical Farm Financings

Source: CleanTechIQ’s Resource Efficiency & Sustainability Financing Database

Innovative financing and implementation of sustainable, resource efficient infrastructure, including agriculture projects, will be the key focus for CleanTechIQ in 2016. We will be introducing reports on key market trends as well as in-depth profiles of innovative companies and projects driving resource efficiency.

We invite readers to engage with us and share insights on key market trends that will help us to develop content that is must have and actionable. Please contact us at editorial@cleantechiq.com with any comments, questions, or insights you would like to share.