A Freight Farms Leafy Green Machine

Money is flowing into companies that specialize in indoor, vertical farms, often located in warehouses or other urban locations. Such farms are expected to grow in coming years as a surge in urban population leads to demand for more crops that are produced close to the consumer. One investor, in fact, thinks the vertical farming industry could scale in the next five years.

In this report, we take a look at what’s driving the interest in indoor farming — the improved technology and lower prices of that technology,

Key takeaways:

– Lots of new investment activity coming from a diverse set of investors for vertical farming.

– A wide range of business models and strategies are attracting funding.

– Money is coming from funds, banks, corporates, sovereigns and more, and investors are based all around the world.

– Investment activity is set to continue as companies work to create new and improved urban farming solutions as city populations continue to rise.

– Many major retailers across the U.S. are buying produce from vertical farms, including Walmart, Amazon, Whole Foods, Pathmark and A&P. Vertical farms are also supplying a growing number of retailers and restaurants in their local markets.

“We think the industry is more or less near an inflection point. It is no longer just a pie-in-the-sky theory. It has the chance to scale in the next five years.” — Hans Tung, managing partner of vertical farm investor GGV Capital, quoted in Forbes.

What are indoor vertical farms and their key benefits?

– They typically grow crops hydroponically, using nutrient-enhanced water instead of soil. That, and the controlled environment of most indoor farms, means farmers can avoid pesticides, herbicides and fungicides, although hydroponically grown plants aren’t considered “organic.”

– Hydroponic plants can grow up to twice as fast as soil-based plants, since they don’t have to spend energy on growing an extensive root system. They also take up less space, which means a farmer can produce more crops in the same amount of space, and the climate-controlled environment means they can produce vegetables all year long.

– With year-round growing, vertical farms can produce 20 times as much produce, using one-tenth the water, than traditional growing.

– Leafy greens and herbs are the products of most vertical farms, though some have managed to grow a wider range, and companies are experimenting with ways to grow even more vegetables and fruits indoors.

– Vertical farms use artificial lighting, in the form of specialized LEDs, to replace natural sunlight. (This is in contrast to urban greenhouse farms that are built on rooftops and use natural light.)

– The controlled environment also reduces the risk of contamination by pathogens like E. coli and salmonella and can allow the growing of fresh food in very arid regions that are unsuitable for traditional farming, such as the Middle East.

– In fact, the Middle East and Asia are growing markets for vertical farms, due to environmental factors as well as rapid urbanization. Indoor vertical farm developers are focusing on these regions in their growth plans to attract investors.

– Urban farms can mean a significant reduction in the resources needed to get the produce from farm to table, since they can be grown literally around the corner from the consumer. They can also help ensure that city dwellers have a steady supply of quality produce.

Indeed, investors are drawn to the fact that the produce can be farmed at or near the retail outlets, which minimizes shipping costs and time, reduces food waste, limits the need for refrigeration and cuts delivery vehicle emissions.

Some important challenges that vertical farms face:

– Indoor farms generally have limited product ranges. Trying to grow grains or fruits or vegetables indoors, with artificial lighting, would require huge amounts of energy, experts say.

– It’s a capital-intensive industry with high start-up costs.

– Vertical farms use a lot of energy. LED prices have come down significantly in recent years, but lighting costs are still high, and can represents up to 50% of a vertical farm’s capital expenses.

Here’s a run-down of recent fundraising activity:

Square Roots – $5.4 Million Seed Round, August 23, 2017

Urban farming incubator Square Roots closed a $5.4 million seed funding round in August. The Brooklyn-based company was founded in 2016 by Kimbal Musk, the brother of Elon Musk, and serial entrepreneur Tobias Peggs.

The Collaborative Fund was the lead investor in the seed round. Square Roots focuses on vertical farms inside shipping containers, using technologies from Freight Farms and ZipGrow. Farmers using the Square Roots program are distributing greens to more than 80 offices and restaurants across New York City and local restaurants.

The urban farmers taking part in the program are also eligible for newly available microloans from the USDA for urban farming.

Plenty – $200 million Series B Round, July 19, 2017

Plenty, an indoor vertical farm company, raised a $200 million Series B round in July, bringing its total funding to $226 million since founding in 2014.

The lead investor in Plenty is SoftBank, through its Vision Fund. Other investors include Finistere Ventures, Innovation Endeavors, Bezos Expeditions, Data Collective and DCM Ventures.

The company’s home base is a 52,000 square foot facility in South San Francisco. With the new funding, Plenty plans an aggressive expansion, including the construction of vertical farms in China, Japan and the Middle East as well as the U.S.

Plenty claims it can expand beyond the leafy greens that most vertical farms produce, and will be able to produce a range of fruits and vegetables whose quality rivals that of traditionally grown produce.

InFarm – $4.5 million seed round, June 26, 2017

Berlin-based InFarm takes a unique approach to indoor farming: it wants to grow leafy greens in modular growing units that are placed inside grocery stores. It raised seed funding of $4.5 million over the summer from investors including Atlantic Food Lab, Cherry Ventures, IDEO, LocalGlobe and Quadia

The company, founded in 2013, is running a pilot program with the Metro supermarket chain and is also working with EDEKA, Germany’s largest supermarket company.

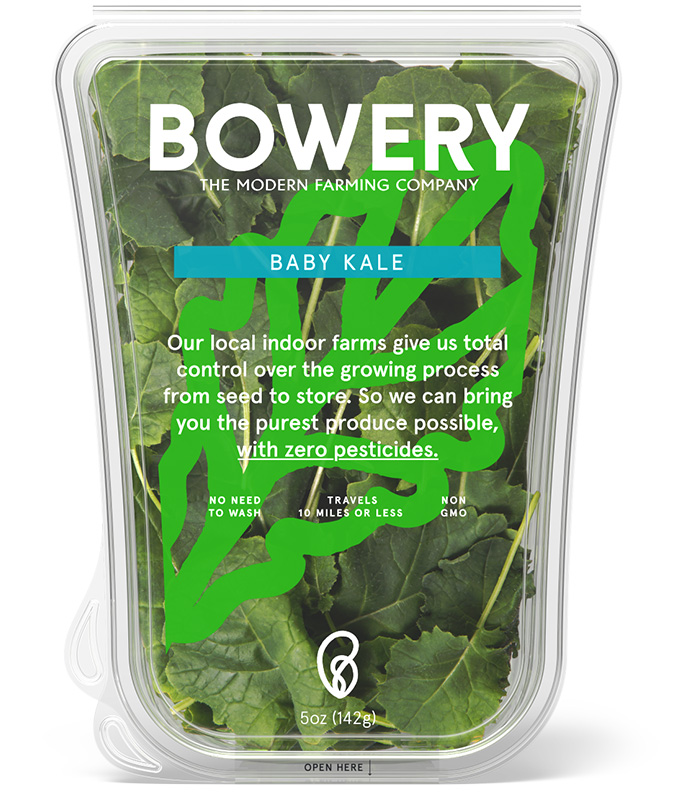

Bowery Farming – $20 million Series A round, June 14, 2017

Also in June, vertical farmer Bowery Farming raised $20 million in a Series A round. Founded in 2015, the Manhattan-based company has raised a total of $27.5 million. Investors in the round included General Catalyst, GGV Capital and GV (formerly Google Ventures).

Bowery Farming grows leafy greens in vertical indoor farms, with its first farm in a warehouse in Kearny, N.J. Current customers include Whole Foods and Foragers markets. The company is testing over 80 different varieties of greens and is also experimenting with other types of crops.

Freight Farms – $7.3 million Series B round, June 6, 2017

Freight Farms grows crops inside shipping containers that it dubs “Leafy Green Machines.” Since its launch in 2010, Freight Farms has raised a total of $12.2 million in venture funding, using the money to deploy 100 farms. Investors include Spark Capital, LaunchCapital, Morningside Group and Right Side Capital Management.

The Boston-based company says one of its containers can produce 1,000 heads of lettuce per week. Google’s corporate campus has been an early adopters of the Leafy Green Machine; so have been the University of Michigan and the University of Massachusetts at Dartmouth, which use the farms to teach students about sustainable agriculture

Freight Farms and Clemson University have also received a grant from NASA to work on ways the containers could be used in space — the idea being that such farming methods will be necessary if humans are to travel to Mars or beyond.

The company raised its first financing from First Round Capital, Box Group, Lerer Hippeau Ventures, Blue Apron CEO Matt Salzberg, and Top Chef Tom Colicchio, whose restaurants Craft and Fowler & Wells have Bowery Farming’s greens on the menu.

AeroFarms – $34 million in Series D funding, May 2017

Founded in 2004, AeroFarms has now raised a total of $97 million. The latest round saw money from ADM Capital’s new growth stage, agriculture-focused Cibus Fund, and from Alliance Bernstein. Meraas, the investment vehicle of the ruler of Dubai, is also an investor, and the company is now looking to expand into the Middle East.

Earlier investors in the company include Wheatsheaf Investments, GSR Ventures, MissionPoint Capital and Middleland Capital.

AeroFarms has 10 vertical farms in development, including what will be its largest facility, a 78,000-square foot farm in Camden, N.J. that’s funded in part by an $11.4 million grant from the state. Its flagship farm is a 69,000 square foot farm in Newark, N.J., that cost $40 million to build, funded through a combination of tax credits, grants and project finance capital backing from Goldman Sachs and Prudential.

The company currently provides produce to ShopRite supermarkets and plans to become a supplier to Whole Foods stores soon as well.

BrightFarms – utilizing an innovative project finance capital model to build its farms.

BrightFarms is a rooftop hydroponic greenhouse developer that has raised over $25 million in financing. It pioneered a funding model called “produce purchase agreement” (PPA) financing, which securitizes the company’s long-term fixed price food supply contracts with supermarkets. This enables it to raise project finance capital.

In 2015, it raised project finance capital from Clean Feet Investors and Prudential to build a greenhouse farm in Virginia to supply produce for a range of supermarket chains in the Virginia, Maryland, Delaware and Washington, D.C. areas. BrightFarms now has three operational farms and one under construction.

Editor’s note: CleanTechIQ hosted a Sustainable Food & Agriculture Forum on Sept. 29 in New York, and urban farming was a key topic of discussion. We will provide coverage of insights from that dialogue — which included both leading developers (Gotham Greens, AeroFarms and Freight Farms) and financiers (Rabobank, Generate Capital and WP Global) — in an upcoming report.