Third in a series taking a look at sustainable project deployment and financing trends.

Increasing buildings’ energy efficiency — ensuring that buildings, especially commercial ones, use as little energy as possible while still providing full services to occupants — is crucial to fighting climate change. It’s also a great way for building owners to save money.

In fact, it’s the money-saving aspect that’s proving to be the greatest selling point for energy efficiency retrofits. But whatever the motivation, making buildings more efficient requires new technology to be installed, and that means a need for financing.

In this briefing we take a look at what energy efficiency projects are most popular these days, and some of the innovative ways they are being financed.

According to financiers we have spoken with, increasingly popular energy efficiency retrofit projects that building owners are adopting include HVAC efficiency technologies, LED lighting and building software control systems.

On that last point, data analytics is “the fastest growing tool in the marketplace right now,” says Peter Scarpelli, global director for energy and sustainability at real estate giant CBRE. Data analytics can find waste in a building’s consumption patterns and help manage operating costs, he notes.

It’s not easy, though. Perhaps the biggest challenge is making all the available energy data from a building “smart.” And on the other end, this data must generate usable insights.

Other popular areas of commercial building upgrades are lighting — with falling LED prices convincing more and more business users to install lighting technology — and controls and building automation software. Such commercial projects are generating high returns on investment and can pay for themselves within two years, and can also reduce a building’s energy use by as much as 30 percent annually.

Key Drivers of Efficiency Projects

Most building owners are primarily inspired to adopt energy efficiency projects for economic reasons – they want to reduce their energy spend.

Also driving demand is policy, such as benchmarking laws and other disclosure requirements for building owners. Those often require building owners to disclose their Energy Star score to potential tenants, for instance.

In fact, over the past two years, many jurisdictions across the U.S. have adopted building disclosure requirements. Nationwide, 23 cities and two states have passed policies requiring benchmarking and transparency for large buildings, while 11 states now have benchmarking rules for public buildings.

But these reasons won’t work for all commercial building owners, who may not want to lay out the capital for energy efficiency retrofits. Efficiency installers say it takes creativity to get such owners to adopt efficiency.

Essentially, you have to create some other value beyond energy savings, says Joe Costello, CEO of Enlighted, a provider of lighting control sensors and analytics platforms for commercial buildings. Beyond the Enlighted sensors, customers like the company’s space-planning tools to optimize workspaces, for asset tracking in facilities and for HVAC management, Costello says. The data collected by the sensors can help building owners better manage their facilities and resources, in addition to energy cost savings.

Joshua Paradise, director of strategic marketing at GE Ventures and former ambassador of GE Current, agrees. The reality is, for most business, energy is not one of the top three cost drivers, he says. For example, a fast food group that implemented GE Current’s energy management solution used the energy data collected to see how well the store was being managed, with the data correlated to service and sales data, according to Paradise.

Yet another trend is related to “wellness,” CBRE’s Scarpelli says. “There are empirical studies that indicate the office of the future has a wellness quotient to it. And that wellness quotient has two drivers: employee health, but also a business benefit related to productivity.”

Additionally, some companies have a socially responsible agenda, and efficiency improvements are about reducing the carbon footprint of their facilities.

Environmental Impact of Efficiency Projects

Buildings are a major contributor to greenhouse gas emissions; current estimates indicate that buildings contribute as much as one third of total global GHG emissions, according to the United Nations Sustainable Buildings & Climate Initiative. And in the U.S., buildings account for 39 percent of carbon dioxide emissions, according to the U.S. Green Building Council. Those numbers mean energy efficiency projects in buildings will play a major role in the fight against climate change.

Indeed, increasing energy efficiency in buildings and transportation are the top two low-carbon measures necessary to keep the global temperature increase below 2 degrees Celsius by 2030, according to the International Energy Agency. And carbon emissions in cities is expected to increase 50 percent by 2050 due to urbanization trends, which means buildings will become an even bigger factor over time.

“There’s a direct correlation to lowering carbon by having lower energy consumption,” Scarpelli says. “But simultaneously, if you have lower consumption you also have lower [energy] bills, which is effectively how these projects get paid for.”

Current Market Size & Major Opportunities

There are 5.8 million commercial buildings in the U.S., according to the U.S. Energy Information Administration, and only about 5 percent of those have advanced building management systems. “The other 4.9 million buildings are dumb. And sensors are going to give us an opportunity to educate buildings themselves and the occupants,” says Bill Kenworthy, director of product management at Direct Energy, a retailer of energy and energy services.

There has been tremendous growth in the adoption of LED lighting, the most common type of building efficiency retrofit today, which have grown from just 1 percent of the lighting market in 2010 to more than 50 percent today. That growth will continue, with LEDs taking an almost 70 percent market share by 2020, driven by regulations and rapid technology improvements that drive down costs, according to a report by Goldman Sachs.

In dollar terms, U.S. LED lighting is currently a $26 billion market and is expected to reach expected to reach $54 billion by 2022, according to Zion Market Research.

Energy efficiency projects in buildings now generate $271.6 billion in revenue globally, including $68.8 billion in the U.S., and have averaged 14 percent annual growth over the past five years, according to Navigant Research. Commercial energy-efficient lighting, the leading product category in this subsegment, reached an estimated $68.7 billion in revenue last year, up 11 percent from 2015. HVAC was a close second with $65.8 billion in revenue, up 6 percent over the prior year.

According to the American Council for an Energy Efficient Economy (ACEEE), the U.S. energy efficiency market represents more than $100 billion in annual investments, which includes financing for energy efficient buildings, electric vehicles, efficient IT equipment, the energy service company (ESCO) market and Property Assessed Clean Energy (PACE) financings. The largest submarket is the financing for the construction and rehabilitation of green commercial buildings.

The U.S. Department of Energy forecasts that LED lighting will cut U.S. lighting energy consumption nearly in half by 2030. It will also reduce annual carbon dioxide emissions by approximately 180 million metric tons.

Providing energy efficiency financing for small- and middle-market companies holds a lot of market opportunity for investors. Small and mid-size corporations own facilities such as golf courses, office buildings, hotels and industrial sites, which are estimated to consume the vast majority of energy in the U.S. According to the Green Building Council, buildings consume 70 percent of the electricity load in the U.S. So this market has huge potential in the adoption of energy efficiency retrofits.

For these retrofits, deal size is typically between $500,000 and $2 million in buildings with less than 100,000 square feet, which represents 65 percent of the commercial building inventory in the U.S. Yet there remains a lack of traditional financing players willing to finance smaller deals, says Ross Reida, the chief sales officer of LED.Finance who previously led energy efficiency financing at Crestmark Bank. Small deals tend to carry high transaction costs for banks and come with greater credit risks.

That segment is where an increasing number of specialty financiers and private equity funds focused on energy efficiency are now entering the market, looking to fill the void and capitalize on this growing opportunity.

Efficiency Financing Trends

No-money-down financing plans are critical for doing energy efficiency retrofits with commercial customers.

New to the commercial sector are energy service contracts provided by energy service companies, or ESCOs. Federal agencies have used such contracts for decades, because they allow an agency to pursue energy efficiency projects with no upfront capital costs. This model is now being applied to commercial energy efficiency retrofits.

Such an approach is catching on because most commercial customers don’t want to tie up their cash in retrofits, even if they can generate a good return on the investment, says Direct Energy’s Kenworthy. Most buildings are owned by relatively small companies with limited amounts of money to spend on sustainability projects.

These projects are increasingly being incorporated into “energy efficiency service agreements,” or ESAs. An ESA is a relatively new financing vehicle that enables equipment to be installed for no money down, enabling third-party ownership of a project and offering a structure for private capital to invest in the energy savings potential of a building.

Like a solar power purchase agreement, an ESA enables private sector third-party ownership of a project, in which a developer designs, finances, implements, and owns a package of energy and water efficiency measures at a customer facility. The property owner does not have to provide up-front capital and shares in the cost savings of the project with the vendor.

And the growing number of building analytics products that measure and verify energy saving improvements are enabling the development of these types of third-party financing tools and enabling private capital to enter the energy efficiency market (see examples of analytics providers in our table below).

Companies offering ESA financing for efficiency retrofits to corporate customers include Hannon Armstrong, Generate Capital, Renew Energy Partners and Metrus Energy, which pioneered the use of ESAs in 2009.

Technology firms and specialty financiers increasingly are offering “no money down” models to spark the adoption of efficiency retrofits. Enlighted, for example, launched its “energy savings-as-a-service” financing model in 2014. This allows clients to get a sensor network, allowing them to optimize commercial space and receive energy savings, without any upfront cost. Enlighted and the client share in the energy cost savings, which are usually around 25 percent to 30 percent, Costello says. Enlighted focuses on large corporate clients with multiple facilities, which include ATT, Google and HP; the company’s typical LED project deployment is $10 million to $20 million.

Enlighted partnered with Square 1 Bank, a division of Pacific Western Bank, which provided $20 million in 2016 to finance its new no money down program and is currently looking to expand its roster of financing partners to support new projects.

Generate Capital, a specialty finance company for resource efficiency projects founded by SunEdison founder Jigar Shah, is financing ESAs for commercial building owners that install energy efficiency technologies such as LED lighting, building controls and efficient HVAC systems, according to Shah. Generate’s other types of financing products include asset-backed lending, project finance, asset warehouses and short-term financing.

And GSV Sustainability Partners (GSVSP) is a finance company backed by GSV Capital that focuses on developing what it calls “sustainability as a service.” In that arrangement, GSVSP owns sustainable infrastructure and provides the equipment or system to the commercial end-user, through long-term service contracts, taking a percentage of the cost savings while helping mid-size companies become more sustainable. That corporate customer contracts with GSVSP to operate the infrastructure asset, gaining the use of the technology while paying nothing up front. In addition to LED lighting retrofits, other sustainable infrastructure projects that GSVSP is actively deploying through its new model include compressed natural gas trucks and wastewater systems. Its average project is greater than $20 million.

Another innovative model is Spark Fund’s “efficiency-as-a-service” online software platform that lets businesses pay over time for energy efficiency products and services, such as LED lighting, building controls and HVAC systems, through a no money down subscription model for projects in the $50,000 to $5 million range. Maintenance, performance monitoring and ongoing service is included in the subscription. It also partners with technology companies, contractors and ESCOs to incorporate Spark Fund’s platform and service model into their sales process. The company raised $7 million in Series B venture funding in February from Energy Impact Partners, Vision Ridge Partners and others.

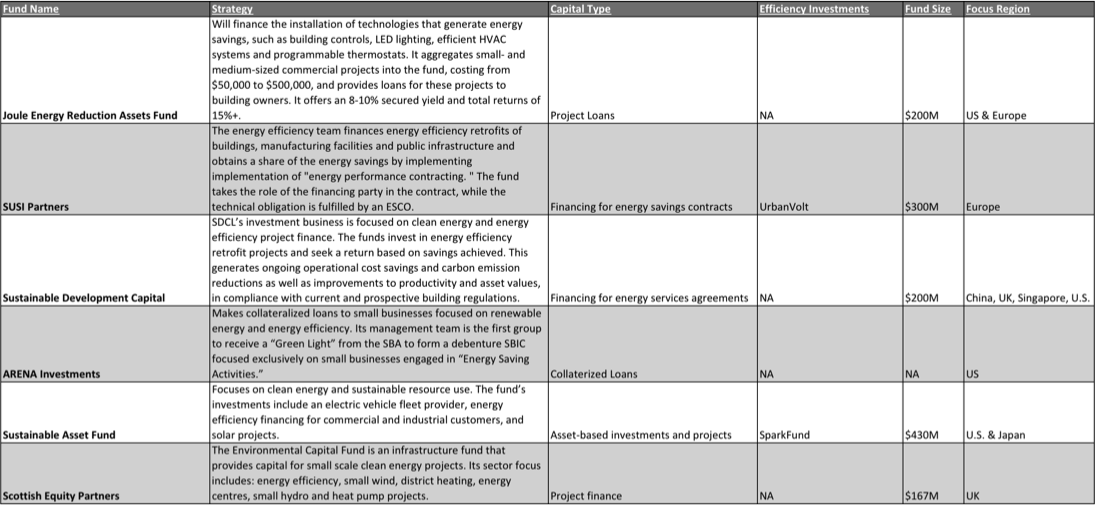

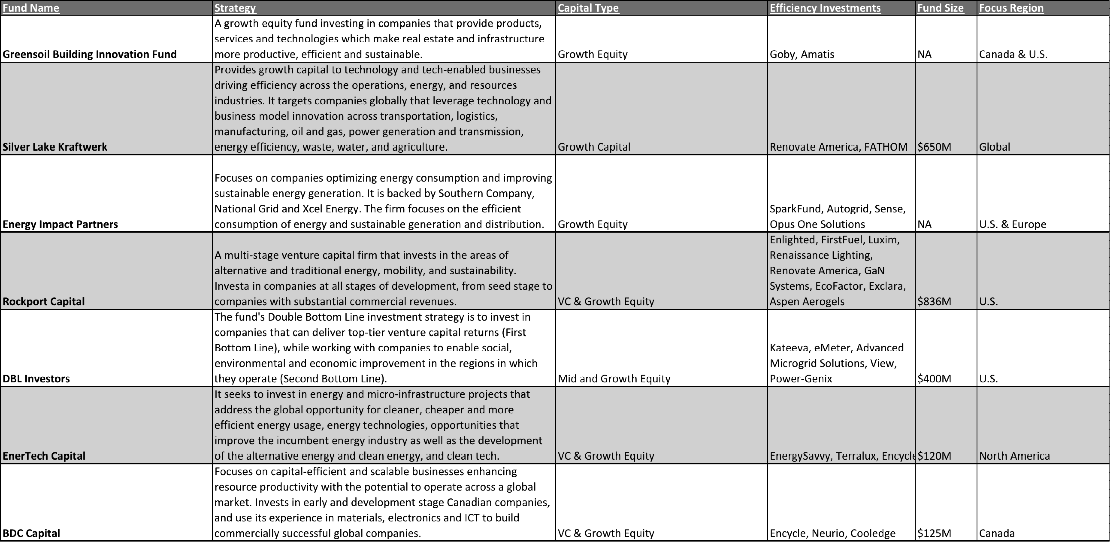

Private equity funds have also stepped in to offer capital for energy efficiency retrofits and investing in leading energy efficiency companies.

Leading Private Equity Firms Financing Energy Efficiency Projects

Leading Private Equity Firms Investing in Energy Efficiency Companies

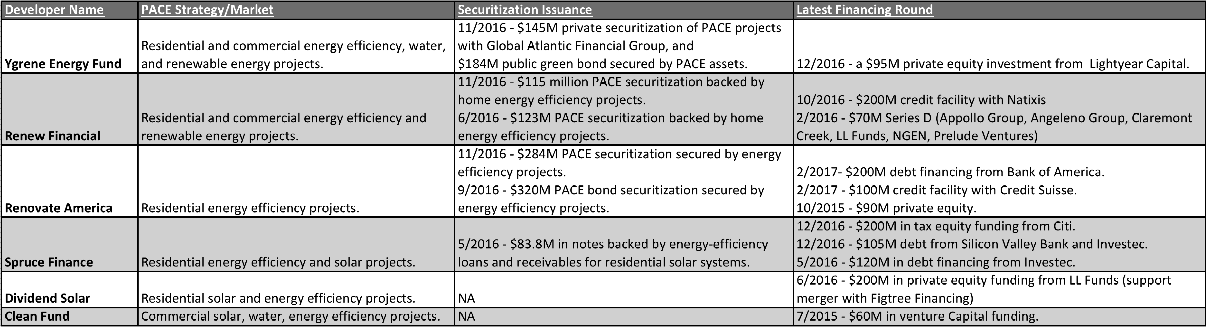

PACE, or property assessed clean energy, gives governments the ability to fund energy efficiency, renewable energy and water efficiency improvements that are paid back over time by residential, commercial and industrial property owners through property tax bills. PACE financing is currently available in 33 U.S. states.PACE financing is another important trend driving new commercial and residential energy efficiency projects.

Although a relatively niche part of the clean energy financing market, the PACE financing model is gaining momentum as a key driver of energy efficiency retrofits in both the commercial and residential markets,

There’s been a growing number of public PACE securitizations by leading developers who pool PACE projects together, which have opened these projects up to capital from the public markets and are being marketed as green bonds.

Leading PACE Financing Project Developers

Banks Developing Energy Efficiency Lending Programs

TD Bank, which says it’s the first carbon-neutral bank in North America, is testing energy efficiency technologies in its own buildings and data centers, and taking those insights on the business case for energy efficiency retrofits to their commercial and retail clients to offer them financing, according to Karen Clarke-Whistler, head of environmental affairs. TD Bank also raised capital by issuing a $500 million green bond in 2014, with part of the proceeds used to invest in energy efficiency retrofits in buildings.

JP Morgan is investigating creating various energy efficiency finance loan programs for corporate customers, says Matt Arnold, managing director and head of social and sustainable finance. In 2016, the company made the world’s largest single order for an LED installation, choosing GE’s Current to install LEDs across 5,000 branches spanning 25 million square feet. The aim is to reduce lighting-related energy use at branches by more than 50 percent.

In 2015, Morgan Stanley issued a $500 million green bond to help fund the development of renewable energy and energy efficiency projects, which included upgrading the company’s New York City headquarters with LED lighting technology.

That same year, Bank of America issued a $600 million green bond, part of which was intended to fund energy efficiency projects. Around the same time, it also announced a $125 billion sustainable investing initiative that included a focus on energy efficiency. In 2011, BofA launched its Energy Efficiency Financing Program to provide up to $55 million of low-cost capital to community development financial institutions for energy efficiency and other clean energy loans.

Just this past February, Bank of America provided $200 million in debt financing to Renovate America, the largest provider of residential PACE funding in the US.

Energy efficiency financing is a major focus at Deutsche Bank, according to Vinod Mukani, head of infrastructure and energy financing. The bank sold the first public PACE bonds tied to residential energy efficiency retrofits in 2014, a $104 million bond. Deutsche Bank also manages the $265 million European Energy Efficiency Fund, a public-private partnership that facilitates investments into projects to improve the energy efficiency of public sector buildings in the European Union. Deutsche also worked with Ygrene Energy Fund on structuring and issuing their $184 million public PACE securitization as an asset-backed security last November. The bond was backed by commercial and residential energy efficiency retrofit projects.

In 2015, Citi and Renew Financial issued the first ever asset-backed security transaction comprising unsecured consumer energy efficiency loans. Calvert Investment Management bought the entire $12.8 million issue .

Renew Financial also received $100 million from New York Green Bank and Citi to expand its consumer lending program for energy efficiency in 2015.

And state-sponsored green banks are working with the private sector to increase energy efficiency investments. For example, the New York Green Bank is focusing on energy efficiency and is actively working with energy service companies and project developers that are doing residential and C&I retrofit projects, says president Alfred Griffin. There is more energy efficiency financing available and these projects are economical, he says, but a key remaining challenge is the need to educate building owners on the benefits of retrofit projects.

Examples of New York Green Bank’s financings include:

– $7.5 million to Sealed last year, allowing the company to offer Sealed Pay As You Save, the first program that invests in energy savings resulting from residential efficiency improvements. Sealed guarantees these savings to customers by leveraging its proprietary software and analytics;

– and the financing of an energy efficiency equipment leasing transaction with a school district in Huntington, New York, as part of a $12.9 million energy efficiency project that is expected to reduce the district’s energy costs by more than $1 million annually. The Green Bank brought in major financial participants into the project, including Bank of America Merrill Lynch and Signature Public Funding Corp., a subsidiary of Signature Bank.

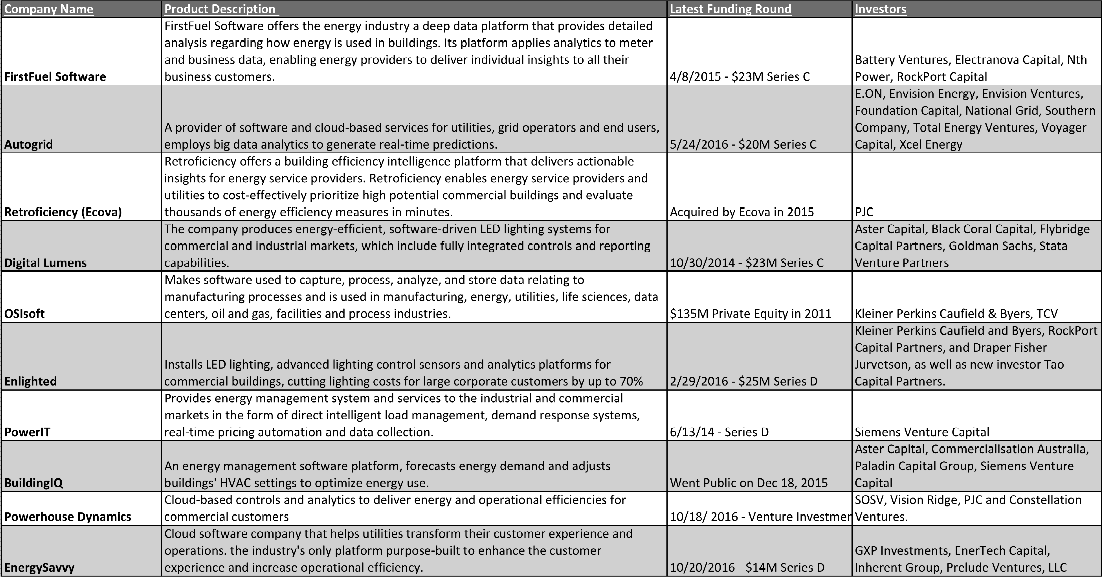

Energy Efficiency Analytics Companies Gaining Traction

Large corporations are increasingly focusing on energy data analytics services for C&I customers:

– IBM’s cognitive buildings division give real estate and facilities management professionals the tools necessary to manage energy use, optimize space, reduce operating costs. IBM Watson IoT lets building owners collect and use data to make informed decisions on how to optimize the experience of occupants, staff and management.

– GE’s Current, its energy efficiency unit focused on commercial customers, acquired Daintree Networks, a building automation company that provides wireless control systems for commercial building automation in 2016.

– Honeywell’s smart building analytics SaaS offering includes dashboards, reporting and support services worldwide in an effort to reduce energy and operating costs by up to 20 percent.

– Johnson Controls merged with Tyco in 2016 in order to focus on C&I smart building, energy management and energy storage services, including IoT capabilities.

– Schneider Electric’s Building Analytics is web-based software for building owners, managers, contractors and engineers that uses analytics and performance monitoring dashboards to promote proactive operations.

Other Sustainability Improvements in Commercial Buildings

Another sustainability area in the commercial building space that is ripe for financing is water efficiency projects. Controlling the consumption of water will follow the same course as energy efficiency, and it’s becoming a big issue for building owners, according to LED.Finance’s Reida.

Major water efficiency improvement projects in commercial buildings that need financing include that installation of water efficient toilets and efficient boilers, he says.

And installing backup power, in the form of distributed energy storage and microgrids, is increasingly important to commercial and industrial building owners since they enable facilities to be more resilient during extreme weather events and emergencies that lead to power outages.

“Smart energy storage” firms such as Stem combine energy management software control solutions with batteries to manage power usage in order to reduce peak demand charges, the premium that utilities levy against businesses during peak demand times, which can add 50 percent or more to the bill.

And this trend is creating new financing opportunities. Stem increased its project financing pool to more than $350 million with the addition in August of up to $100 million from Starwood Energy Group to finance no-money-down, behind-the-meter smart storage projects with commercial and industrial customers. Stem’s primary project financing comes from Generate Capital.

Water and energy storage financing will both be topics of future CleanTechIQ briefings.