Key Takeaway: Major interest in the Internet of Things is broadening out the clean tech sector to “capital light” models, attracting funding from large corporations, and spurring traditional VCs to return to the sector.

Introduction

In this analysis of recent fundings, we’ve uncovered the top venture deal trends for 2016 year-to-date through Q3 2016, analyzed investor sentiment, and highlighted marquee deal flow for clean tech investors from venture capital to deployment opportunities.

New data show that current clean tech deal activity is being driven by increasing venture capital investor and corporate interest in themes such as connected buildings, connected devices, the industrial internet, and how these themes interface with the Internet of Things (IoT) phenomenon. Increased corporate interest in particular has broadened the clean tech sector into themes that traditionally haven’t been traditionally thought of as clean tech.

New corporate groups are investing in the clean tech sector, including telecommunications firms that have a fundamental capability in networking and communications that can apply Internet of Things (IoT) into their products and services, explains Troy Ault, director of research at Cleantech Group (CTG.) Corporates making investments in this space now include Orange, Cisco, and Verizon.

This intersection between IoT and clean tech is being fundamentally driven by the core areas of innovation today in software and the Internet of Things. Applications include energy and resource-intensive industries like utilities, oil and gas, manufacturing and agriculture. Progressive companies in these industries have acknowledged an environmental benefit to IoT, in addition to cost savings and other efficiencies.

Emerging sectors that are benefiting from the proliferation of sensors, software and connected devices — the backbone of the Internet of Things — include smart buildings, smart cities, smart agriculture and transportation. These new areas of IoT now fit squarely in the realm of clean tech and resource efficiency, says Ault.

This trend is also driving more types of corporates to invest in clean tech deals in areas that didn’t used to draw broad corporate attention, such as energy and agriculture. In fact, many large corporates now view sustainability as a competitive advantage in the areas of energy and resource efficiency. This shift in view is creating new business opportunities, in addition to reducing costs and mitigating the risks associated with climate change.

We are also seeing growing interest in resource efficiency themes from corporates in a wider range of resource-intensive industries that are showing up in 2016 clean tech deals. These industries include industrials, energy, utilities, transportation, chemicals, materials, and retailing companies.

Internet of Things, Energy Efficiency and Smart Buildings Collide

The intertwining of IoT and the push for smart buildings has driven increased deal volumes and participation by corporates. Start-ups in these areas are no longer defining themselves as just energy efficiency companies, as fundings appear to have slowed to that sector, says Ault.

“What I have seen is companies redefining themselves in the IoT/smart buildings age, saying ‘Maybe we used to be a smart thermostat company or HVAC controls company, but now we are the gateway into the building, controlling everything from lighting to elevators to comfort,'” he says.

The intertwining of IoT and the push for smart buildings has driven increased deal volumes and participation by corporates. Of particular note are Google and Amazon each creating new smart home platforms, which is leading to increasing interest in the sector by venture investors.

And Vivint Smart Home’s sizeable $100 million growth funding in April. It’s meant to expand the company’s home automation IoT business, and drew investors including Peter Thiel and strategic investor Solamere Capital.

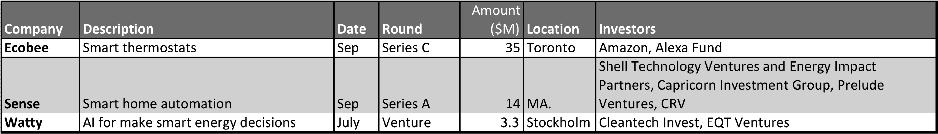

Notable recent IoT deals include:

Broadening Focus Brings VCs Back

There are also early signs that traditional venture firms may be returning to the sector after a two-year hiatus, as the number of institutional VC investors in clean tech deals has been steadily growing over the past three quarters, according to CTG’s data.

A major reason for this trend is that today’s clean tech deals are not as capital-intensive as they were a few years ago, when investments predominantly went into large solar, wind or energy storage manufacturing companies. Today’s clean tech deals are much more capital efficient, with a focus on software or business model innovation, making them more akin to other technologies that VCs typically invest in.

Also driving this nascent renewed interest is solar and energy efficiency projects gaining major traction globally within both the corporate and residential markets. That’s largely due to major cost declines that are making them much more economical to adopt.

The transportation sector, meanwhile, is seeing major shifts in ride-sharing models, pushed by the urbanization trend, while the adoption of electric vehicles is being helped by significant declines in the cost of lithium ion batteries.

Clean tech venture capital deal pipelines are currently very strong, particularly in energy storage, according to venture investors we’ve spoken with this year. Other sectors with growing deal interest and pipelines include waste-to-value and water technologies.

There is also continued enthusiasm among financiers around clean tech deployment, particularly LED lighting, distributed solar and energy storage. This trend is being driven by major reductions in costs for these technologies and by business model innovations that are enabling customers to adopt these technologies in “no money down” models through leases or shared savings agreements. This deployment trend is generating interest and investment in new project finance deployment funds and leading to new platforms that are being launched.

Family office investors are showing more interest in clean tech, though they still remain mostly on the sidelines as they get more education on the sector. They are expected to be a major part of a growing wave of capital into the sector in coming quarters, as mitigating the impact of climate change is a big part of the impact investing trend that family offices are leading. We are also starting to see more clean tech and resource efficiency funds being labeled as “impact investing” funds (ie. DBL Partners’ new $400 million “impact fund”) to attract these investors.

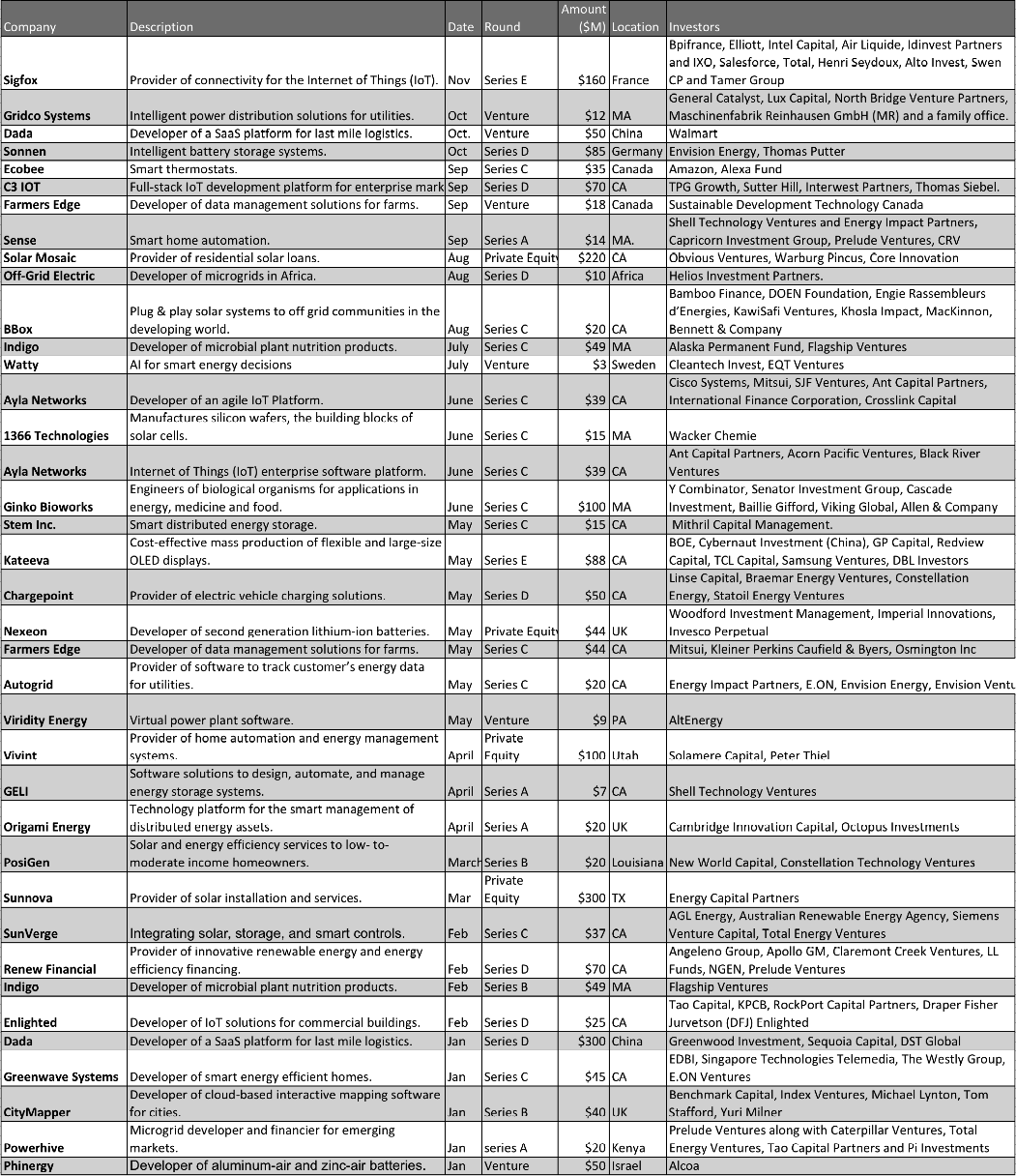

Notable venture fundings that reflect key 2016 themes:

The top clean tech venture capital investors in 2016 year-to-date through Q3, by deal volume, are: GE Ventures, BDC Capital, Khosla Ventures, Samsung, Intel Capital, Fontinalis Partners and Sustainable Development Technology Canada.

Kleiner Perkins Caufield & Byers was the top clean tech investor in the third quarter with 4 deals including: Agrivida, Mode Inc., Ambiq Micro, and Farmers Business Networks.

Key 2016 Fundings Trend Data

Global venture capital investment activity in clean teach rose to $10.8 billion in 2015, up 11% over 2014, and signs of renewed vigor and enthusiasm in the space have continued in 2016, according to CTG’s data through Sept. 30.

Despite deal volume itself continuing to slide this year on a quarterly basis, the third quarter of 2016 saw the largest total investment in clean tech companies since the start of 2011. And overall average deal size has continued to grow, mostly due to the increased average size of later-stage deals and a decline in early-stage deal volume.

The third quarter saw $2.8 billion invested in 243 clean tech deals, CTG says. This compares to $2.1 billion in 247 deals in the second quarter. The average round size of Series B+ deals jumped even more, from $13 million in the second quarter to $22 million in the third.

Looking at first three quarters of 2016, there was $6.8 billion invested in 742 clean tech venture deals versus $6.8 billion 710 deals during the same period in 2015.

Bloomberg New Energy Finance (BNEF) reported a big increase in global clean energy venture capital funding in the third quarter to $3.2 billion, more than double the $1.3 billion pulled in during Q2. And venture funding is up 28% year-to-date through Sept. 30 over the same period last year, they say.

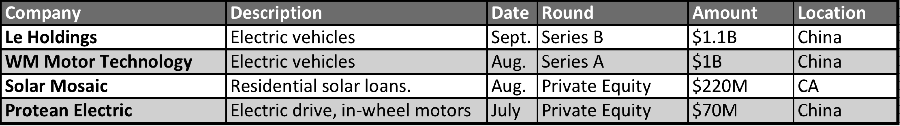

Q3’s biggest venture deals tracked by BNEF include:

According to the latest estimates from PwC, U.S. clean tech VC funding in Q3 of 2016 was $576 million, 37% above the three year quarterly funding average. The average U.S. deal size in the third quarter increased to $21.3 million, versus a three-year average of $10 million. However, U.S. VCs completed 13% fewer deals in the third quarter than in the second. The majority of Q3’s investments went into solar (45%) and smart grid and energy storage deals (18%), according to PwC.

Based on the trend data and what we’ve heard about venture deals slowing down in the fourth quarter, we would expect that the full year of 2016 may not see as much of a percentage increase in venture dollars over 2015 versus the prior year’s comparison, though it should still be higher than 2015 overall.

Rising Global Deal Volume & Round Sizes

The long-term trend is positive in terms of deal volume, according to Cleantech Group. After two and a half years of consecutive decline, overall venture deal volume has been steadily increasing since mid-2015.

The increase in deal volume has been better sustained in early-stage Seed and Series A deals, reflecting our notion of the existence of strong early stage clean tech deal pipelines.

The average venture round size jumped from $9 million in Q2 to $12 million in Q3 of 2016. However, this is down from the average of $13.5 million in 2015, but up sharply from $8.8 million in 2014.

Early stage Seed and Series A round size average round sizes have stayed steady at $4 million over the previous 12 months.

Series B+ average deal size increased dramatically to $22 million in Q3, up from $13 million in Q2 of 2016, and higher than the $21 million average in 2015.

Regionally, North America constituted 69% of venture deals in Q3, while Europe & Israel contributed 21% and Asia/Pacific at 8%, according to CTG’s data.

Corporate Participation Breaks Record in Q3

While the third quarter saw a big uptick in dollars invested, CTG recorded a record- breaking quarter for corporate participation, both in deal volume and dollar amount. During the period, 32% of deals exhibited corporate participation, compared to historical average of about 20%. And Q3 2016 was the highest dollar amount and number of deals with corporate participation in the past 5 years.

Corporate participation in clean tech venture deals jumped to $1.3 billion in 75 deals versus Q2’s $670 million in 50 deals. And there were 104 corporate groups that invested in Q3 versus 70 in Q2 and an average of 64 per quarter in 2015.

The top corporate clean tech venture investors this year have included: GE Ventures, Ford, Intel Capital, Samsung, E.ON Ventures, Total, Qualcomm Ventures, Cisco, Mitsui, General Motors, Air Liquide, Engie and Google Ventures.

Cleantech Group’s data also suggests that corporates are now more willing to invest the early stage deals, rather than focusing just on late stage companies, which is a departure from the past.

One sign of this came in February 2016, when the U.S. Department of Energy’s ARPA-E Summit drew record corporate attendance. These attendees included IBM, BASF, GE, ABB, XeroxParc, Lockheed Martin, MMM, Dow Chemical, Boeing, Bosch, Aramco, KLA-Tencor, ExxonMobil, Siemens, General Motors, GE, Johnson Controls, Texas Instruments and Panasonic.

Corporate Investor Spotlight: LG

LG is one such corporate on an ongoing hunt for deals, says Henry Chung, managing director of its venture unit LG Innovation Ventures, which opened its San Jose, Calif. office in 2010 to scout for technologies that support all 60 LG business units.

Speaking at the Advanced Energy conference in April, Chung said that LG prefers to establish commercial relationships with start-ups first, such as a joint development or licensing arrangement. Consideration of an investment comes later.

LG is primarily hunting for technological solutions that enhance its existing products. Areas of strategic interest include EV powertrains, HVAC systems, advanced chemicals and materials, batteries, solar PV and LED lighting, Chung said.

In fact, LG Chem, one of its subsidiaries, launched a home battery system with residential solar installer SunRun in October.

Since LG builds devices that consume significant amounts of power, Chung pointed out that technologies involved with buildings and home energy management systems hold particular interest for LG. The company is also hunting for next-generation solar PV materials, such as thin films, he said.

Chung said his biggest challenge is finding partnerships in the area of microgrid controls, software in particular. “It’s an underserved area at the moment,” with needs around security. “We have many years of enterprise security, but not much on this.”

Corporate Co-Investment Deals Rising

CTG also notes an increase in the rate of corporate co-investment in clean tech venture deals in 2016. There were 29 deals in the first half of 2016 that saw two or more corporates co-investing in the same round. This accounted for $1.6 billion of clean tech investment, with an average round size of $55 million, according to their data.

Several multi-corporate investment rounds have occurred in hot investment themes such as IoT, robotics and transportation, which are attracting investment from corporates across different industries.

Cooperative investments are also being driven by corporates realizing that sustainability is a big issue, and a recognition that the impact from climate change is becoming a material risk to their businesses.

Notable corporate co-investment deals in 2016 include:

Maana (big data analytics and IoT) raised $26 million in Series B funding from Intel Capital, GE Capital, Shell, Chevron, Saudi Aramco.

Precision Hawk (drones for agriculture) raised $18 million growth equity from Intel, Verizon, USAA, Pioneer, DuPont, Docomo, Yamaha.

Veniam Works (WiFi networks for the Internet of Moving Things) raised $22 million in Series B funding from Cisco, Verizon, Orange, Yamaha.

Chargepoint (EV charging infrastructure) received $50 million from Constellation Ventures and Statoil Energy Ventures.

Ayla Networks (IoT platform for manufacturers) raised $39 million in Series C funding from Cisco and Mitsui.

M&A Activity

Besides investments, some corporates have been making strategic clean tech acquisitions in 2016. These have included:

– Engie acquired Green Charge Networks (distributed energy storage) in May.

– GE’s energy efficiency unit, Current, acquired Daintree Networks (building automation) for $77 million in April

– Oracle acquired public company OPower (energy efficiency) for $532 million in May.

– Oil giant Total acquired Saft (energy storage) for $1.1 billion in May.

– Microsoft acquired Solair (IoT platform) in May.

– Korea’s Doosan Heavy Industries acquired 1Energy Systems (energy storage software) in July.

– BASF acquired battery maker EnerG2 (high-performance battery materials) in June.

And Space-Time Insight, a developer of geospatial and visual analytics software for the energy sector, acquired Industrial IoT data and analytics firm Go Factory in June.

Sector Funding Trends & Observations

Q3 Year-to-Date 2016 Deal Volume:

Energy Efficiency – 16%

Agriculture and Food – 15.2%

Transportation – 13.5%

Solar – 8.8%

Advanced Materials – 8.6%

Energy Storage – 6.2%

Q3 Year-to-Date 2016 % Share of Total Dollars:

Transportation – 26.3%

Solar – 14.3%

Energy Efficiency – 13.1%

Agriculture and Food – 10.8%

Advanced Materials – 6.1%

Energy Storage 3.2%

If Transportation sector venture fundings are excluded, then Solar (26%) and Agriculture & Food (22%) and Energy Efficiency (13%), took in the bulk of the venture capital dollars year-to-date through Q3 2016.

Energy Efficiency deals have seen the greatest increase in deal volume so far in 2016, while Transportation and Agriculture & Food sector fundings are seeing a continued leveling off.

Fundings Increase for Energy Storage

Most of today’s energy storage investment dollars are going to capital-light “smart storage” models that combine software with batteries, rather than into capital-intensive battery chemistries.

Through software that collects energy and weather data to increase the predictability of performance and lowers financing risk, energy storage developers are enabling further battery deployment by raising project finance funding to offer no-money-down financing packages in shared savings or leasing models, mainly to corporate and municipal end users.

This trend towards capital-light energy storage software plays has been playing out in smaller round sizes for energy storage startups versus prior years, although there’s been an increasing number of deals.

Energy storage continues to increase its share of venture investment deal volume, rising from 5.2% in full year 2015 to 6.3% in 2016 year-to-date through Q3.

German smart energy storage firm Sonnen, which entered the US market in 2016 through a partnership with commercial and residential solar installer SK Solar, raised a whopping $85 million Series D funding in October, led by Shanghai-based wind turbine maker Envision Energy.

There has also been a slew of new investment capital focusing on the deployment of “behind the meter” distributed storage, reflecting confidence in the “no money down” business models that distributed storage firms are pioneering in order to accelerate deployment. With battery prices falling 35% over the past year and expected to drop another 77% by 2018, rapid adoption is expected to continue.

Stem increased its project financing pool to more than $350 million with the addition in August of up to $100 million from Starwood Energy Group.

Advanced Microgrid Solutions (AMS) raised $200 million in equity project financing from Macquarie Capital in July.

And distributed energy storage firm Green Charge Networks raised $20 million in non-recourse debt in January 2016 from Ares Capital to help fund the installation costs of its systems with commercial customers, before being acquired by French electric utility Engie in May.

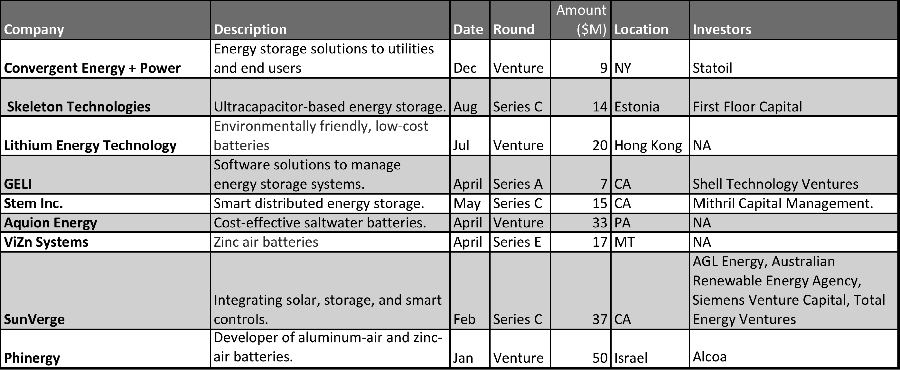

Notable 2016 energy storage fundings:

Interest Shining on Solar Deployment Startups

Solar deal volume, which dropped substantially post-Solyndra five years ago, has risen to 8.8% in 2016 from 6% in 2014 and its share of dollars has shot up to 14.3% in 2016 from 10% last year. The extension of the federal Solar Investment Tax Credit in December 2015 and a shift to capital light software-driven business models are driving solar deals, but has meant lower average round sizes for the sector.

And the increasing bankability of solar and financial innovation are creating major excitement for solar deployment among traditional financiers. Most of the capital is being directed to off-grid home and portable systems which is a market that is growing by an average of 30% annually.

Between 2010 and 2015, solar power costs have dropped by three quarters , according to Bloomberg, making it cost competitive to traditional sources of energy, which is driving this trend.

Start-ups helping to drive further deployment of solar include KWH Analytics, which is developing solar data and analytics that help to lower the cost of financing by attracting traditional capital sources into the sector. KWH raised a $5 million Series A round in September from Anthemis Group and Engie.

EnergySage, an online marketplace for distributed solar that connects contractors with customers, raised $1 million in Series A funding in May. In November, it announced that it will also be offering loans directly to residential customers, partnering with financiers BlueWave, Renew Financial and Wunder Capital.

And Geostellar, which simplifies procurement, financing, installation, and maintenance for solar rooftop developers and financiers, raised $7 million in October.

Mosaic has been residential solar’s belle of the ball in 2016. It raised $260 million in private equity funding in August to build out its marketplace for financing residential solar projects by offering loans to residential customers. Funding was provided by Warburg Pincus, Core Innovation Capital and Obvious Ventures.

Mosaic also created a $200 million warehouse line of credit in April with debt funding provided by DZ Bank and New York Green Bank to fund its solar loans. And it closed on another $250 million credit facility with Deutsche Bank in November, with a goal of originating $1 billion worth of loans for residential solar PV by next year.

Solar power deployment is a big theme at one of Mosaic’s funders, Obvious Ventures. The venture firm raised its first $123 million investment fund in 2014, says managing director Andrew Beebe. Because the solar industry is maturing, “residential solar is returning to the basics of home improvement finance,” he says. This is enabling consumers to own their own solar panels, in contrast to the leasing model pioneered by firms such as SolarCity.

And Wunder Capital, a solar financing platform that raises capital online from accredited investors to support distributed solar projects for medium-sized businesses, raised $3.6 million Series A in March.

Agriculture Remains a Key Theme

Agriculture and food remains a key theme for venture investors, especially more traditional generalist VCs.

However, in terms of deal volume growth, it appears to have plateaued in 2016. Early indications are that there is some rationalization in AgTech startup investing, and maybe even a bubble bursting in the space as companies are starting to go through a funding crunch.

The sector accounted for 16% of deal volume in 2015 but has dropped to 15.2% in 2016 year-to-date through Q3. Dollar venture investment in the sector has risen to 10.8% year-to-date in through Q3 versus 8.4% in all of 2015.

As entrepreneurs and investors focused on farming are finding out, it’s a tough industry to deploy new products into quickly en masse, as farms are very disparate in nature and often have trouble adopting and financing the new technologies being developed for them.

One farmer speaking at the Global AgInvesting event in New York in May noted that the technologies being developed don’t actually meet farmers’ needs, due to the fact that there isn’t enough dialogue between Silicon Valley and farmers. There’s also a need for more hands-on training on new technologies.

“Those looking for instant success from a venture investment in the Ag sector are going to need to develop more patience or be disappointed,” said panelist Arama Kukutai, partner at Finistere Ventures. “I think we are going to see a fair bit of shake up, especially in digital agriculture.”

This conundrum led Finistere to partner with International Farming Corporation to form Willow Hill Ventures in April, creating an on-farm innovation ecosystem dedicated to growth capital to adopt and scale early AgTech investments into viable farming businesses, making land accessible to entrepreneurs to test their technologies in a real, commercial environment.

And in June, Finistere, Cloud Break Advisors, and a group of leading agriculture companies including Bayer and DuPont launched a new AgTech accelerator called Radicle in various regions across the U.S. as well as Israel, Australia and Canada.

In fact, over a dozen new AgTech venture funds and incubators have been launched this year alone.

However, AgTech innovation activity is focused on more than just selling directly to farms. Large companies are investing in or acquiring products in agricultural big data and biotech, generating further entrepreneurial activity. Examples include Monstanto’s acquisition of the Climate Corporation in 2014 and IBM’s acquisition of the Weather Company in January.

In March, IBM set up a partnership with precision agriculture and farm data management firm Farmers Edge, which had raised $58 million in venture capital funding in January from Mitsui, KKR and Osmington.

Another promising data driven AgTech startup is Farmers Business Network, a farmer-to-farmer network intended to connect farmers and allowing for the sharing of data. The Network raised a $20 million Series B funding in August, led by Acre Venture Partners.

Robert Sutor, IBM’s v.p. for Mobile Solutions & Mathematical Sciences, said at the Future Food-Tech conference in May that the company’s key area of focus around agriculture is utilizing big data to help farmers increase crop production and water efficiency. This includes the curation and analysis of “geospatial and temporal data,” such as data on soil, weather, land and roads.

Industrial biotech, another key sector gaining interest from investors, is increasingly crossing over to the agriculture space. For example, Bio/AgTech firm Indigo announced it closed on a monumental $100 million Series C venture round of investment in July, one of the largest AgTech fundings to date, from the Alaska Permanent Fund and Flagship Ventures. It also launched its first commercial product, a microbial seed coating promoting water efficiency in cotton, that same month.

Other big industrial biotech deals in the third quarter include Zymergen, which raised $130 million, and Renmatix, which raised $14 million.

Transportation Takes the Lead

Transportation has taken over the top spot in terms of dollar investments, at about 40%. The majority of venture dollars being invested in the sector are directed towards “Mobility Services,” which consist mainly of ride-sharing companies such as Uber, Didi Chuxing, and GetTaxi. Mobility Services have taken in over $4 billion of investments so far in 2016, after taking in $9.2 billion in full year 2015.

Although Transportation is accounting for an increasing amount of large deals, there is still healthy early stage investment in the sector, says Cleantech Group’s Ault.

Taking out Mobility Services deals, Transportation deals attracted 26.3% of total dollars year-to-date through Q3 2016, up from 13% in all of 2015. And Transportation falls to third, behind Agriculture & Food and Energy Efficiency, in deal volume, without Mobility Services.

The areas of Transportation that are generating the most excitement among VCs right now include autonomous driving and connected vehicles. Other emerging areas gaining interest include efficient motors, heads-up displays, freight logistics, and driving analytics, according to Ault.

A notable success story in the autonomous driving space is MobileEye, which is developing vision-based advanced driver assistance systems that help prevent and mitigate collisions. The company raised over $500 million in private equity funding and $890 million in a public offering in 2014, which has led to increased investor interest in this space.

Autonomous vehicles and electric vehicles are both areas that Obvious Ventures’ Beebe is excited by, as he is seeing a lot of good early stage investment opportunities in both categories, and where he expects to announce new investments.

In fact, by 2040, 50% of new cars are projected to be electric, led by China with a 35% market share and the US with a 21% market share. This widespread adoption of EVs is expected to displace 2 million barrels of oil per day by 2023, says Bloomberg.

Such forecasts have driven Ford to make autonomous vehicle- focused investments in car sensor manufacturer Velodyne, as part of its $150 million venture round in August, and in Civil Maps, which makes augmented reality maps for self-driving cars, as part of its $4 million seed round in July.

Another big area of innovation within the transportation sector is fleet tracking and fleet efficiency. UPS is using big data to optimize package movement to help minimize its energy usage; to that end, the company spent $1.8 billion in 2015 to acquire Coyote Logistics, a third-party logistics company that focuses on transportation services for shippers. UPS is also investing in energy conservation measures at its warehouses and other facilities and in its daily operations.

In February, UPS joined other investors in providing $28 million in funding for Deliv, a start-up company in Menlo Park, Calif., that offers same-day delivery of merchandise purchased by consumers from major retailers and shopping malls, to boost its “last mile” delivery capabilities.

Verizon, meanwhile, acquired software-as-a-service fleet management and mobile workforce solutions firm Fleetmatics for $2.4 billion in August. The public company provides fleet operators with information on vehicle location, speed, mileage, and fuel usage.

Notable 2016 Transportation fundings (non-Mobility Services):

Drones Taking Off

2016 has been a breakthrough year for clean tech drone investments, with 18 deals worth $59 million through mid-year exceeding the $33 million invested in all of 2015, according to CTG.

Drones are seeing more applications across industries. In agriculture, drones facilitate targeted, uniform spraying of pesticides on crops and can be fitted with payloads such as cameras that enable farmers to get a bird’s eye view of their crops. Drones are also being applied in industrial settings, such as in the utilities and oil and gas sectors. A lot of maintenance and equipment inspection work can be done by dispatching a drone at a fraction of the cost of doing it manually, as well as improving safety, driving their adoption.

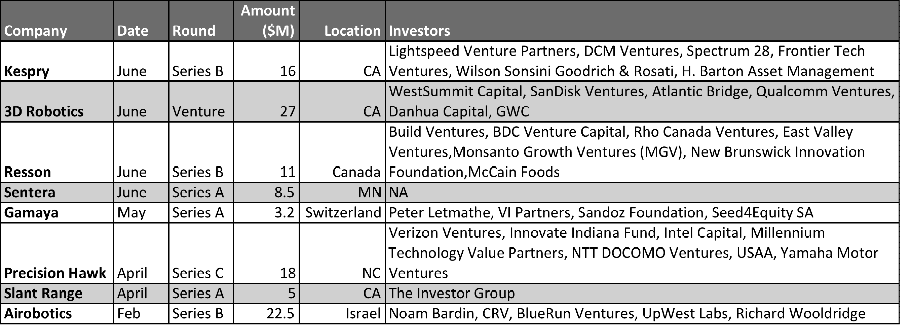

Notable 2016 Drone fundings:

Oil & Gas Corporates Still Investing

Adopting new technologies in field operations is a major focus for oil and gas corporate investments. And leading energy companies increasingly want to have a diversified energy portfolio that includes renewables as well as traditional energy sources.

On November 4, the $1 billion Oil and Gas Climate Initiative (OGCI) was launched by a partnership of major global oil and gas industry players, including BP, CNPC, Eni, Pemex, Reliance Industries, Repsol, Saudi Aramco, Shell, Statoil and Total. Rather than promote renewable energy, the new fund will focus on ways the industry can reduce its carbon footprint in its current operations. Methods include reducing leakages of methane gas, technology to capture and store carbon emissions when gas is burned to produce electricity, and increasing the fuel efficiency of vehicles.

Statoil announced the creation of its Statoil Energy Ventures fund in February, saying it would put up to $200 million into renewable energy through the new vehicle. The fund’s first move was a $3 million investment in United Wind, a distributed wind company. The sectors that the firm will consider investing in are solar, energy storage, onshore and offshore wind, transportation and energy efficiency, according to Gareth Burns, a Statoil vice president and managing director of the new fund.

Statoil has another venture fund, Statoil Technology Invest, which has a focus on early-phase investments in upstream oil and gas. It invested in chemical monitoring startup LUX Assure’s $3.3 million venture capital round in June.

In January, Canadian oil companies Suncor Energy and Cenovus Energy, along with the BC Cleantech CEO Alliance, announced the formation of Evok Innovations. It’s a new clean tech fund intended to “accelerate the development and commercialization of impactful energy solutions to address the most pressing environmental and economic challenges facing the oil and gas sector today,” the companies said. Cenovus and Suncor each committed C$50 million in funding over the next 10 years.

And the world’s largest oil company, Saudi Aramco, is said to be restarting its clean tech investing activities. In April, it invested $10 million in NanoMech, which develops highly efficient products for industrial and mechanical applications, such as lubricants, coatings and specialty chemicals.

In May, Shell established a separate division, New Energies, bringing together its existing hydrogen, biofuels and electrical activities. The division will also be used as a base for a new drive into wind power. Shell Technology Ventures continues to actively invest in clean tech start-ups; in October it invested in home energy monitoring start-up Sense Home as part of its $14 million Series A venture round.

Developing carbon capture and fuel cell technologies is a major focus at ExxonMobil, which is partnering with governments and major universities to make advancements in this area. It recently announced a $15 million investment into the University of Texas at Austin Energy Institute to support its emerging technology development program, with a focus on developments in renewable energy, battery technologies and power grid modeling.

Growing Interest in Water & Waste-to-Value

Although water and wastewater comprised a relatively small portion of overall clean tech venture investments, with only 4% of deal volume and 1% of dollars in 2015, we’ve seen growing interest and activity focused on the water tech space, mainly tied to industrial processes, health and wellness, and food and agriculture. In fact, water and wastewater venture investments jumped to 13% of dollars year-to-date through Q3 2016, and took in $620 million, according to CTG.

Water is another area where we’ve seen increased in cooperation among traditional food and beverage competitors to work around the issue of sustainability. It’s a hot topic among water-intensive corporates, including food and beverage firms like Pepsi, Coca-Cola, Nestle and MillerCoors, consumer companies such as Nike and Patagonia, microprocessor firm Intel, and oil and gas behemoths Saudi Aramco, ExxonMobil and Statoil.

Waste & recycling startups attracted 13% of dollars in Q3 2016, and have taken in $442 million year-to-date. Its another area that seems to be quickly picking up in terms of interest from investors and corporates alike, with buzz we are hearing around areas like anaerobic digestion systems and biodegradable packaging.

Waste-to-value is an area of focus for Obvious Ventures, which in 2015 invested in Zymergen, a company that makes bio-based plastic products from genetically altered microbes and uses robotics and machine learning to optimize the production of microbes for different processes. Beebe told us that the startup is getting a lot of interest from large corporates asking for bio-based alternatives to their materials.

Zymergen raised a $130 million Series B funding in October from Softbank, Iconiq Capital, Prelude Ventures, and Tao Capital Partners.

And Ginkgo Bioworks raised $100 million in Series C funding in June from Senator Investment Group, Cascade Investment, Baillie Gifford, Allen & Company and Viking Global Investors for its genetically engineered microbes for customers in the flavor, fragrance and food industries.

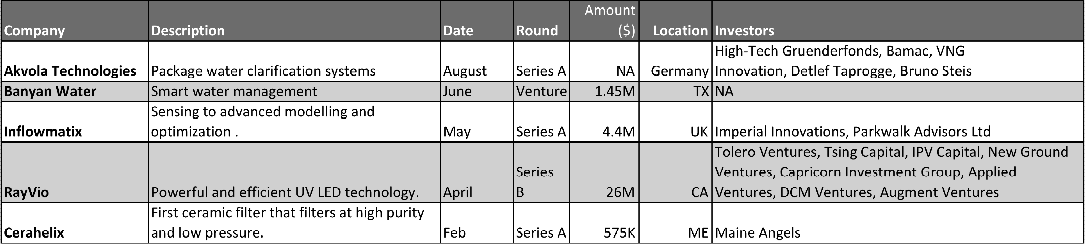

Notable 2016 Water fundings:

Early Stage Venture Investor Spotlight

David Miller founded Boston-based Clean Energy Venture Group in 2005, which has now invested in 28 companies. The firm is typically the first institutional investor in early stage companies, Miller says. The firm has plans to begin raise capital from limited partners for a new venture capital fund this year, according to Miller.

Miller, who spoke at the Advanced Energy Conference in April, said his biggest area of interest today is energy efficiency because of its capital efficiency, as most start-ups in the space are software and big data plays.

Regarding the potential for energy savings, “It’s a huge untapped resource,” he says. “We use much more energy than we need across every sector. Reducing the amount of energy we use very often generates very strong returns and there are tons of opportunities.”

He cites his firm’s investment in Powerhouse Dynamics, which uses cloud-based controls and analytics to deliver energy and operational efficiencies for commercial customers, and which raised $1.8 million in a convertible note offering in August, following a $6.3 million Series B in 2014. Other major investors in the start-up include Vision Ridge, PJC and Constellation Ventures.

Grid scale energy storage is another area Miller is seeing promising investment opportunities, driven by the need to solve the intermittency problems as wind and solar get “massively deployed.” His firm invested in Quidnet in July, which promises large scale, very cheap energy storage.

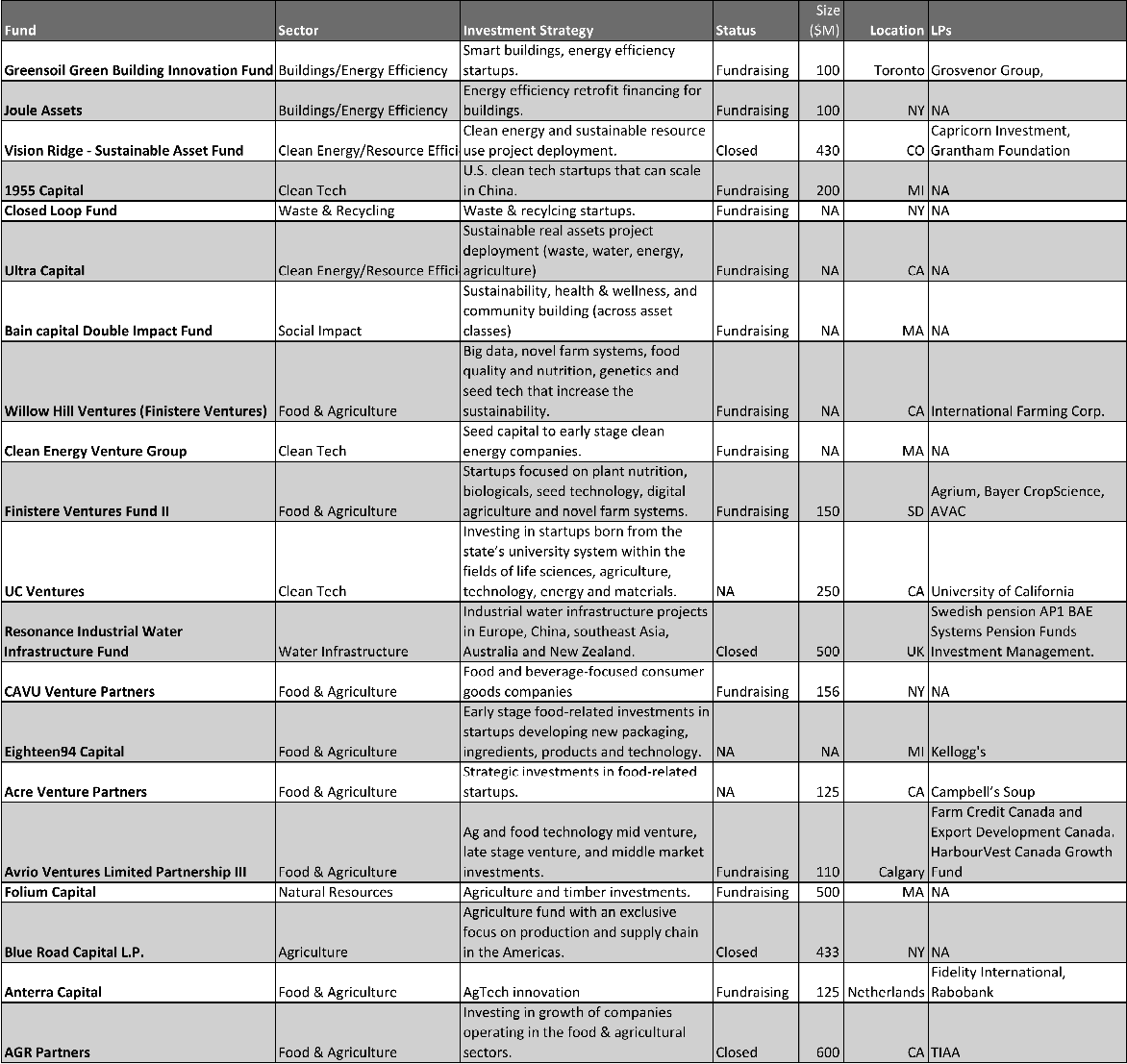

2016 New Funds & Fundraising Activity