The last time we wrote about collaborative consumption (i.e. the “sharing economy”) the industry was like a gawky adolescent. Yes, there were some major moments of maturity, including ZipCar’s all-cash sale to Avis for $500 million. Yet there were still painful outbursts of youth: New York City had recently declared Airbnb illegal, and the cofounders of Yerdle admitted their site for sharing household items had no business model.

Boy, what a difference 10 months makes. You know the big headlines. Airbnb’s immodest $10-billion valuation. Fundraising rounds of $300 million and $250 million for rideshare companies Uber and Lyft, and investors betting millions on shared fashion (Poshmark), pots and pans (KitchenSurfing) and Legos (Pley).

Maturity isn’t only in the dollar signs, of course. Airbnb is proving so successful it’s spawned its own sector of ancillary companies in both the online and physical worlds. Even the failures are proving fruitful, as investors try to piece together why seemingly sure-thing companies like Qhojo, a sharing site for camera equipment, languish for want of users and investors.

Melissa O’Young, founder of Let’s Collaborate!

“It’s hard to know why it didn’t work,” said Melissa O’Young, founder of Let’s Collaborate!, a group that promotes the collaborative consumption movement in New York City, and community-building expert. “Someone else might do it with the right funding or the right brand.”

Another niche equipment sharing company, GearLode, which launched at the South by Southwest festival last year and focuses on music equipment, seems to be doing well with its exhibition at the NAMM conference in January. It received funding in 2013, according to the Wall Street Journal.

Sure, the sector still has some maturing to do. Again Airbnb is the lightning rod here, especially with the revelations this week that some johns, prostitutes and sexual swingers are using the website for trysts.

Meanwhile, under the loud news of fundings and failures, collaborative consumption quietly cleared a major hurdle. For a few years, venture capitalists were not convinced the sector had sufficient margins, on either side of the ledger. Since their startup costs tended to be modest, associated mostly with writing code, and the potential size of their exits appeared limited mostly to the size of the communities they were able to attract, collaborative consumption companies seemed to lack both the capital needs and the profit opportunities required to get VCs excited.

A third of the way into 2014, those questions have definitively been answered. On the investment side, simply coding a new website may not a successful venture make. Bandwagon, a company that helps people avoid expensive taxi rides by arranging rideshares from airports, has physical infrastructure needs, including signage and queuing stations. Even Lyft needs cash for all those fluffy pink moustaches.

On the profit side, Airbnb recently gave 10 billion reasons why that’s no longer a major concern.

“That came up last year, where the concern was that VCs won’t make enough money,” O’Young says. “So now they’ve seen startups that can scale and provide returns for investors and founders Airbnb and Uber indicate that investors can clearly make a profit.”

Here are some trends that are guiding investment in collaborative consumption. At the end, we’ll give some intel on cool companies to check out.

Use the Tech You’ve Got

We have Grindr and we have Blendr. But geolocation isn’t just for cheap hookups anymore. A whole generation of new collaborative startups is predicated on the fact that most urban Americans now carry smartphones that (creepily) track their every movement. If you need space on-demand there’s Breather, which offers relaxing rooms for people in the go to meditate, nap or catch a breath. For more work-oriented needs there’s Liquid Spaces, which helps people in need of temporary office space dispense with the bad music and harrowing hunt for electrical outlets common to working in many coffeeshops.

On other on-demand sites, the services come to you. For cleaning services there’s Exec and Get Maid. For crosstown deliveries there’s PostMates. There’s even Zeel, an on-demand site for massage, which as far as we can tell has not devolved into a cheap hookup site (see Blendr, above).

“In terms of new business models, I’m noticing a lot of sharing economy startups that enable you to access things on demand,” O’Young says.

Start Small, Then Pray

There may never be another Craigslist, where anyone anywhere can buy or swap just about anything. The trend is headed in the exact opposite direction: Start with laser focus on one small niche, and then expand from there.

“The trend is definitely to focus narrowly on one thing,” O’Young says.

Of course, starting small does not guarantee success. For every Pley, there’s a dozen companies that tried to establish online marketplaces for one tightly defined sector of goods and services, only to fail. Maybe the design is amateurish. Maybe the stars just didn’t align. Whatever the reason, sharing economy failures often look alike: In most cases, they fail to attract enough people to the platform.

Could such failures be turned around by a big investment in marketing? Or should smart money just walk away? Sometimes it’s hard to tell.

“They don’t have the critical mass for people to start sharing,” says O’Young. Each individual niche may be small, but the breadth of such sites is dizzying. Share a boat on BoatBound, a bike from an Alta Bike Share program in major cities or a Vespa on Scoot Networks. Borrow a $10,000 watch on Eleven James for a small monthly fee, or high-fashion clothes on Rent the Runway. Kitchen Surfing raised $15 million in March for a site that helps people bring amateur and professional cooks into their home kitchens.

Consider the Threshold

Let’s say you own a kettle. It’s a nice kettle, but you don’t make tea often, and it takes up too much space in your cupboard. Why not use Yerdle to make some money renting it out?

If you’re an active VC in the collaborative consumption space, you’ve probably heard a pitch like this. So why doesn’t it work? One problem, O’Young says, is getting over the cost/benefit threshold. Legos are expensive, and kids quickly outgrow them. That presents a natural opportunity for sharing and selling.

But kettles are cheap. Other common household things like chairs may be so useful and so ubiquitous, few people would even think of sharing them. If you’re looking to start or fund a collaborative consumption company, it means you’re also trying to find a motivator strong enough to change consumers’ behaviors. Which means pots and pans may not cut it.

“It’s very often just cheaper to go to the store to buy a kettle, and less of a hassle,” says O’Young. “People aren’t used to sharing those things yet.”

AirBnB (Yes, it deserves its own subhead)

What’s newsy about collaborative consumption’s biggest success story isn’t just its big valuation. Everybody and their brother covered the fact that Airbnb is expanding into other hospitality businesses including car services and trip planning. Less widely appreciated is the fact that Airbnb has become the hub of its own micro-sector, spawning new business models and startups. Some users have enjoyed such success renting spaces on Airbnb that they’ve bought additional properties specifically to rent them out, too.

Other startups are digital. Localeur and Vayable help would-be renters find the best places on Airbnb. A host of sites including Airenvy, Urban Bellhop and Beyond Stays help hosts manage their properties, covering everything from check-in to maintenance and concierge services. (A shout-out here to Jeremiah Owyang for pointing these sites out on his blog.)

If hitching a ride on Facebook was good enough for Farmville to earn a 47-percent profit in 2010, perhaps Airbnb has coattails long enough to support a few more hangers-on?

Finally, Airbnb took a big step toward clearing its regulatory hurdles this month when it announced it will help property owners collect hotel taxes in New York, San Francisco and Portland, where officials have squawked that the site’s great deals are due partly to apartment owners’ ability to undercut established hotels. The system is voluntary and many hosts won’t participate, so it remains an open question whether it will placate the tax collectors of New York City.

“The regulations just don’t exist at the moment to handle these kind of exchanges, and governments can be slow-moving,” says O’Young. Airbnb’s announcement shows that “companies are finding ways around it.”

It’s a VC Playground (With Corporates Tagging Along)

Especially in cleantech, venture investors have taken it on the chin lately. Big failed bets on things like revolutionary batteries and electric cars in Israel prompted many green investors to pull up stakes.

But in collaborative consumption, VCs still rule.

“The bulk of the money is from VCs,” O’Young says of recent big fundings. “I guess what it indicates is VCs’ invest in truly disruptive businesses.”

The cast of major characters is familiar. In three weeks in February and March, Union Square Ventures placed significant bets on Sidecar (ridesharing), Skillshare (collaborative education) and Kitchen Surfing. Marc Andreessen invested in Local Motion (car sharing) and Lyft; Kleiner Perkins bought stakes in Indigogo (crowdfunding) and NextDoor (community networks); and Shasta Ventures put money into Storefront (retail space sharing for artists), Flywheel Software (taxi hailing app), Liquid Spaces and NextDoor.

Corporates play a role, of course. GE has teamed with Task Rabbit, Marriott entered the space rental business with Workspace on Demand, and everybody from BMW (car sharing and parking space apps) to Henri Bendel is experimenting with collaborative business models. Volvo recently invested in RidePal (a commuter ride sharing app), Google invested in Uber and CBRE Group invested in Liquid Spaces. Fund managers T. Rowe Price and Wellington Management Co. invested in Lending Club (peer-to-peer lending) and American Express invested in Rent the Runway. For the moment, however, the biggest source of funding is still venture capital.

Companies to Watch

Transportation sharing is still a hot area, but early stage VCs and angel investors have moved on from cars and are funding niche areas such as scooters, boats, and public transportation or parking space aggregator apps. In addition, new sharing models around food and fashion are sprouting up, which are also receiving early stage funding.

Here are some startups that are attracting buzz lately.

– The Black Tux professes to offer rented tuxedoes that actually fit. Raised $2.6 million in seed funding in February from Lerer Ventures, First Round Capital, RRE, Founder Collective, Crosscut, Menlo Ventures, and Raine.

– Makers. Some offer spaces for makers, including TechShop, which raised $3 million in crowdfunding in October, and NYC Resistor. There’s also CustomMade, which raised $18 million last June, which is like a heavy-duty Etsy with a torch welder.

– Kidizen. A site for swapping kids’ clothes, the company received $100,000 in seed funding from Steve Case earlier this month at Google’s Entrepreneur Demo Day, following an initial $85,000 investment in December and $100,000 in 2010.

– BoatBound. Remember the truism: A boat is a hole in the water into which you throw money. So why not share the fun and the cost? BoatBound raised $2.5 million on April 1 from the Brunswick Corporation, OurCrowd, Laszlo Bock and Google’s John Thomas, among others. Another boat sharing company, GetMyBoat, claims to have over 11,500 boats listed in more than 1,100 cities, 80 countries, and 49 U.S. states, with total annual reservations of $1 million.

– Feastly. An online marketplace that connects communities of eaters (or “Feasters”) with nearby cooks that host shared meals in people’s homes. It is currently available in New York, Washington DC and San Francisco, but the company has plans to expand into other cities. It has raised seed funding from Tim Draper, Mike Walsh, Scott and Cyan Banister, Lisa Gansky, Adri Capital, and others.

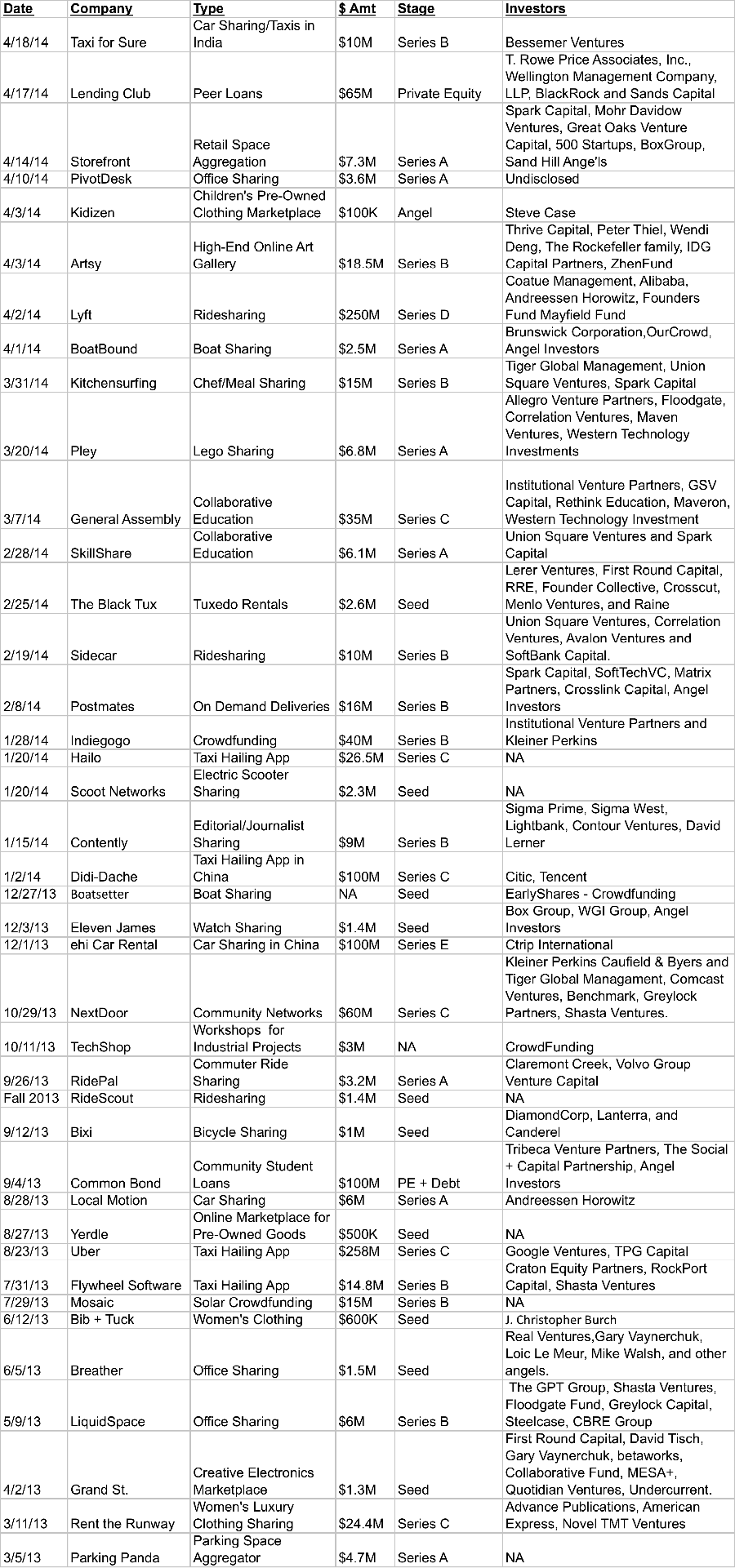

Sharing Economy / Collaborative Consumption Company Fundings

source: CleanTechIQ’s New Fundings Database

very nice article and great content.