VCs invested $297 million in 40 cleantech deals in Q3, decreasing 20% in dollar terms versus the prior quarter, with deal volume decreasing by 7% versus Q2 and dropping by 39 percent versus Q3 2012. The average deal size in the latest quarter was $7.8M, a decrease of 43 percent versus a year prior. Early stage funding saw a significant drop in the quarter, down 70% versus Q3 2012, with later stage investment dropping by 64% versus the prior year, to $237M, according to PWC in its latest cleantech venture funding report.

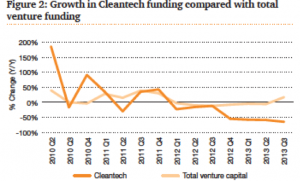

The third quarter of 2013 marks the seventh consecutive quarter of declining investment levels in the cleantech sector, says PWC.

The latest cleantech funding report follows PWC’s analysis of total quarterly venture capital funding where they are seeing an overall pick up in funding, with a rise of 12 percent in Q3 (to $7.8B) versus the prior quarter and an increase of 5 percent (to 1,005) in the number of deals. Total year-to-date VC funding through the third quarter was slightly higher than in the first three quarters of 2012, the PWC report showed.

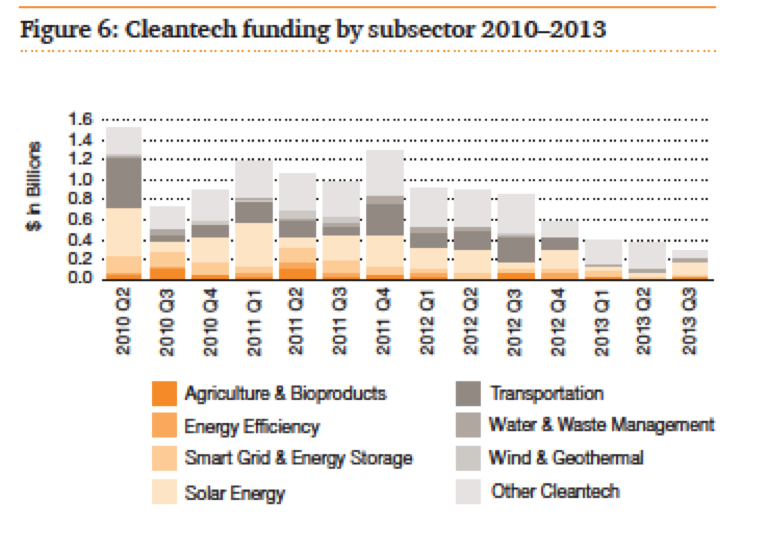

Total cleantech venture funding for the year-to-date period through Q3 was $1.1B in 143 deals, versus $2.7B invested in 196 deals during the first three quarters of 2012. This represents a drop of 60% in dollar terms and 27% in the number of deals versus the year-to-date period through Q3 of 2012, according to National Venture Capital Association data.

Compared to a year ago, total cleantech “first time funding” in Q3 declined by 69% to $21 million, with 9 deals averaging $2.6 million. And cleantech “follow on funding” in Q3 dropped 65% to $276 million, with an average deal size of $9.2M in 31 deals.

The latest quarter’s subsector funding winner was “Water & Waste Management” – increasing 229% vs. Q3 2012 to $64 million and taking in 22% of the total amount invested in the quarter, says PWC. Solar funding in Q3 increased by 82% to $128 million versus the same period last year, taking in 43% of the total amount invested during the latest quarter.

“Solar seems to be a bright spot in the cleantech industry,” said Tom Solazzo, PWC’s Cleantech Practice Leader. This favorable environment for solar venture funding is supported by Mercom Capital’s quartlery report, which showed that venture funding in the solar sector increased to $207 million in the third quarter from $189 million in the second.

Transportation funding in Q3 decreased 98% versus a year ago to $4M (2% of the total), with “Smart Grid and Energy Storage” decreasing by 23% to $30M (10% of the total), according to PWC’s analysis. The “Other Cleantech” subsector took in 21% of the total during the quarter and “Agriculture & Bioproducts” took in 2% of the total. The subsectors that didn’t receive any venture funding in Q3 included: Wind, Geothermal, and Energy Efficiency

In terms of regional investments, Silicon Valley area cleantech companies received the most venture funding with $83 million, followed by LA/Orange County with $54M and New England with $40M.

The cleantech subsectors included in PWC’s analysis include: agriculture and bioproducts, energy efficiency, smart grid and energy storage, solar energy, transportation, water and waste management, wind and geothermal, and other renewables.

To access the PWC MoneyTree Q3 Cleantech report, click here