With wind and solar prices plummeting and electric vehicles gaining popularity, attention has naturally turned to energy storage, in terms of both financing and technology, in order to take full advantage of these trends.

Advances and interest in energy storage is expected to accelerate. Improvements in, and additional deployments of, wind and solar will encourage improvements to energy storage, which will encourage more deployments of wind and solar, creating a virtuous circle that investors and financiers will be happy to take part in.

In this briefing, we take a look at some of the recent developments in the energy storage space – new financing models, new developments and deals, and advances in some technologies that will help drive future progress in the space, today and far into the future.

Among the most important findings:

– Behind-the-meter growth, the fastest growing segment, is being driven by its ability to reduce costs as well as growing demand for resiliency by commercial and industrial customers.

– With more successful projects up and running, improving technology and new business models that increase the value of storage, energy storage is becoming a bankable sector that is attracting a growing number of financiers entering the market.

– Leading the way are so-called “virtual power plants” — fleets of distributed batteries, controlled by utilities, that create value for both the utility and the corporate end-user.

The numbers set the stage for explaining the strong interest in the space: U.S. energy storage reached 336 MWh in 2016, about double what it was in 2015. This is forecast to bloom to 7.3 GWh by 2022, according to GTM. Behind-the-meter storage capacity will soar too: it was 25% of installed capacity in 2016 and is expected to account for 52% of the annual U.S. market by 2022, making it the fastest-growing storage segment over the next five years, GTM says.

This year has been a boom time for energy storage in the U.S. In the first quarter alone, energy storage deployment was up 944% in terms of megawatt-hours deployed over the first quarter of 2016, with a record 234 MWh installed during the quarter, GTM says, driven largely by utility scale projects in California.

And behind-the-meter energy storage is a worldwide phenomenon, with global commercial and industrial (C&I) energy storage capacity deployments expected to grow from 499MW in 2016 to 9.1 GW in 2025, according to Navigant.

New Financing Models Drive Deployment

The development of new financing models, including shared savings and leases, is enabling more corporations to take advantage of behind-the-meter energy storage solutions — the same way the no-money-down, third-party ownership structures helped the residential solar industry grow into a $10 billion industry in recent years.

These behind-the-meter “smart” energy storage developers use software that analyzes data points like weather and past energy usage to forecast usage in the future. Improved predictions help lower financing risk and enable project developers to raise funding that allows them to offer financing packages to corporate customers.

The key to attracting financing, experts say, is the quality of the developer’s software for verification and measurement of the savings generated by storage. That’s why most project developers claim that their proprietary software is their “secret sauce.”

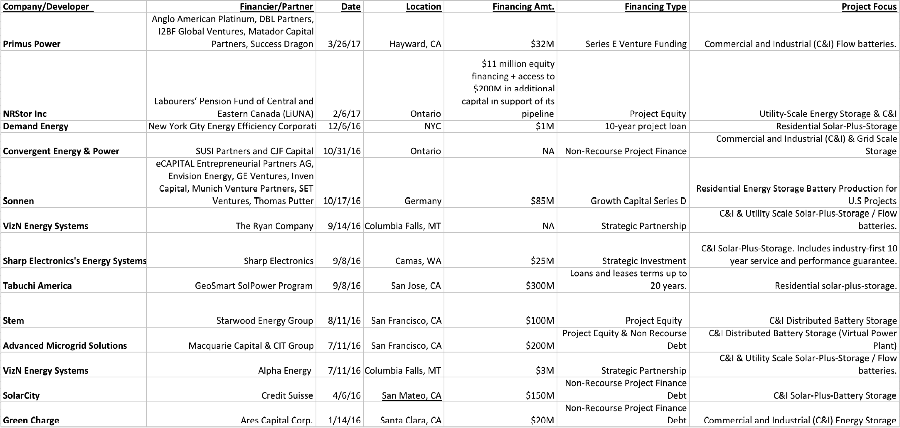

Traditional project financiers are seeing growing opportunities in the deployment of customer-sited distributed energy storage systems and say there is an increasing amount of financing going into the sector to fund these new models. Growing project developer deal pipelines with long-term contracts and increased project financing are increasing the bankability of behind-the-meter energy storage — which in turn will drive more capital to this market. (See our table of energy storage project financings below.)

Among the names getting financing for energy storage deployment recently is distributed energy storage firm Stem, which combines software and lithium-ion batteries. The San Francisco-based company increased its project financing pool to more than $350 million with the addition last year of up to $100 million from Starwood Energy Group. Stem will use the funding to finance its distributed energy storage systems to commercial and industrial customers.

Stem’s Customer-Sited Intelligence Energy Storage System

Another innovative San Francisco firm, Geli, has also been raising money for energy storage. The company, whose name stands for Growing Energy Labs Inc., raised $7 million in Series A venture funding from investors including Shell Technology Ventures in April 2016, followed by an undisclosed amount of funding from next47 in December. Geli has been installing small-scale behind-the-meter battery projects and will use its new funding to incorporate a variety of distributed energy resources, including using its on-site control hardware and cloud-based software to manage microgrid and electric vehicle/solar/battery integration projects.

Corporate & Industrial (C&I) Market Demand

C&I energy consumers are showing growing demand for behind-the-meter energy storage systems in order to reduce demand charges, the premium that utilities charge businesses during peak power demand times, which can add 50% or more to their bill. C&I consumers are finding that smart energy storage systems can significantly reduce demand charges by shifting load from peak to off-peak times, storing the energy for use during peak hours.

Resiliency is also a growing driver for the deployment of energy storage in the small and mid-size C&I markets. These businesses are increasingly willing to pay for a source of backup power if the grid goes down during severe weather events. Concerns around resiliency are also sparking the growth of combined solar and battery systems, as well as microgrids that allow the customer to separate from the grid entirely during severe weather events.

A good example of C&I activity is the recent deal between Macquarie Capital and CIT Group to finance 50 MW of behind-the- meter storage systems being deployed in Southern California, purportedly the largest battery project to get bank funding to date. Macquarie is developing a $200 million portfolio of energy storage projects that it acquired in 2016 from Advanced Microgrid Solutions (AMS), which will help in the development. The systems will be installed at commercial and industrial sites, including at 27 Walmart stores and Kilroy Realty Corporation’s properties across the region.

CIT will provide an undisclosed amount of non-recourse debt financing for the battery systems.

AMS uses batteries and its proprietary software system to aggregate and operate its customer-sited batteries as a “fleet” that can be used as a grid resource which opens up multiple revenue streams from both the utilities and corporate building owners and increases the value of its energy storage projects.

The AMS-Macquarie project will have three separate revenue streams: the corporate end-users will pay to store energy in the batteries that create energy savings; Southern California Edison will buy power from the batteries through 10-year PPA contracts for capacity; and the storage systems will offer the grid services like voltage management and reserve capacity.

AMS will install Tesla’s Powerpack energy storage systems in its C&I projects.

Energy Storage Policy Drivers

More and more state governments are issuing energy storage mandates, which are implemented through each state’s utilities. These mandates are proving to be a crucial driver of the energy storage market, with California the leader by far, having mandated 1.3 GW of energy storage. Massachusetts is expected to adopt an energy storage target on July 1, and California is likely to issue additional energy storage mandates soon as well. There are also a record 30 different energy storage bills before various state legislatures across the US that will further drive mandates.

Another big move came in June, when the California State Senate passed an energy storage bill that further promotes the adoption of customer-sited solar-plus-storage systems at homes ands businesses through a new 10-year $1.4 billion rebate program.

Municipalities are expected to get into the energy storage game as well, with New York City having established the nation’s first municipal energy storage target of 100 MWh by 2020 last fall.

Recent utility grid energy storage deployments

Across the U.S., utility-scale battery storage installed capacity grew by 221 MW in 2016, according to the Energy Storage Association. The momentum has continued in 2017 with numerous projects, including:

– San Diego Gas & Electric said in April it would build nearly 84 MW of new battery storage across five lithium-ion projects with private firms. AES Energy Storage, which earlier built 37.5 MW of storage for the utility, will build a 40 MW facility, while Renewable Energy Systems (RES) will construct another 30 MW of storage. SGD&E will own and operate those two facilities; the other three battery facilities, totaling 13.5 MW in all, will be built and owned by Powin Energy, Enel Green Power North America and AMS.

– In another example of the burgeoning industry, one of those companies, UK-based RES, says it has projects completed or under way in eight U.S. electricity markets, is raising project financing for its large scale battery storage projects from mainstream financial institutions, and has received project financing from the Prudential Group and the Lincoln National Life Insurance Company.

– In January, Southern California Edison, the largest subsidiary of utility Edison International, and Telsa completed an 80 MWh lithium ion battery storage facility, using 400 of Tesla’s Powerpack 2 battery. It’s said to be the largest lithium-ion battery storage facility in operation today. The utility also worked with Greensmith Energy to bring another 80 MWh battery storage facility online.

Grid modernization efforts in many states are driving utilities to develop distributed battery storage projects. In addition to California and Massachusetts, the Energy Storage Association has noted the growing use of energy storage in Connecticut, New York, Arizona, Washington, Hawaii, Texas and Utah. This trend is driving more utilities to be aggressive in experimenting with the value of energy storage on their systems.

Examples of utilities experimenting with storage include:

– North Carolina’s Duke Energy has 10 storage pilot programs and has said it is ready for a commercial storage project to be fully operational in a regulated market. Its storage partners include Green Charge Networks, Sun Edison, Aquion Energy and Maxwell Technologies.

– Consolidated Edison of New York is actively pursuing pilot projects as part of the state’s Reforming the Energy Vision (REV) program; this is driving energy storage coupled with renewable energy generation. ConEd’s storage partners include NRG, Sunverge, Stem, LG Chem and Greensmith Energy.

– ConEd also has a new demand management incentive program, and recently awarded the first microgrid to be deployed under the system. Demand Energy, a subsidiary of Enel Green Power North America, has begun construction on a microgrid that integrates solar PV and battery storage. The microgrid project is the first lithium-ion battery approved for behind-the- meter use in a multi-family residential building in New York City.

– In Vermont, Green Mountain Power has installed 2 MW of energy storage, including a Stafford Hill Solar microgrid project using Tesla batteries. It’s one of the first microgrids powered entirely by solar and battery back-up.

– Austin Energy of Texas is working with Stem to develop an aggregated fleet of customer-sited energy storage as part of the Department of Energy’s Sustainable and Holistic Integration of Energy Storage and Solar Photovoltaics (SHINES) program. The goal is to reduce the cost of electricity from combined solar and storage projects to below $0.14 per kWh.

– Hawaiian Electric Company and Stem have successfully tested nearly 1 MW of intelligent energy storage systems deployed at 29 commercial customer sites on Oahu to help businesses reduce demand charges.

Virtual Power Plants and Solar-plus-Storage Attract Financing

The development of software that can aggregate and control small batteries is a key factor driving the development of “virtual power plants” or VPPs, where a utility controls a “fleet” of behind-the-meter batteries as a grid resource. The software also enables battery projects to integrate solar into these systems.

Key to the growth of VPPs has been the development of multiple revenue streams for behind-the-meter storage projects, which increases the value of energy storage beyond just customer savings. Having these multiple revenue streams is vital to raising project financing for distributed battery storage.

In order to make financing attractive for virtual power plants, they require subsidy programs and incentives for energy storage to be offered by utilities, or a state mandate for energy storage that is issued through an RFP by a utility.

Integrating rooftop solar with energy storage is another major driver in the adoption of distributed storage, with more solar installers integrating storage into their projects. Navigant Research forecasts the annual global market for the deployment of solar-plus-storage to reach 27.4 GW, and $49.1 billion in revenue, by 2026.

The Stem/Hawaiian Electric deal cited earlier is a good example of a VPP. Among the other leading companies pushing VPPs is Sunverge Energy, which has partnered with Australian utility AGL and the federal Australian Renewable Energy Agency (ARENA) to develop what is said to be the world’s largest VPP. The A$20 million ($15 million), 5 MW VPP will comprise multiple residential PV and battery units connected via a single software platform.

Sunverge, along with SunPower and Con Edison, also is participating in a demonstration project for New York’s REV program, in which the companies are integrating residential behind-the-meter storage that is paired with rooftop solar PV. The project is intended to help trim peak demand and also save customers money.

Big Solar Players Combining Energy Storage

SolarCity says it is incorporating Tesla’s new lithium ion battery into its DemandLogic energy storage system, which the solar installer introduced in December 2013. The system’s software automates the discharge of stored energy, and offers businesses no-money-down 10-year contracts for solar energy and storage to provide backup power as well as address demand charges. Several large biotech, Internet and retail companies have adopted the system, including Walmart and BJ’s Wholesale Club.

SolarCity raised $150 million in project financing in 2016 from Credit Suisse to deploy solar-plus-storage systems with commercial customers.

In May, Vivint Solar, the industry’s third-largest residential solar installer, finalized what it calls an “exclusive strategic collaboration” with Mercedes-Benz Energy to deliver solar-plus-storage systems. It’s Vivint’s first storage partnership and the first solar partnership for the U.S. branch of Mercedes-Benz’s energy division.

Also in May, solar developer 8minutenergy Renewables announced its expansion into the energy storage market with a 1 GW project pipeline. It will focus on pairing storage alongside new solar projects in areas including Texas, the Southeast and California, where the company has more than 700 MW in operational generation assets.

Global Firms Investing in U.S. Energy Storage

A growing number of overseas firms are investing in energy storage projects and companies in the U.S. Among the notable names are French electric utility Engie, which took an 80% stake in behind-the-meter smart energy storage firm Green Charge Networks in 2016, intending to incorporate battery storage with its U.S. customers. Engie is also the largest strategic investor in AMS, the distributed energy storage developer. Outside of the U.S., Engie announced in May that it has installed a 2 MW/2 MWh energy storage system in Chile.

Other international investors making moves in the U.S. include German utility E.ON. Its E.ON North America unit announced in March that it will work with Virginia-based Greensmith Energy to build two batteries with a total storage volume of nearly 20 MW at a wind farm in Texas.

Last year, E.ON launched its Iron Horse Energy Storage & Solar Project at the University of Arizona’s Tech Park near Tucson. It’s a 10 MW lithium-ion battery system, linked to a 2 MW solar array, that should be operational this year.

The company has also begun installation work on a 10 MW battery facility at a biomass combined heat and power plant in the United Kingdom.

Battery Technologies: Lithium-ion and Beyond

Lithium-ion technologies have gained the most traction by far in battery deployments; they account for 95 percent of new energy storage deployments, according to McKinsey.

With battery prices falling 35% over the past year, driven by a rise in electric vehicle manufacturing, and expected to drop another 77% by 2018, the rapid adoption of batteries is expected to continue. New U.S battery manufacturing initiatives — including efforts by Tesla, Mercedes-Benz and Sonnen — will continue driving the costs of batteries lower and increase their interest by customers and investors.

Other battery chemistries hold great promise as well and are gaining some attention from investors. This includes flow batteries, which generate electrochemical reactions in dissolved liquids that are stored in separate containers that flow through a membrane. Flow batteries are seen as being particularly appealing for microgrid storage, since they have a longer duration than other types of batteries and recharge rapidly.

As with lithium-ion, flow batteries are expected to become more economical given the rate of technological advancement.

Promising flow battery makers gaining funding include:

– VionX raised $12 million in March, bringing total funding to at least $79 million for its vanadium redox flow battery. Investors in the company include VantagePoint Capital, Starwood Energy Group, Scottish & Southern Energy Ventures and North Sky Capital. VionX is working with United Technologies, Starwood Energy Group, VantagePoint Capital Siemens, 3M and Jabil on the commercial deployment of its systems.

– Energy Storage Systems (ESS) has received investor attention for its development of “all-iron” non-toxic, rechargeable, low cost flow batteries. The company raised an undisclosed amount of funding in October. It also received $2.8 million under ARPA-E’s Grid-Scale Rampable Intermittent Dispatchable Storage (GRIDS) program and $3.2 million in Series A funding in 2015 from investors including Pangaea Ventures, Element 8, Wilson Sonsini Goodrich & Rosati and Sand Hill Angels.

– Primus Power, which makes zinc bromine flow batteries, raised $32 million in Series E funding in March to ramp up production. New investors include Matador Capital and Hong Kong’s Success Dragon; existing investors who also participated in this round included DBL Partners, Anglo American Platinum, I2BF and the Russia Kazakhstan Nanotechnology Fund. In May, Microsoft announced a pilot project with Primus, in collaboration with NRG Energy, to improve energy storage at its data centers around the world.

– ViZN Energy Systems raised $17 million in Series E funding last year, bringing its funding total to $40 million. The company will use the financing to expand production of its zinc-iron flow battery, which is used mainly in microgrids. Energy storage software system developer Greensmith is incorporating ViZN’s batteries in its systems, and microgrid developers BlueSky Energy and Princeton Power are also using its batteries. VIZN partnered with financier LFC Capital in 2015 to provide financing to deploy its batteries, in combination with solar, in C&I projects using traditional operating leases.

The Key Deployment Challenges

Recent research has shown that utilities do benefit from the deployment of distributed energy storage systems. However, it can be a challenge to get a utility to compensate distributed energy storage developers for their projects.

In fact, getting utilities to pay their share of distributed energy storage benefits is a major roadblock to getting more such deals done, according to Jigar Shah, founder of Generate Capital, a finance company for resource innovation projects. This is due to the fact that only counting on the customer cost savings the projects generate, and having just one revenue source, is not enough to make these projects economically attractive for financing.

Other challenges that are holding back further energy storage deployment include governmental policies that don’t optimize storage in most markets, inconsistent tariffs, and a lack of performance data on battery projects, according to a McKinsey report from last year.

Market reform is crucial for new technologies to compete. Kelly Warner, president of AMS, would like to see more access to energy markets for energy storage technologies and incentives for energy efficiency in order to drive more projects forward. “Storage plays well in more open, dynamic markets,” Warner says.

Another consideration for investors is that distributed energy deals often are relatively small — typically under $1 million each. Because of this, project financiers tend to look to back developers with very large project pipelines so they can finance large portfolios of $100 million or more.

Yet another issue with funding distributed storage deals, according to Shah, is that each project individually doesn’t make a major impact on climate change, a key feature that many institutional investors are increasingly looking to invest in energy storage.

Shah estimates that there needs to be at least $1 trillion of investment in battery storage, or deployment of about 2 terawatt-hours, to begin making an impact on climate change through reduced carbon emissions.

To help overcome some of these challenges, private developers like Generate are taking matters into their own hands. That’s because, as Shah points out, further financing and business model innovation that enables more customers to adopt energy storage is the key.

To that end, Generate is providing project financing to fund no-money-down, pay-as-you-go deals to spark the sales of sustainability infrastructure products that enable businesses to avoid the large up-front expenses of these products. In January, the company set up a $300 million warehouse facility with online solar investing platform CleanCapital to acquire operating distributed solar projects. Generate also reportedly closed the world’s first 20-year solar-plus-storage PPA with a corporate customer, and the company is also the primary project financier of distributed energy storage developer Stem.

Other Financiers Taking Note

Such activity has enticed more project financiers to take a look at financing storage as well, and experts think the sector will attract a lot more financing this year. Traditional financiers and infrastructure investors that are increasingly committing capital to this space include Deutsche Bank, Prudential, Wells Fargo, Macquarie Capital, Starwood Energy, Goldman Sachs and Investec. Meanwhile, several other large, traditional financiers tell CleanTechIQ they are keeping a close eye on the energy storage market as well.

New private equity funds are also financing the deployment of distributed energy storage. For example, SUSI Partners’ SUSI Energy Storage Fund reached its first close of $72 million in April. The fund made its first energy storage investment last year when it helped finance 12 MW of energy storage across two projects in Ontario with energy storage developer Convergent Energy and financing lead CJF Capital. The projects were awarded as part of a move by the Ontario Independent Electricity System Operator’s to show the potential of energy storage in the power grid.

Future SUSI investments will include microgrids and load-leveling projects. The fund is targeting about $280 million in total assets.

Energy Storage Project Finance Funds & Deployment