Second in a series of briefings on distributed, sustainable project deployment and financing trends.

A little over a year ago, in December 2015, the U.S. government approved a five-year extension of the solar Investment Tax Credit. The ITC, which provides a 30 percent tax credit for both residential and commercial solar systems, has been a crucial driver in the growth of the solar industry over the past decade, and proponents said its extension would help ensure continued growth.

In this, the second in our series of articles on deployment and financing trends for distributed and sustainable projects, we find that the tax credit has, indeed, helped the solar industry continue to grow. Experts tell us that both commercial and residential solar developments should remain strong, and provide plenty of opportunities for investors to put their money, and make money.

In fact, the industry is now seeing increasing opportunities to put project finance capital to work, both in rooftop (“behind the meter”) solar and in community solar, according to leading financiers we’ve spoken with.

Rooftop solar, for both residential and businesses, has been the fastest growing segment of the solar market over the past several years. It’s a market that has been growing by more than 30% annually in the U.S., according to the Solar Energy Industries Association (SEIA).

These distributed solar projects are relatively small systems that generate 500 kilowatts (kW) to 1 megawatt (MW) of power for a single location. Major cost declines that have made solar more competitive with traditional energy have helped spark interest in these projects; so have new financing models that enable consumers to use third-party leases and install solar panels with no upfront costs.

A Large and Growing Market

Distributed solar projects accounted for about $40 billion of investment globally in 2016, according to Bloomberg New Energy Finance (BNEF.) Such projects now represent a quarter of all new investment in renewable energy capacity.

In terms of investment, the biggest global market for distributed solar projects in 2015 was Japan ($32 billion), followed by the U.S. ($8.7 billion) and China ($5.5 billion), according to the United Nations Environment Programme.

In the U.S., the number of residential rooftop solar installations has jumped more than 10-fold since 2010; these installations produced a combined 2,800 MW in 2016, according to BNEF, though that rapid pace is unlikely to continue. Still, despite the growth, only 1 percent of U.S. households today have solar panels on their roof, BNEF says — meaning there is still major room for the market to grow.

Indeed, the number of residential customers with PV is predicted to more than double nationally between 2015 and 2020, according to the SEIA. Worldwide, 25 million homes now have rooftop solar, according to BNEF. That figure is expected to soar to 99 million homes by 2020.

In other words, there will be plenty of rooftop solar projects to finance.

Another major growth market will be Sub-Saharan Africa and developing parts of Asia — areas where distributed solar energy will grow substantially in the so-called “off-grid solar market.” Growth here will allow the 1.2 billion people currently living without electricity to access solar power through very small “pica-solar” systems of less than 10MW. It’s a market that is expected to grow from $700 million to $3.1 billion of investment over the next 10 years, according to the World Bank and BNEF.

Off-grid solar market developers that have raised significant capital to deploy their systems include:

D.Light, which manufactures and distributes solar lighting and power products using pay-as-you-go financing solutions in East Africa, West Africa, India, Southeast Asia, raised $5M in venture funding from Norfund and $5.5M in grants from Shell Foundation and Beyond the Grid in January, 2017. In 2016, it raised $15M in Series D venture funding from Energy Access Ventures, KawiSafi Ventures, Aster Capital, NewQuest Capital Partners, Omidyar Network, $10M in debt from SunFunder and Developing World Markets, and an another $5M in grant funding.

Off-Grid Electric, which spreads solar and energy storage using cell phones and pay-as-you-go financing, raised $8M debt financing from responsAbility, as well as $10M in Series D venture funding from Helios Investment Partners in 2016. In 2015, the firm raised $45M in debt financing from the Packard Foundation, Ceniarth, and Calvert Foundation.

BBoxx, which manufactures, distributes and finances innovative plug & play solar systems to off grid communities in Africa, closed on a $20M Series C venture funding in 2016. The startup has 36 retail outlets in the two East African countries and expects to scale up to 400 retail shops in the next two years. It also closed a landmark $500,000 securitization with Oikocredit, the first securitization of residential solar installations in Africa.

And Powerhive, which develops and operates solar microgrids, raised $20M in Series A funding from Prelude Ventures to develop and operate solar microgrids with battery storage and local distribution in western Kenya.

A Shift to Bank Loans for Residential Solar PV

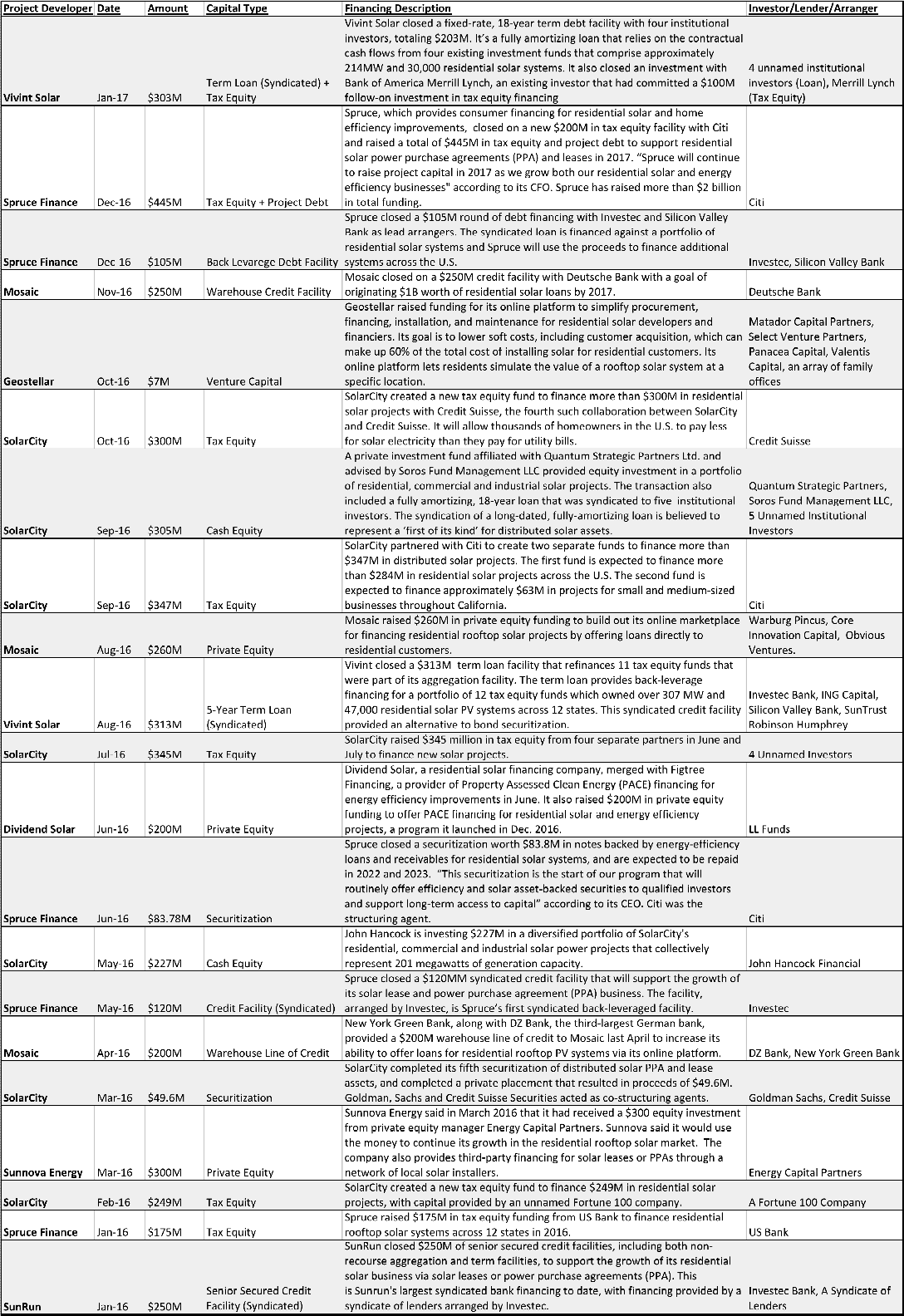

Both corporate and residential market adoption rates are rising fast. Third-party solar project developers are raising project finance funds from investors that enable them to offer no-money-down approaches to adopting solar, especially for residential users. (See our table below with details on distributed solar developers and $4.8B in financings.) In fact, there were 30 residential and commercial distributed solar project finance funds announced in 2016, compared to 24 funds announced in 2015, according to Mercom Capital Group.

An important and relatively new development is that, because the sector is more mature, there’s more financing available through traditional bank loan models, which allow end-users to own their solar PV systems themselves. They can then finance the bank debt with the cost savings the systems produce.

For example, the New York Green Bank, along with DZ Bank, the third-largest German bank, provided a $200 million warehouse line of credit to Mosaic last April to increase its ability to offer loans for residential rooftop systems via its online platform. Mosaic went on to close another $250 million credit facility with Deutsche Bank in November. Overall, Mosaic raised $460 million in debt and $200 million in private equity in 2016. With its stated goal of originating $1 billion of residential solar loans in 2017, it presents opportunities for capital providers to put more money to work in this sector.

In fact, as customer-owned systems become more popular, leased installations are plummeting in popularity: GTM Research expects solar leasing to account for less than half of new installations this year, down from more than 70 percent in 2014.

Bank Financing Trends

Among large banks interested in financing distributed asset projects in solar and energy efficiency, the primary interest these days is in “portfolio approaches,” in which many small projects are aggregated together in order to raise financing.

Driving further interest from large banks, there’s growing potential to do large-scale asset securitizations of aggregated residential solar projects, as these projects tend to be quite similar and can be standardized, making it easier to securitize them. Doing so enables these projects to gain access to greater sources of capital, thereby lowering their cost of capital and driving further adoption since it allows banks to offer more attractive financing terms to consumers.

Indeed, over the past two years, there has been a growing number of rated securitizations of residential solar lease PPAs by project developers and financiers. A good example is SolarCity, which issued two public bond securitizations of distributed solar projects, worth $235 million in total, in 2016.

Residential solar financing transactions in 2016 totaling $4.84 billion:

*Source: CleanTechIQ Deal Research

The Corporate & Industrial (C&I) Market

There’s also big opportunities arising in the C&I distributed generation market. Corporates are increasingly adopting onsite, behind-the-meter solar, and they are now major buyers of offsite utility-scale solar power purchase agreements (PPAs). Large corporations like PPAs because it lets them lock in low energy prices for the long-term. In many cases, in fact, these decisions are increasingly being made for economic reasons, rather than from policy or public pressure.

According to PwC’s 2016 corporate clean energy procurement survey, 72% of corporate respondents are actively pursuing renewable energy, with distributed solar by far the most popular type. The U.S. National Renewable Energy Laboratory (NREL) recently pegged the US rooftop solar PV potential at 1,118 gigawatts, with more than half of this potential coming from the corporate sector.

The C&I sector’s adoption of distributed energy has been drawing interest from large financial services firms, who are seeing increasing financing opportunities, particularly among large corporate entities with the ability to deploy renewables across multiple locations to spread out the transaction costs.

Banks bullish on providing financing to the C&I distributed generation space include Goldman Sachs, JP Morgan, U.S. Bank, GE Energy Financial Services and Credit Suisse, according to panelists from those firms speaking at a major industry conference in 2016.

However, this space is not without its drawbacks. Hurdles in the way of the financing of the C&I space include lower credit ratings and the relative complexity of these deals, which means they are less standardized and carry increased transaction costs.

Despite these challenges, “Corporate customers are going to change the industry the most over the next five to 10 years,” said Yuri Horwitz, CEO of Sol Systems, which works with banks, pension funds and insurance companies to deploy tax equity into the corporate market, including onsite rooftop solar and offsite procurement of solar energy projects. “Onsite or offsite, these folks are going to take the industry to next level.”

Sol Systems deploys $100 million of tax equity every year into the C&I solar market with rates of returns of 8%-9%, according to Horwitz. As of December 2016, Sol Systems had delivered more than 500 MW of solar projects for Fortune 100 companies, municipalities, universities, churches and small businesses. Sol says it now manages over $650 million in solar energy assets for utilities, banks, and Fortune 500 companies.

Distributed Sun, which launched a new solar tax equity fund in 2015, called sunFIVE, invested $50 million of tax equity in C&I solar assets primarily with unrated credit off-takers in 2016. An increasing amount of their funding has been coming from family offices and private equity firms, who are drawn to its “above hurdle return” according to Jeff Weiss, the firm’s managing director. Private equity funds have been increasing backing corporate distributed solar projects, according to developers speaking at a recent industry conference.

And in November, Soltage, a developer of C&I solar PPA projects, and Basalt Infrastructure Partners announced the first close of $70 million on a $140 million equity capital partnership to fund over 100 MW of C&I and utility pipeline solar projects across the country.

Community Solar

Community solar has also become an attractive market to financiers. Several bankers said last year they were seeing a marked increase in community solar project developers approaching them for financing in 2016.

In fact, large financial institutions such as U.S. Bank, Deutsche Bank and Goldman Sachs are actively looking to finance community solar projects, we learned at the REFF-Wall Street conference in June.

Community-owned “solar gardens” enable participating utility customers, who can’t install solar panels at their sites because of practical concerns or other reasons, to receive a credit on their electricity bills for the energy generated from the plant. Community solar is expected to become an increasingly important part of both the corporate and residential renewable energy markets.

There are 25 states with at least one community solar project on-line, with 91 projects and 102 MW installed through early 2016, according to the SEIA. Four states — California, Colorado, Massachusetts and Minnesota — are expected to install the majority of community solar over the next two years.

GTM Research estimates that the U.S. community solar market will reach 410 MW in 2017, due largely to pent-up demand in states with regulatory and legislative delays.

Over the next five years, the amount of power generated may rise to about 1.8 GW as more states encourage development and individuals take advantage of federal incentives, according to the SEIA.

Community solar project developers include Clean Energy Collective, which is developing community solar projects in Colorado and Massachusetts, and actively raises project finance capital from investors and banks to develop its projects. It added 21 MW of new community solar projects in Massachusetts to its existing portfolio in 2016.

NRG Community Solar broke ground on five community solar projects in Minnesota last year, totaling almost 23 MW of renewable capacity. Minnesota is known as a hot spot for community solar thanks to new policies it has put in place to expand the sector.

And, in Dec. 2015, Morgan Stanley subsidiary MS Solar Solutions committed $100 million to solar developer BlueWave Renewables to build more than 25 MW of community solar in Massachusetts.