We’ve summarized the most important take-aways and the major themes discussed at the Sustain Summit, which was held in Newport Beach, California in February. The conference attracted speakers from major corporations who revealed their innovation and investment strategies around sustainability and resource efficiency.

Theme #1: Resource productivity innovation will be equivalent to the next “Industrial Revolution.”

Driven by the urgent global need for greater resource productivity, Fortune 500 Companies are making investments in sustainability and resource efficiency. Key innovations are arising in such areas as transportation, buildings, disruptive materials, and IT-driven energy management, all of which are ripe for major gains in productivity and efficiency.

According to the Sustain Summit conference chairman, Wal Van Lierop, cofounder and CEO of Chrysalix Energy Venture Capital, sustainability has become a critical issue for Fortune 500 companies, driven by customer demand for “better, cheaper, cleaner products.” In fact, a recent McKinsey survey showed that sustainability is one of the top 3 priorities of more that 50% of Fortune 500 CEOs, he said. “Sustainability is not a niche industry anymore. We are now part of the innovation system of large corporations,” said Van Lierop.

“Unprecedented improvements in science and technologies…combined with enormous volumes of talent coming to the market from all over the world… is creating a perfect storm to unleash a new innovation supercycle,” said Van Lierop, adding, “We are unleashing innovation in the area of things that matter.”

According to Stefan Heck, a professor at Stanford University and a former McKinsey & Co. partner, we are on the cusp of a new Industrial Revolution in resource productivity that will drive major innovations in transportation efficiency, green buildings, disruptive materials, and demand-side energy management.

“We have an energy shift every 50 years, but we have not had a productivity shift in resources,” said Heck.

The resource productivity shift is being driven by population growth in emerging countries, particularly in China and India, and their related income growth, which increases the demand for all of our resources, including water, energy, and food, said Heck.

Major areas of innovation that will drive this new resource-driven “Industrial Revolution” include: waste reduction and recycling, distributed generation, disruptive material technologies, demand-side energy management, transportation optimization, and “virtualization,” with portable electronics replacing much larger systems. “We can take a block-sized city substation and shrink it to the size of closet,” he said.

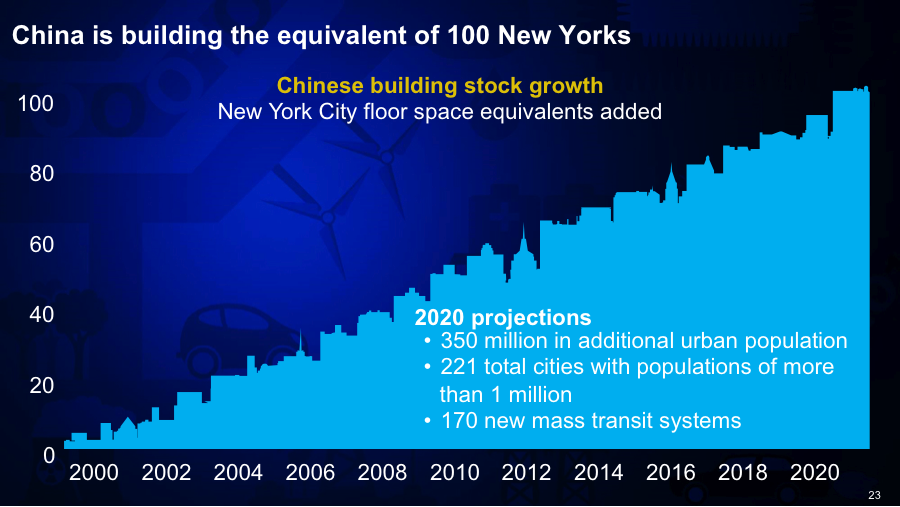

China will be a major driver in the adoption of energy efficiency, green building and waste reduction technologies, as the country plans to build the equivalent of 100 cities the size of New York City over the next 10 years, he said.

China will be a major driver in the adoption of energy efficiency, green building and waste reduction technologies, as the country plans to build the equivalent of 100 cities the size of New York City over the next 10 years, he said.

And “we haven’t seen the real Uber yet,” said Heck. The “real Uber” of the future is autonomous car fleets that can free up one-third of the traffic and 20% of city real estate, mainly by eliminating parking and making cars more accessible and affordable to a younger demographic that “values their phone more than their car,” according to Heck.

Theme #2: The corporate viewpoint on sustainability and resource efficiency has evolved.

Corporations now measure the economic impact of sustainability and factor in the financial risks of climate change. They’ve moved beyond the “old view” of sustainability that mainly focused on the environmental benefits.

And having a sustainability attribute is now viewed as a corporate competitive advantage. New sustainable products must be better or cheaper and more convenient to use than previous “dirtier” products, facilitating a faster consumer-adoption rate.

According to Ed Pinero, senior vice president of sustainability at Veolia North America, the new corporate viewpoint on sustainability such as waste and recycling (i.e. the circular economy) has to do with its economic factors. And considerations for corporate investment in these areas of sustainability are being centered on “resource and commodity volatility in price and availability, or the cost implications of risks.” This is different from the conversations they were having 10-15 years ago, he said, which were focused on the environmental benefits.

And corporations must start to measure their operations in a way that takes into account that “resource productivity is the new competitive edge,” said Stanford’s Heck. He encourages corporations to measure their “profit per water,” “profit per energy,” and their “fixed asset utilization” across the company.

According to Sebastian Titz, manager at 3M New Ventures, sustainability is just one aspect of a product, but there also needs to be a performance improvement over the existing technology that makes it easier to convince a customer to adopt. He notes these attributes in products 3M offers, such as energy-efficient air conditioners, new lighting technologies, and smart meters, which provide both value and savings to customers, in addition to being environmentally friendly.

Business model innovation is another way to increase the adoption of innovations in sustainability. According to Rick Gibson, a partner at GSV Sustainability Partners, there is greater demand for sustainability and resource efficiency technologies, such as energy efficiency and water-saving products, among small and midsize corporate and municipal customers, though these customers typically don’t have the budget to invest in them.

His firm is pioneering a new business model by which they purchase the technology and then provide it to their customers via a monthly service agreement. GSV receives a portion of the savings or benefit the client generates from the new technology. This is called the “sustainability as a service” model. Gibson noted that his clients say, “I want the device, but I don’t need to own those things.”

Gibson sees big demand now for LED lighting among his corporate customers, such as building owners and hotels, which offer energy savings of up to 60-70% over traditional lighting.

Thermo Fisher Scientific’s chief sustainability officer, Christina Amorim, focuses a lot of her firm’s sustainability activities on energy efficiency retrofits, energy storage, clean transportation, and the elimination of waste. Fuel cells have been a “winning story” for them, she said, due to their short payback period and the savings they generate. “The [fuel cells] financials worked,” she said.

Amorim explained that there has also been a payback in Thermo Fisher’s “zero waste activities,” such as in water efficiency, recycling, and green packaging. And due to their sustainability initiatives overall, they are becoming “25% more efficient every four years,” which is benefiting the company financially through cost savings and increased productivity, she said.

Theme #3: Investing in waste conversion technologies is hot, as corporations focus on greater resource efficiency.

Big investments are happening now in eliminating waste, converting waste-to-energy and into higher-value products, water efficiency, and recycling materials. Lots of disruptive innovations in the “circular economy” are coming to the fore, and there’s good economics in converting waste streams into higher-value products. And taking waste out of industrial processes can reduce greenhouse gas emissions.

According to Patrick Ramm, director of corporate venturing at Waste Management, “Out of our 25 portfolio companies, a good eight or nine are really focused around waste conversion technologies.” He noted that there are plenty of potential disruptive technologies around waste conversion, including “onsite treatment of waste,” which means “no collection [of waste],” Ramm said. “Companies are trying to turn waste into methanol, ethanol, diesel, oil, whatever. If the back-end economics are good, I could pay you for your waste.”

At Novelis, the world’s largest buyer of aluminum and a leading recycling company, “resource efficiency has become our business model,” said John Gardner, the company’s chief sustainability officer. They’ve brought in new technologies to turn the company into “a recycling-based business” that enables them to takes 20 million tons of greenhouse gasses out of the system. These technologies are also giving them a competitive advantage in the marketplace, said Gardner.

John Suh, executive director for Hyundai Ventures, mentioned that Hyundai, which owns companies that produce the steel used in their cars, has put recycled steel into production—and that they are the only car company today that “does circularity in terms of steel.”

At Finland-based Outotec, a technology services provider to the mining industry, the focus is on applying recycling technologies in the metals and mining sector, said Pia Kall, the firm’s senior vice president of strategy. She noted that, “with metals, they don’t get worse when you recycle them.” And they are making recycled fertilizer in their pioneering phosphorus recovery process, which turns biomass into ash and helps eliminate waste, said Kall.

The “big nut” for American Water, the largest investor-owned water utility in the U.S., is in detecting leaks in water pipes, says Paul Gagliardo, its manager of innovation development. He noted that American Water currently spends “hundreds of millions of dollars per year fixing and replacing pipe” and that most of the money is spent digging up the pipe from the ground. He’s currently on the hunt for more innovative solutions to this problem, including “tiny water drones” that can be driven remotely to detect and fix leaks, he said.

At Cenovus Energy, an integrated Canadian oil company, it has become very important to find ways to lower their environmental impact on both the land and water side, said Judy Fairburn, the company’s executive advisor. And “customers are expecting cheaper and cleaner energy,” she said.

The biggest focus at Cenovus today is limiting greenhouse gas emissions. So far they’ve reduced their emissions by about 26% since 1990, said Fairburn. A big part of the reduction in GHGs has been due to their large-scale carbon capture (CCS) operation, one of the largest in the world, which stores CO2 underground. They’ve also been working with entrepreneurs for a number of years in areas such as water cleanup, fiber optics for pipeline leak detection, and carbon capture and reuse technologies, she said.

And at 3M, sustainability is big across all of their business units, with their focus being on reducing waste, reducing energy consumption, and reducing raw material intake from their internal processes, said 3M’s Titz.

For 3M’s venture investment strategy—which directs investments around the big themes of urbanization, energy consumption, and reducing pollution—they’ve made investments in energy generation, energy storage, energy transmission, and technologies that reduce energy consumption, such as efficient air conditioning and smart lighting in the home, he said.

Theme #4: For corporate venturing, strategic partnering is more important than making an equity investment.

Corporate partnerships can take various forms as corporates actively look externally for innovations. Corporates want to further develop customer relationships, create joint ventures, and co-develop new products with startups. Even partnerships among traditional competitors are forming.

BASF’s venture investment manager Björn Heinz noted, “Partnering is very important and the key to venturing out into new fields.” BASF, the world’s largest chemical company, has in place around 400 to 600 partnerships with universities on a global basis. BASF is particularly interested in bio-based chemistry and their venture unit was mandated to make investments in this area, said Heinz. At BASF, partnering can take the form of co-marketing, licensing, or joint development of product, but they need to have some agreement in place before they make an investment, he says.

Ramm said Waste Management utilizes varying approaches. “We’ll do a business relationship before investing,” he said, adding that “sometimes, depending on the state of [a technology’s or product’s] commercialization,” the company may choose to first invest.

According to Hyundai’s Suh, “We think of partnering first, then investing second… We may not invest in equity, but will put in some money into a joint venture or project to get things started,” he said.

In the Oil & Gas industry, competitors are becoming collaborators, said Cenovus’s Fairburn. Exxon Mobil, Shell, BP, and Conoco Phillips have shared more than one billion dollars worth of effort on innovation to date on over 700 projects, she said.

Theme #5: For startups, it’s about solving problems for corporate partners.

Rich Larsen, president of smart grid startup Smart Energy Instruments, recommends that startups look to develop strategic partnerships with the top players in their industry. For Smart Energy Instruments, it is GE, Siemens, and 3M, all major smart-grid players, he said.

“Find big guys that can help remove friction, shorten time—that is who you should partner with,” said Tom Stepien, CEO of energy storage startup Primus Power.

And understand your corporate partner’s growth goals. “If you can connect the dots, and then find the champions in business units… you can make a case… you have to sell yourself, you have to talk in their language, and solve their problem, and do that at multiple levels… It also takes a lot of repeat interactions…and it takes a little while to get it,” said Stepien.

Afshin Partovi, CEO of wireless charging startup Mojo Mobility, said, “Look at strategics you feel are in [your] space, and are trying to have products or services in that area, but are also missing a piece of the puzzle, and where you can provide a leg up to accelerate their development.”

Michael Steifman, CEO of UtiliSave, which helps corporate clients optimize their energy use and reduce costs, offered a succinct summation: “You really, really have to figure out your value proposition. If you do, that is when you succeed so that you solve a problem for your partner.”