Blackstone’s new fund, called Global Water Development Partners, will invest hundreds of millions of dollars in desalination and wastewater treatment projects to help emerging market countries meet their growing need for clean water.

The investment team will be led by the former Global Head of the International Finance Corporation’s (IFC) Water and Wastewater Group, Usha Rao-Monari, and Lars Thunell, former Chief Executive Officer of the IFC.

The fund will invest in sustainable water facilities focused on the development of desalination of large-scale waste water treatment in Africa, Asia and Latin America. Blackstone plans to invest hundreds of millions of dollars across the region, according to the Wall Street Journal.

Big Water Potential in Emerging Markets

Emerging markets water projects haven’t received sufficient financial intellectual capital focus from the private sector over the past decade, says Sean Klimczak, a senior managing director at Blackstone.

Developing countries would need to invest an estimated $18 billion annually to meet global goals for clean water access, according to a 2012 Organization for Economic Co-operation and Development report.

And, by 2030, the world will need 40 percent more water and 50 percent more energy than it does today, according to the World Water Development Report published by the U.N.. Water is under pressure from factors such as a rising population, pollution and droughts, floods and heat waves linked to global warming.

Around the world, about 770 million of the world’s 7 billion people now lack access to safe drinking water, according to the U.N. report.

“Demand for energy and freshwater will increase significantly in the coming decades,” U.N. agencies said in the World Water Development Report.

Large energy companies, such as Exxon Mobil, are already trying to limit their water use, reports Reuters. The company has stated that net freshwater consumption at its operations fell by 11 percent in 2012 from 2011.

Top Water Investment Opportunities

Some key breakthroughs to watch for are in desalination, or converting salt water to fresh water. Emerging desalination plays include solutions driven by low grade heat, such as waste heat or solar thermal, says Paul O’Callaghan, CEO of BlueTech Research, a firm specializing in water technology.

“Another idea which can help to ‘fool nature’ is the phenomenon of pressure retarded osmosis (PRO), whereby we can treat the osmotic energy stored in salt concentrates like a ‘battery’ and get this energy back again by exposing the concentrated salts to seawater or freshwater using forward osmosis for recover energy.”

Wastewater treatment represents another area with big potential for the development of breakthrough technology.

“For wastewater treatment solutions for the developing world, the real potential, and in fact the only viable solution for countries like India, where over half of the population rely on open defecation for sanitation, is decentralized treatment with source separation of urine and solids” says O’Callaghan.

Investors Show Increasing Interest in Water

Foundations and endowments have been increasingly interested in investing in water venture capital investments in water efficiency, as we previously reported. Within clean water, fundraising from foundations and endowments is coming for funds investing in improving irrigation and water leaks due to aging infrastructure.

Private investors in water companies tend to be more patient than venture capital investors, as water investments typically take 7-10 years to see a return on their investment, rather than the typical 3-5 year time frame expected by most VCs.

“Private equity is flowing into water. The private equity track record has been far better in water than the venture capital track record. It’s a story of the hare and the tortoise, or ‘slow and steady wins the race’” says BlueTech’s O’Callaghan.

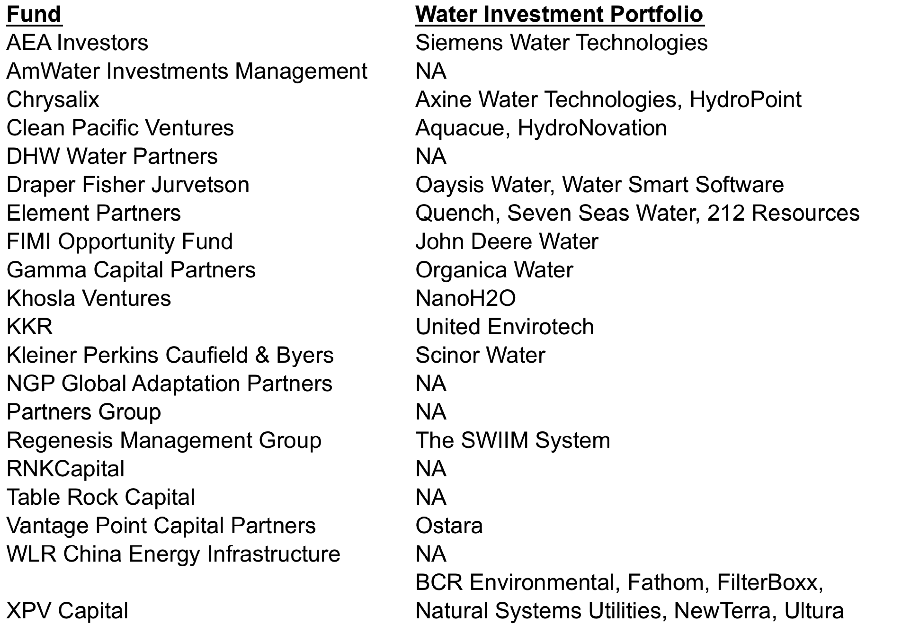

Top Private Equity and Venture Funds That Invest in Water