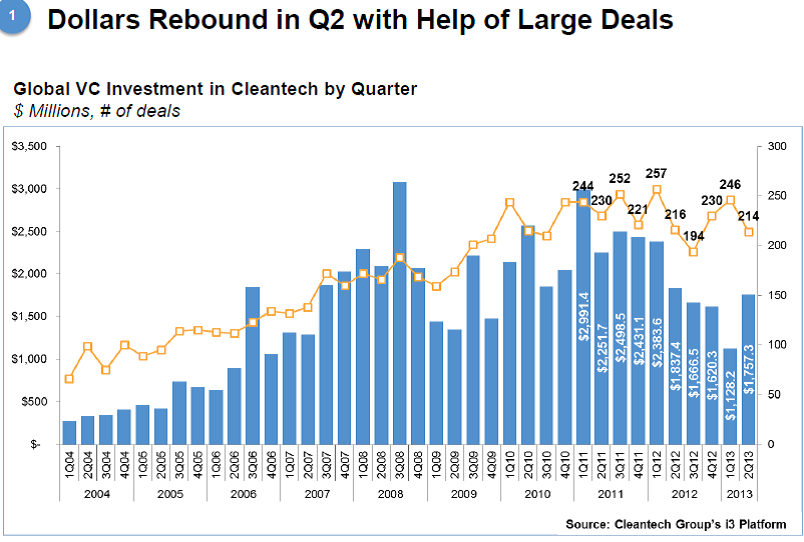

Venture capital dollars in the cleantech sector “turned a corner” in the last quarter and could increase further after President Barack Obama announced his climate plan last week, according to Sheeraz Haji, the chief executive officer of the Cleantech Group.

VCs invested $1.76bn across 214 deals in Q1 of this year, up from $1.28bn across 246 deals in the previous quarter, according to data released today by the Cleantech Group.

Haji said: “After six consecutive quarters of decline, this is a big jump, 56%. It’s hard to predict the future but you can’t help but think have we turned a corner is there a bottoming out of not just sentiment but actual dollars put to work.

“We cannot ignore the big announcement from the White House a week ago. We have noticed a shift in sentiment in part due to this announcement … and it could have a very significant impact to help cleantech far and wide.”

Haji also noted that deal sizes had increased significantly since the last quarter when no deal size exceeded $80m.

This quarter, however, Bloom Energy raised $150m from Credit Suisse, German utility company EON and previous investors New Enterprise Associates and Kleiner Perkins Caulfield & Byers. After widely reported operating losses, the fuel cell company has indicated it expects to make a profit in the second half of the year and that a public offering may follow. Bloom has so far raised around $1bn in capital and its customers include Walmart, Google, eBay, FedEx, Staples and Coca-Cola.

“I am quite bullish and impressed with Bloom,” said Haji. “Distributed generation is for real. Bloom has a set of customers now who care about getting off the grid, whether it’s Superstorm Sandy or other extreme weather events the theme of resiliency is pretty high on the list for customers when they have really mission-critical power needs – think about data centers and grocery stores [for whom] being off the grid and having more reliable power is a very interesting value proposition.”

“I am quite bullish and impressed with Bloom,” said Haji. “Distributed generation is for real. Bloom has a set of customers now who care about getting off the grid, whether it’s Superstorm Sandy or other extreme weather events the theme of resiliency is pretty high on the list for customers when they have really mission-critical power needs – think about data centers and grocery stores [for whom] being off the grid and having more reliable power is a very interesting value proposition.”

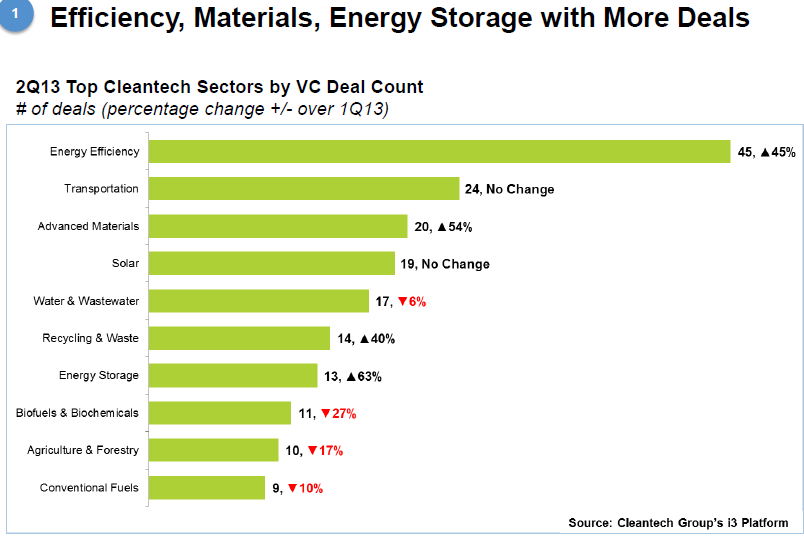

Energy efficiency took the largest amount (18.9%) of VC dollars, a 45% increase from the previous quarter, followed by solar, transportation and biofuels at around 10%. However, other categories also saw more investment in the second quarter such as energy storage (63%), recycling and waste (40%) and advanced materials (54%).

Funds for solar projects were also continuing to do well and may well become a new category for the Cleantech Group’s i3 data platform, said Haji.

Sunrun topped the chart with a $630m facility with JP Morgan, while SolarCity raised $500m from Goldman Sachs and SolarReserve raised $260m from Google, among others.

M&A activity in Q2 was “encouraging” said Haji, with $5bn versus $2bn earned in Q1, including a $1bn acquisition of Power One, a power management company, by ABB and a $350m acquisition of ecoATM, an electronics recycling company, by CoinStar company, Outerwall. ecoATM had raised $30m and $40m convertible debt from investors including Claremont Creek Ventures

“These are wonderful validations to the industry, clearly great returns,” said Haji.

On the public markets, SolarCity, Tesla and First Solar had performed much higher than the S&P average of 18%. Tesla stock had risen 276% year on year, SolarCity had risen 220% and First Solar was up 199%.

“These clean tech stars went public with a lot of scepticism and have dramatically outperformed even the smartphone and other tech public companies,” said Haji. “These companies are cleantech stars, but they will be seen as stars of the public markets among all companies. This is very encouraging for the cleantech sector.”

After a challenging time for IPOs in the past couple of years, BioAmber, a biochemcials company, broke the drought in the last quarter by raising $80m in its debut. More recent IPO activity had given hope that the public markets may be more welcoming in the third and fourth quarters. Control 4, a home automation company, has filed for a $60m IPO and Marrone Bio Innovations natural weed pest and disease control filed for a $60m IPO.

“This is encouraging so we can’t wait to see what the second half brings,” he said.

In the water category, Haji said there had been a good uptick to $290m in investments from the first quarter across 28 deals as Canada’s oil sands and companies seek to reduce or re-use their consumption in the fracking process.

“It takes eight barrels of water for one barrel of oil coming out of the ground. Industrial water applications are the big driver, instead of trucking in water from one frack site to another states and re-injecting it in the well, there’s all sorts of interest in treatment on-site.”