Investors, developers and business owners alike are showing increased interest in microgrids. These small-scale power systems, with their own power generation, software controls and storage that can operate independently from an area’s main electric grid, are attracting attention as companies look to insure themselves against widespread power outages.

GTM forecasts that microgrid capacity in the U.S. will reach 4.3 GW by 2020 – up from 1.6 GW from about 160 microgrids today – and the market opportunity will double to $1.66 billion by that same year.

Energy storage is becoming an increasingly valuable component of microgrids, with about half of them now employing battery storage. Navigant expects to see 14.9 gigawatts of batteries installed and connected to microgrids globally by 2026. Those projects could generate $22.3 billion in global investment over that time period, according to Navigant.

Microgrid developments are spurring major capital providers and corporations to enter the market:

– In November, private equity giant The Carlyle Group announced that it is investing $500 million to back a new “energy as a service” microgrid platform set up by Dynamic Energy Networks (DEN) and Schneider Electric. The platform eliminates upfront capital requirements and makes it easier for C&I customers to adopt microgrids.

– Anbaric, a developer of clean energy transmission and microgrid projects, said in March that it’s pairing with the Ontario Teachers’ Pension Plan to create a new development company, Anbaric Development Partners. The pension, with $130 billion in assets, will own 40% of the new firm, which plans to build $2 billion worth of microgrid projects.

– Also in March, Macquarie Capital and CIT Group closed a deal to finance 50 MW of behind-the-meter commercial energy storage systems, worth $200 million, that are being deployed in Southern California, purportedly the largest battery project to get bank funding to date. The projects are being developed by Advanced Microgrid Solutions (AMS), which uses batteries and its proprietary software system to aggregate and operate its customer-sited batteries as a “fleet” that can be used as a grid resource, also called a Virtual Power Plant (VPP).

– In December, Breakthrough Energy Ventures, founded by Bill Gates in 2016, listed the development of microgrids and mini-grids across the developing world as one of its top five investment themes. The $1 billion fund is backed by major investors including Vinod Khosla (Khosla Ventures), John Doerr (Kleiner Perkins,) Jack Ma (Alibaba) Jeff Bezos (Amazon) and Masayoshi Son (Softbank).

– The Microgrid Investment Accelerator was launched in August by venture capital firm Allotrope Partners, with funding from Facebook and Microsoft, to unlock $50 million of private capital between now and 2020 to expand energy access in India, Indonesia and East Africa. The new financing platform will leverage grant and concessionary finance to lower the risk of and unlock private capital to microgrid projects.

CleanTechIQ gathered a number of microgrid developers, investors and proponents for an in-depth discussion about microgrids’ usefulness and challenges, how these projects can be financed, and their outlook during a recent CleanTechIQ Forum. Here’s some of what they had to say.

The Customer Value Proposition of Microgrids

Microgrids’ primary value proposition in the Commercial & Industrial market is resiliency, said Thomas McAndrew, president and CEO of Texas-based microgrid developer Enchanted Rock. Microgrid customers get cost-effective reliability that means their operations won’t be interrupted by a regional blackout, whether the outage is brief or longer-lasting due to a storm. The latter point is becoming more important as companies grapple with the effects of climate change-induced strengthening of hurricanes and other weather systems.

Charlotte Matthews, director of sustainability at New York-based real estate firm The Related Companies, agreed that microgrids are increasingly important to businesses. Property owners and landlord “never have enough capacity on-site” to provide adequate backup to their tenant businesses. So when it comes to microgrids, “it’s all about enabling resiliency and backup,” she said.

Beyond that, microgrids help companies reach their sustainability goals. That – in addition to offering reliability to tenants – is an important reason Related is building a 14.5 MW microgrid, powered by two cogeneration plants, at its Hudson Yards development in Manhattan. Because those generators capture heat to generate electricity, the microgrid will allow the project to reduce its overall carbon footprint, she said.

Additionally, the widespread damage caused by recent extreme hurricanes, such as in Puerto Rico, the Virgin Islands and Houston, has pushed private companies to step in and build battery-connected microgrids to generate power for critical infrastructure. Recent examples include battery developers Sonnen and Tesla, which are deploying batteries coupled with solar PV to restore power to hospitals, medical clinics and emergency shelters in Puerto Rico.

Batteries & Load Controls Drive Microgrid Growth

Batteries are crucial components of microgrids. The sharp drop in battery prices in recent years, plummeting by some 70% since 2012, has allowed them to be increasingly deployed in microgrids. Prices are expected to continue to fall, according to IHS Markit.

This price drop is boosting the deployment of behind-the-meter batteries in the C&I market, where they offer the greatest value due to their ability to offset “demand charges”, the premium that utilities charge businesses during peak demand times, which can add 50 percent or more to their bill.

There’s also a growing realization by C&I customers that batteries can provide capacity for distributed generation, rather than just being used as a source of backup power.

This realization is driving a shift: it’s not just that energy storage is being used as a stand-alone resource; we’re also seeing the coupling of storage with solar PV for distributed generation, said Frank Genova, COO of Convergent Energy + Power.

A major innovation that is driving the adoption of microgrids is in the area of “load control” for demand-side management, according to Enchanted Rock’s McAndrew. He said the focus of development will be on “micro” load controls, “where you have ability to very precisely control load at a valve or switch level in a facility.” By having a greater level of control, users can curtail certain loads for a period of time to ride out power outages, he pointed out.

And, he said, you need very fine load control to integrate it into the microgrid controller. This control also increases a microgrids’ monetization value in electricity and energy resource markets.

But it’s not only batteries that are driving growth of microgrid projects, according to McAndrew. Since his customers’ key need is to ride out a power outage, which can last longer than the three to four hours a typical battery provides, Enchanted Rock focuses on providing “power storage” rather than energy storage. Power can come from either batteries or an on-site generator using natural gas, he said. “The ability to right-size a generator using power storage is important

Matthews pointed out that in Manhattan and other dense urban areas, there’s not enough surface area to rely solely on renewables to power microgrids, which is why Related incorporated cogen, or combined heat and power (CHP) plants, into their Hudson Yards project. In addition to the cost advantages of using natural gas, the plants offer “twice the efficiency of the grid,” she said, since they recover thermal energy from the buildings. “I’m an evangelist for natural gas cogeneration. If you want [distributed resources] and you want reliable, you need cogen.”

How to Attract Financing to Microgrids

The ability to make an economical business case for microgrids is critical to attracting traditional project financing needed for their development, panelists said.

Joshua Rogol, v.p. of sales at ViZn Energy, a developer of zinc-iron flow batteries for use in microgrids, said his firm believes the concept of “revenue stacking” is the key enabler for the adoption of batteries and the development of microgrid projects. That means generating multiple revenue streams from battery-based systems through the use of smart controls, which lets microgrid developers and operators provide services to ancillary power markets.

Rogol said furthering this concept will increase the use of batteries within microgrids, and also make battery storage an investable asset class.

So far, financing for microgrids has come mainly from venture capital, private equity and vendor financing, said Princeton Power Systems CEO Darren Hammel. That’s been good enough for now – but if microgrids are to develop at a larger scale, they need to attract financing from traditional capital sources, according to panelists.

There are challenges to overcome. The different ownership structures of microgrid assets make them difficult to wrap projects into a traditional project finance structure, Hammel said.

Another challenge a microgrid project developer faces when raising financing is the relatively small size of the assets in the C&I marketplace, said Convergent’s Genova. Distributed generation projects tend to be relatively small, in the 5MW to 10MW range. This is too small for commercial banks, like to finance assets that are 200MW and up, he said.

That means the key to structuring deals is to develop multiple projects with the same customer in order to get to the scale necessary to attract financing from banks. “If you structure the deal in the right way based on traditional models, you can get banks interested in the concept of financing microgrids,” Genova said. “It’s not one 200MW asset, it’s 20 10MW assets.”

Transmission company Anbaric provides a good example of this concept. Last March, the Massachusetts-based company partnered with the giant Ontario Teachers’ Pension Plan to create a new development company, Anbaric Development Partners, that will build $2 billion worth of microgrid projects.

Anbaric focuses on finding C&I customers that are large enough to aggregate multiple projects in order to reach the scale necessary to attract capital from traditional sources. Using this strategy, the company’s pipeline of projects become large enough for it to attract project financing in multiple phases over several years, said Dirk van Ouwerkerk, Anbaric’s lead partner for microgrids.

Because the process of developing each microgrid is costly, Anbaric focuses on large customers that can provide repeat business, from 10 to 100 projects, such that “the process becomes commoditized.” And aggregating multiple projects with C&I customers reduces the development risk from the financier’s perspective, he added.

McAndrew also pointed out that standardization is key to getting financing for microgrids. Enchanted Rock operates and maintains resiliency microgrids for C&I customers and federal agencies in Texas. “We are not looking to do base load power and don’t try to compete with utilities,” he said. This focus on specific types of microgrids allows the company to create more standardized projects, which makes it much easier to attract investors including pooled asset funds. In fact, last February, Enchanted Rock raised $10 million from Energy Impact Partners, a venture investment firm backed by large utilities, to accelerate deployments of its microgrid systems.

Regulatory Challenges to Financing

The current regulatory framework for distributed energy tends to be a a barrier to growth, panelists said. The changing regulatory structure for distributed resources creates problems for developers and financiers. For example, “If I build a project with assumptions and the rate structure changes, or the way batteries can or cannot participate changes in front of or behind the meter, it makes it complicated,” said ViZn’s Rogol.

Regulatory transparency will be important for microgrid development going forward. As well, regulators and state officials must begin to value distributed resources in order to create a market which will drive more projects forward.

Because batteries don’t quality for tax credits, “we need to develop economically viable business cases without battery storage elements,” Genova said. “Giving microgrids, distributed resources and energy storage a fair shake is critical.”

Anbaric’s van Ouwerkerk pointed to Germany’s feed-in tariff systems as a good model for the U.S. to follow. Once it was put in place, the system stayed the same, he said.

Panelists did point out that some regulatory issues are moving in the right direction: some states are now forcing utilities to evaluate distributed resources such as microgrids. New York and California are two states where these assets are being financed successfully, they say. In fact, New York Gov. Andrew Cuomo recently announced the state is setting one of the most aggressive energy storage targets in the country, targeting 1.5 GW to be deployed by 2025 along with an investment of $200 million in storage projects, which should lead to greater adoption of microgrids across the state.

When regulations are favorable, big projects can get off the ground. For example, last March, CIT did the first senior secured project financing of stand-alone battery storage assets with Macquarie Capital that included a portfolio of 600 projects in California. They were able to do project finance in traditional way because the developer, Advanced Microgrid Systems or AMS, had a contract with a utility off-taker that created a revenue stream that can be collateralized, said Rhys Marsh, a director in CIT’s Energy Financing business.

AMS, for its part, announced other new projects last year, including new VPP projects with the Long Beach Water Department and San Diego Gas & Electric, as well as a strategic alliance with the largest microgrid developer in the U.S., PowerSecure, to expand and jointly build new products and services. PowerSecure was acquired by Southern Company in 2016.

Another example is Demand Energy’s microgrid that integrates solar PV and battery storage under utility Consolidated Edison’s new demand management incentive program. The project, which began in April 2017, is the first lithium-ion battery approved for behind-the-meter use in a multi-family residential building in New York City and secured a $1 million 10-year project loan from the New York City Energy Efficiency Corporation. Demand Energy was acquired by Enel Green Power North America in January, 2017.

Notable New Utility Led Microgrid Projects

– In May, Tucson Electric Power announced a new solar-plus-storage facility, set for completion by the end of next year. The project, being built by NextEra Energy, includes a 100 MW solar array and a 30 MW, 120 MWh energy storage system. The project marked the lowest price announced for a solar-plus-storage project to date ($0.045/kWh over 20 years).

– Portland General Electric said in November it will spend $100 million to develop customer-sited and community microgrids, with battery storage, at existing solar and biomass facilities. The utility intends to develop two to five microgrid pilot projects including a storage asset at an existing solar facility; up to 500 residential behind-the-meter batteries as the start of a residential storage program; and a 4 MW to 6 MW, transmission-connected storage device that would create a hybrid plant at an existing gas-fired plant.

– In April, Duke Energy Renewables announced its first microgrid project at Schneider Electric’s North American headquarters outside Boston. The microgrid was built by Schneider Electric and REC Solar, a subsidiary of Duke Energy Renewables. It was funded through a “Microgrid as a Service” business model, which the company says adds resiliency and sustainability with no upfront costs. The microgrid includes a solar array as well as a natural gas generator and is expected to generate more than 520 mWh annually.

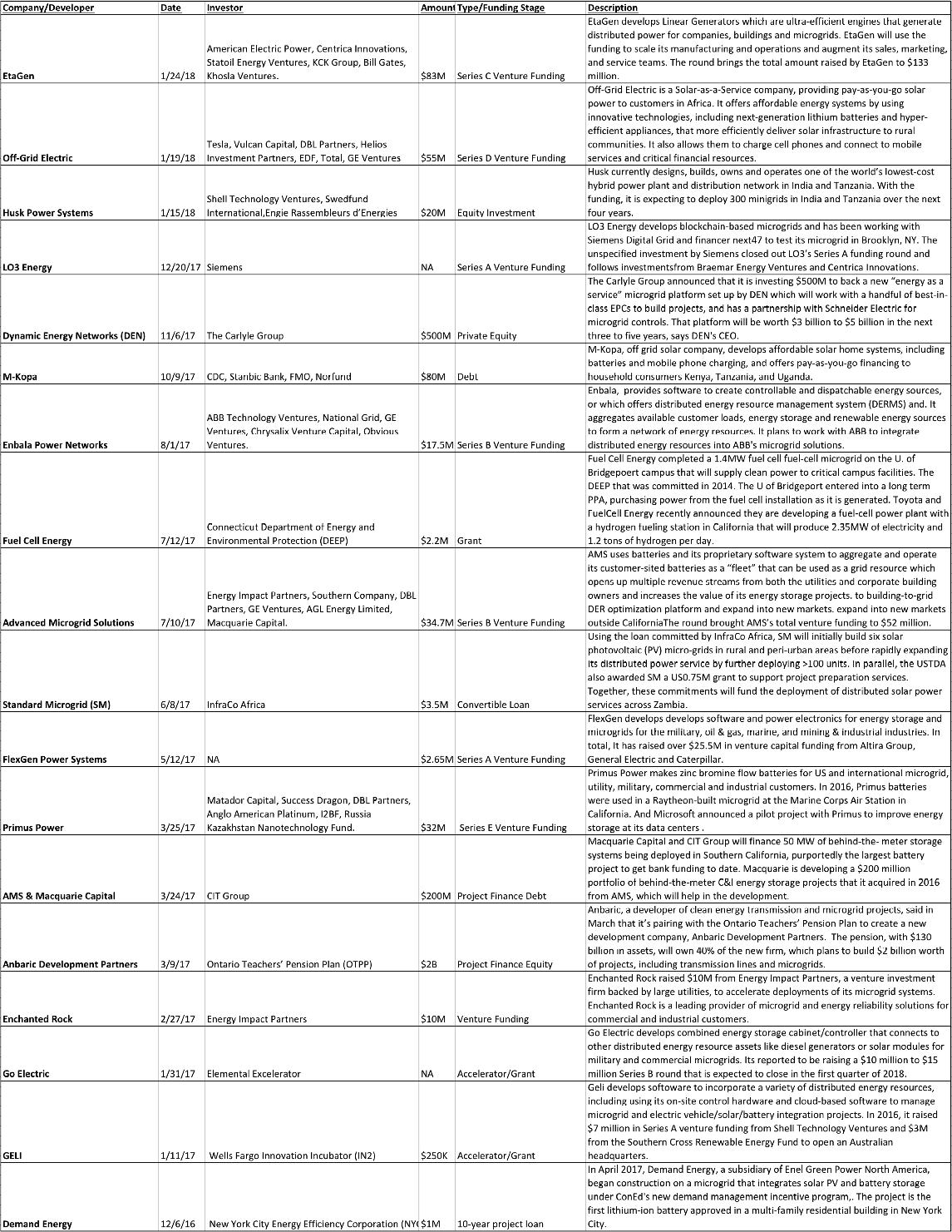

Notable Recent Microgrid-Related Company and Project Financings